FHA Loans Explained: Who Qualifies and What You Can Buy

For many first-time homebuyers in the U.S., FHA loans offer a more accessible path to homeownership. Backed by the Federal Housing Administration, FHA loans are designed to support individuals with lower credit scores, limited down payments, or non-traditional financial backgrounds. Understanding who qualifies for an FHA loan and what you can buy with one is critical for making smart real estate decisions in 2025.

What Is an FHA Loan?

An FHA loan is a government-backed mortgage issued by an approved lender and insured by the Federal Housing Administration. It’s specifically designed to make buying a home more achievable for borrowers who may not qualify for conventional loans due to financial limitations.

| Feature | FHA Loan |

|---|---|

| Minimum Down Payment | 3.5% (with credit score ≥ 580) |

| Credit Score Requirement | As low as 500 (with 10% down) |

| Mortgage Insurance Required | Yes – upfront and annual premiums |

| Property Types Allowed | Primary residences only |

| Loan Limits | Varies by county (e.g., $498,257 in low-cost areas for 2025) |

Who Qualifies for an FHA Loan?

To qualify for an FHA mortgage, borrowers must meet certain financial and property-related criteria. FHA loans are ideal for:

- First-time buyers with limited savings

- Individuals with lower credit scores

- Buyers with a high debt-to-income ratio

- Those needing flexible underwriting guidelines

| Qualification Criteria | Requirement |

|---|---|

| Credit Score | 580+ for 3.5% down, 500–579 with 10% down |

| Steady Income | Must prove reliable employment or income for past 2 years |

| Primary Residence | Must occupy the home as their main residence |

| FHA-Approved Property | Property must meet HUD safety standards and pass appraisal |

| Mortgage Insurance | Mandatory for life of the loan or until 78% LTV is reached (with refinance) |

What Can You Buy with an FHA Loan?

FHA loans are limited to primary residences, but that still includes a wide range of home types:

| Property Type | FHA Eligible? | Notes |

|---|---|---|

| Single-Family Homes | ✅ | Most common FHA purchase |

| Multi-Family (2–4 Units) | ✅ | Must live in one unit; great for owner-investors |

| Condominiums | ✅ | Must be on HUD-approved condo list |

| Manufactured Homes | ✅ | Must be permanently affixed and meet HUD requirements |

| Investment Properties | ❌ | Not eligible for FHA financing |

| Vacation or Second Homes | ❌ | Must be primary residence |

Benefits of FHA Loans

- Lower down payments make it easier to buy sooner

- Flexible credit requirements are ideal for credit-challenged borrowers

- Assumable loans, which can be transferred to a qualified buyer

- Potential for seller-paid closing costs (up to 6%)

FHA Loan Limits in 2025

Loan limits vary by county and are adjusted annually. Here’s a sample of FHA loan limits in 2025:

| Area Type | Single-Family FHA Loan Limit |

|---|---|

| Low-Cost Areas | $498,257 |

| High-Cost Areas | $1,149,825 |

| Alaska, Hawaii, Guam | Up to $1,724,725 |

Is an FHA Loan Right for You?

While FHA home loans are a great tool for many, it’s important to compare them with conventional loans or VA loans if you qualify. Factors such as long-term mortgage insurance costs and property type restrictions may influence your choice.

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Explore

How Travel Credit Cards Can Maximize Your Rewards

What Does a Wedding Planner Really Do? Responsibilities Explained

How to Choose Local Kitchen Remodelers You Can Trust

What a Car Accident Lawyer Can Do for You After a Crash

Local Flower Delivery Services You Can Trust

Top Healthy Dog Food Brands You Can Order Online

Why Choosing a Local Law Firm Can Improve Your Case Outcome

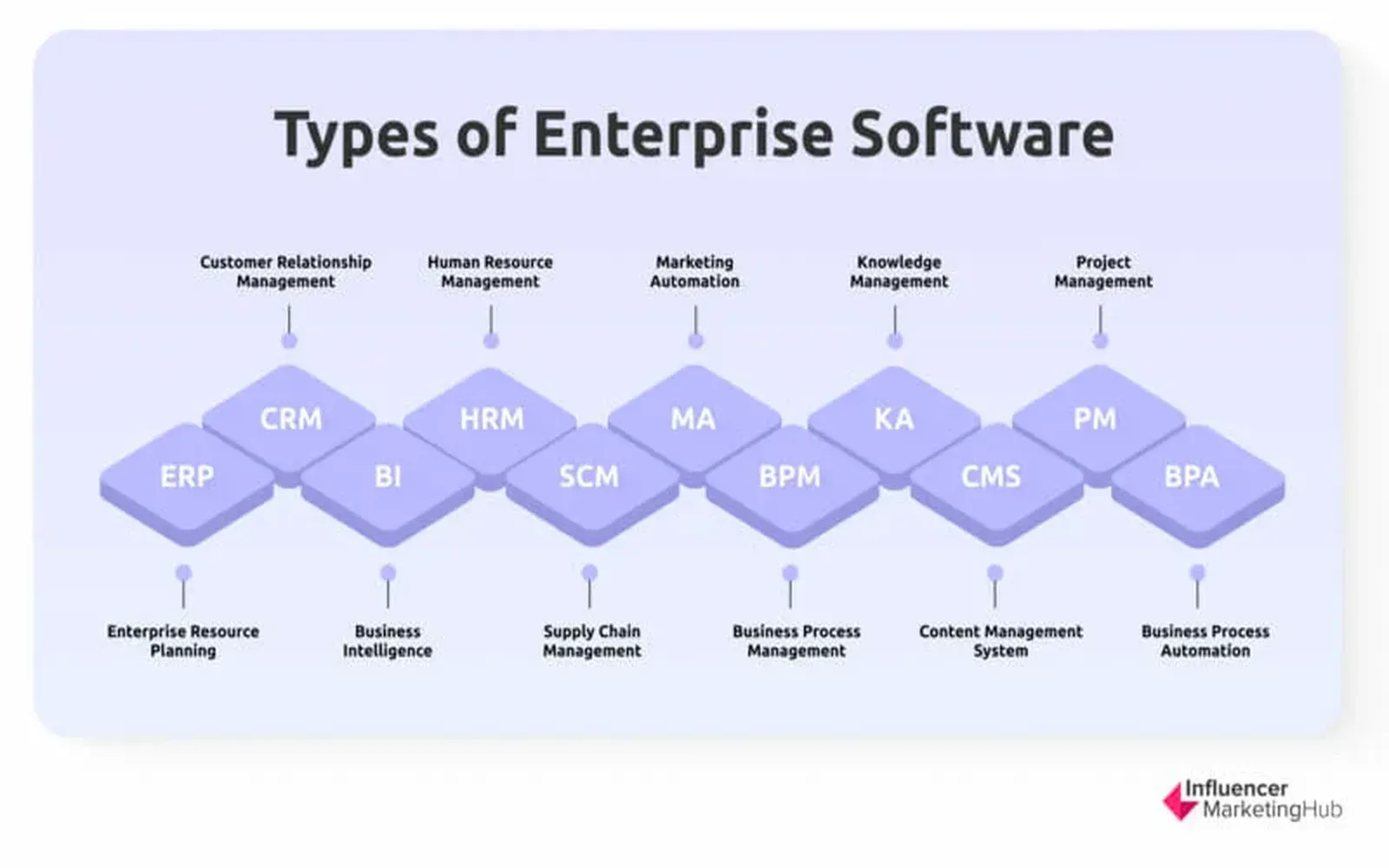

How Enterprise Software Can Drive Growth