The 'Three Bucket' Strategy: Balancing Cash, Bonds, and Growth Assets

The 'Three Bucket' Strategy is an innovative approach to managing your retirement investments, focusing on a balanced allocation among cash, bonds, and growth assets. This method provides a structured way to ensure that retirees can meet their financial needs while also taking advantage of growth opportunities. By categorizing your investments into three distinct "buckets," you can effectively manage risk and optimize your returns. In this article, we will delve deeper into the three buckets and how they contribute to a well-rounded retirement investment strategy.

Understanding the Three Buckets

The 'Three Bucket' Strategy involves categorizing your retirement savings into three distinct groups: cash, bonds, and growth assets. Each bucket serves a unique purpose and is designed to mitigate the risks associated with market volatility while providing the necessary liquidity for living expenses.

Bucket One: Cash for Immediate Needs

The first bucket focuses on cash and cash equivalents, such as savings accounts, money market funds, and short-term certificates of deposit. The primary goal of this bucket is to provide liquidity for your immediate financial needs during retirement, such as monthly living expenses or unexpected medical bills.

Having a cash reserve allows retirees to avoid selling off investments during market downturns, which can lead to substantial losses. Financial advisors often recommend having enough cash to cover at least three to five years of living expenses in this bucket. This strategy ensures that you can weather any financial storms without sacrificing your long-term investment goals.

Bucket Two: Bonds for Stability

The second bucket is dedicated to bonds, which are generally considered a more stable investment compared to stocks. This bucket can include government bonds, corporate bonds, and municipal bonds. The purpose of the bond bucket is to provide steady income through interest payments while preserving capital.

Bonds can act as a buffer against stock market volatility, making them an essential component of a balanced retirement portfolio. Depending on your risk tolerance and investment horizon, the allocation to bonds can vary. Generally, retirees are advised to have a higher percentage of their portfolio in bonds as they age, gradually shifting away from riskier assets.

Bucket Three: Growth Assets for Long-Term Growth

The third bucket focuses on growth assets, such as stocks and mutual funds. This bucket is designed for long-term growth, providing the potential for capital appreciation over time. While growth assets can be more volatile and risky, they are crucial for combating inflation and ensuring that your retirement savings continue to grow.

Typically, the allocation to growth assets decreases as you age, but maintaining some exposure to equities is essential for long-term financial health. Financial experts recommend that retirees consider their risk tolerance and time horizon when determining how much to allocate to this bucket. For younger retirees, a higher allocation to growth assets may be appropriate, while those closer to their spending phase may prefer a more conservative approach.

Creating a Balanced Portfolio

Implementing the 'Three Bucket' Strategy requires careful planning and regular review. The allocation among the three buckets should align with your retirement goals, risk tolerance, and time horizon. A common guideline is to allocate 20-30% of your portfolio to cash, 30-40% to bonds, and 40-50% to growth assets, but these percentages can vary based on individual circumstances.

It’s also important to regularly rebalance your portfolio to ensure that your allocations remain consistent with your strategy. Market fluctuations can cause your allocations to shift over time, leading to unintended risk exposure or underperformance. Rebalancing helps you maintain your desired investment mix and can enhance your overall returns.

Benefits of the Three Bucket Strategy

The 'Three Bucket' Strategy offers several advantages for retirees looking to manage their investments effectively:

- Risk Management: By diversifying your investments across cash, bonds, and growth assets, you can reduce the overall risk of your portfolio.

- Liquidity: The cash bucket ensures that you have immediate access to funds for living expenses, minimizing the need to sell investments at an inopportune time.

- Income Generation: Bonds provide a reliable source of income, while growth assets offer the potential for capital appreciation.

- Inflation Protection: Maintaining a portion of your portfolio in growth assets helps protect against inflation, ensuring that your purchasing power is preserved over time.

Conclusion

In summary, the 'Three Bucket' Strategy is an effective framework for managing retirement investments. By balancing your portfolio across cash, bonds, and growth assets, you can create a retirement investment plan that provides liquidity, stability, and long-term growth. As you navigate your retirement years, consider implementing this strategy to help achieve your financial goals and secure a comfortable future.

Explore

Upscale Family Vacations: Balancing Kid‑Friendly and Luxe

Unlocking Success: How Call Answering Services Enhance Customer Experience and Boost Business Growth

Top HBS Online Courses for Career Growth in 2025

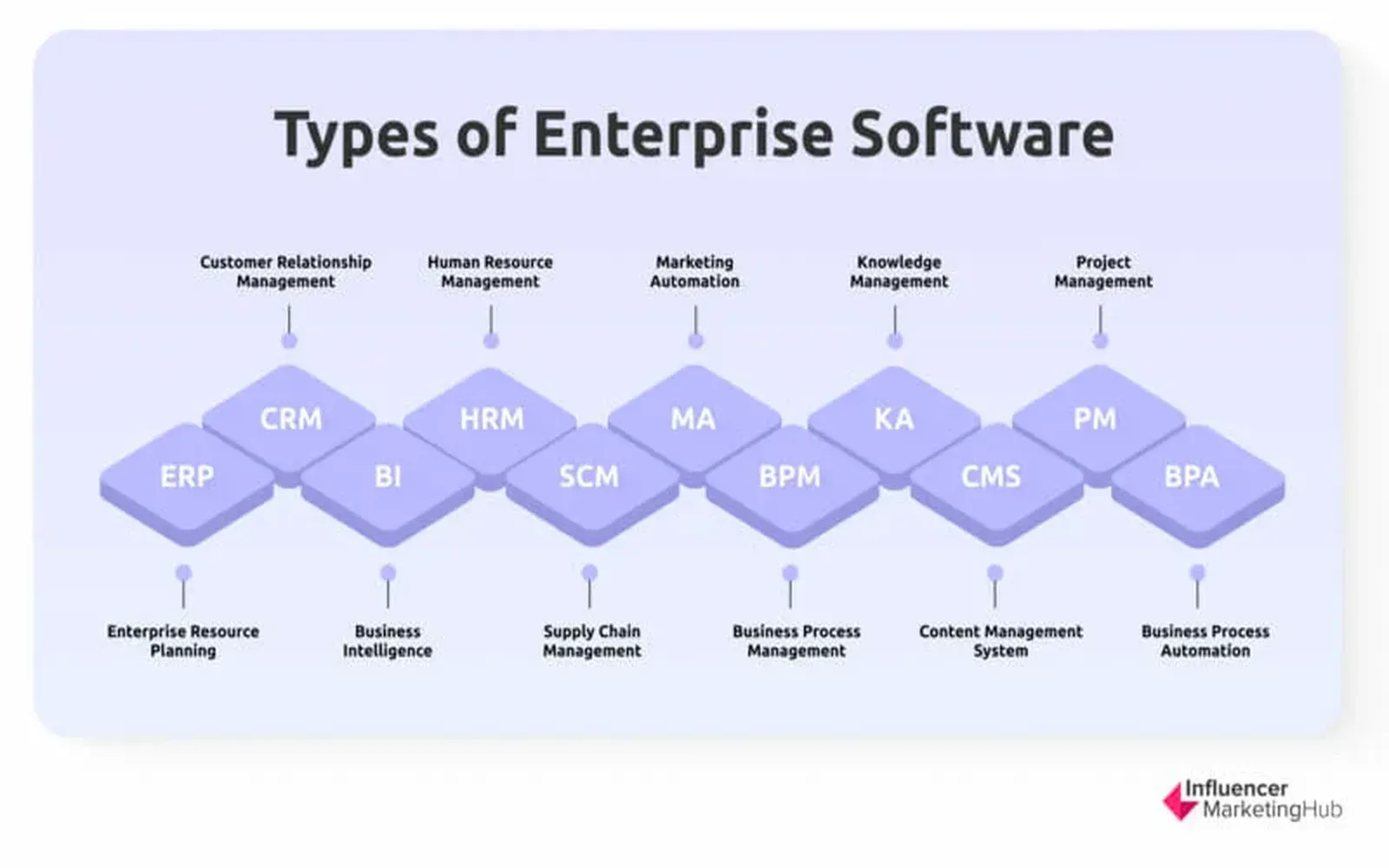

How Enterprise Software Can Drive Growth

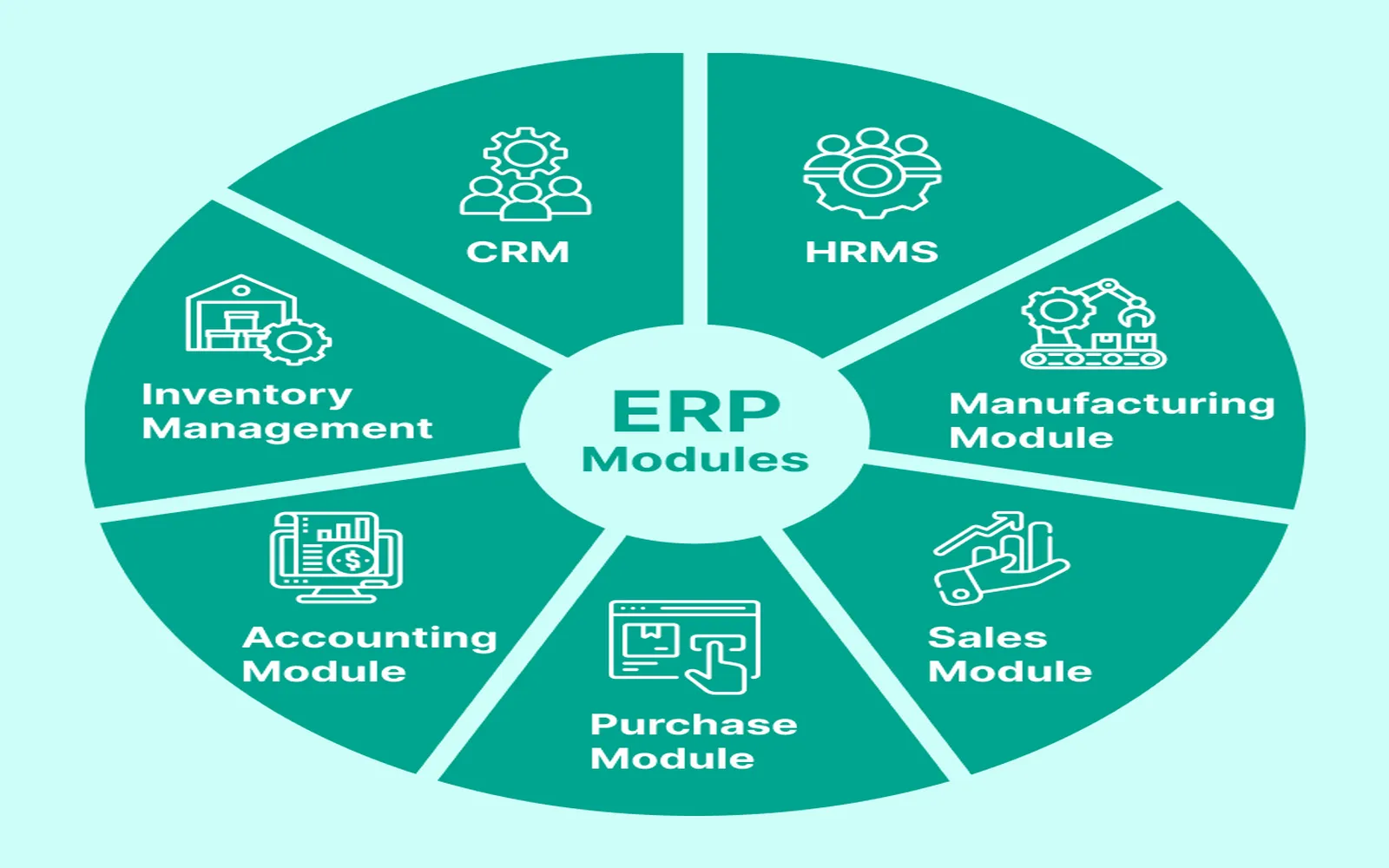

Top ERP Tools to Power Small Business Growth

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

How Sewer Cameras and Locators Improve Plumbing Diagnostics

Top Cruise Lines Offering Senior-Friendly Amenities and Discounts