Top Small Business Accounting Tools for 2025

As small businesses navigate financial management in 2025, choosing the right accounting software is crucial. Top tools offer features like invoicing, expense tracking, and tax preparation, tailored for small enterprises. Solutions such as QuickBooks, FreshBooks, and Xero stand out for their user-friendly interfaces and integration capabilities, helping small business owners streamline operations and enhance financial visibility.

As we move into 2025, small businesses are increasingly relying on technology to streamline their financial operations. The right accounting software can make a significant difference in how efficiently a business operates. By leveraging advanced features and user-friendly interfaces, small businesses can not only save time but also reduce errors in their accounting processes. Here, we explore some of the top **small business accounting tools** that are set to make waves in 2025.

1. QuickBooks Online

QuickBooks Online has long been a favorite among **small business accounting software** users. Its comprehensive features include invoicing, expense tracking, and payroll management. The platform's cloud-based architecture allows business owners to access their financial data from anywhere, making it a top choice for businesses with remote teams. In 2025, QuickBooks will continue to evolve with enhanced reporting capabilities and even more integrations with third-party applications.

2. FreshBooks

FreshBooks is another leading contender in the realm of **small business accounting tools**. Known for its intuitive interface, FreshBooks provides functionality that caters specifically to freelancers and service-based businesses. Features such as time tracking, client management, and customizable invoices make it ideal for small business owners who need to manage multiple clients efficiently. The software also boasts robust reporting features that can help users analyze their financial health effectively.

3. Xero

Xero is a cloud-based accounting software that has gained popularity for its easy navigation and extensive features. It offers invoicing, bank reconciliation, and inventory tracking, making it suitable for various types of small businesses. The real-time collaboration feature allows business owners and accountants to work together seamlessly, ensuring that financial data is always up-to-date. In 2025, Xero is expected to introduce AI-driven insights, providing users with predictive analytics that can help in decision-making.

4. Wave Accounting

For small businesses with budget constraints, Wave Accounting offers a robust free solution. It includes features like invoicing, expense tracking, and receipt scanning, making it an effective choice for startups and freelancers. While some premium features are available at a cost, the basic functionalities are sufficient for many small businesses. In 2025, Wave is anticipated to expand its offerings with more integrations and enhanced customer support.

5. Zoho Books

Zoho Books is part of the broader Zoho suite of applications and is designed to cater to the diverse needs of small businesses. It offers a comprehensive set of features, including invoicing, expense tracking, and tax management. One of its standout features is the ability to automate workflows, which can save time and reduce manual errors. In 2025, Zoho Books is likely to enhance its mobile app, making financial management even more accessible on the go.

6. Sage Business Cloud Accounting

Sage Business Cloud Accounting is designed for small businesses looking for robust accounting solutions. It offers invoicing, cash flow management, and VAT compliance. Its user-friendly interface makes it easy for business owners to navigate their financial data. In 2025, Sage is expected to introduce new features that leverage machine learning to provide better insights into financial trends, helping small businesses make informed decisions.

7. Kashoo

Kashoo is a simple yet effective accounting software tailored for small business owners. Its straightforward interface allows users to handle invoicing, expense tracking, and financial reporting without a steep learning curve. Kashoo emphasizes ease of use, making it ideal for entrepreneurs who may not have a financial background. In 2025, Kashoo aims to integrate more advanced features like multi-currency support, catering to businesses with international clients.

Comparison Table of Top Small Business Accounting Tools

| Tool | Best For | Key Features | Pricing |

|---|---|---|---|

| QuickBooks Online | Comprehensive accounting | Invoicing, expense tracking, payroll | Starts at $25/month |

| FreshBooks | Freelancers and service businesses | Time tracking, client management | Starts at $15/month |

| Xero | Collaborative accounting | Bank reconciliation, inventory tracking | Starts at $12/month |

| Wave Accounting | Free solution | Invoicing, receipt scanning | Free, with premium features available |

| Zoho Books | Integrated suite | Workflow automation, tax management | Starts at $15/month |

| Sage Business Cloud Accounting | Robust accounting | Cash flow management, VAT compliance | Starts at $10/month |

| Kashoo | Simple accounting | Invoicing, financial reporting | Starts at $16.65/month |

Conclusion

Choosing the right **small business accounting software** can significantly impact your business's financial health and operational efficiency. Each of the tools mentioned offers unique features tailored to different types of businesses. As we head into 2025, it’s essential for small business owners to consider their specific needs and choose the accounting software that best aligns with their goals. By leveraging these advanced tools, businesses can ensure they stay on top of their financial responsibilities and focus on growth.

Explore

Best Tools to Generate SEO-Friendly Website Names

Top Website Design Tools for Beginners and Pros

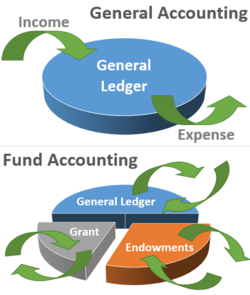

Online Fund Accounting Programs: Flexibility for Busy Learners

Top Customer Support Tools for Small Business

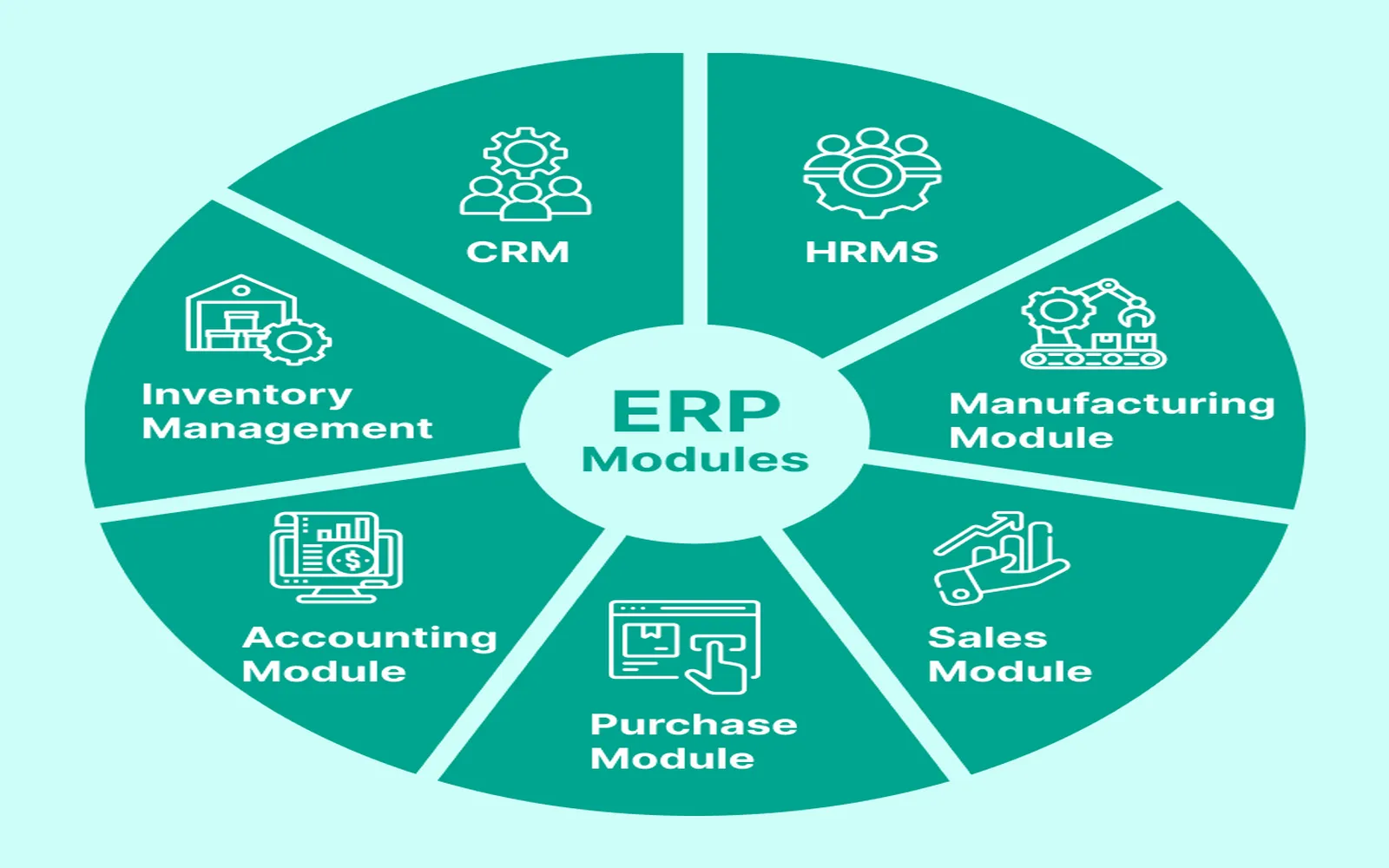

Top ERP Tools to Power Small Business Growth

Best Cloud Backup Tools to Protect Data in 2025

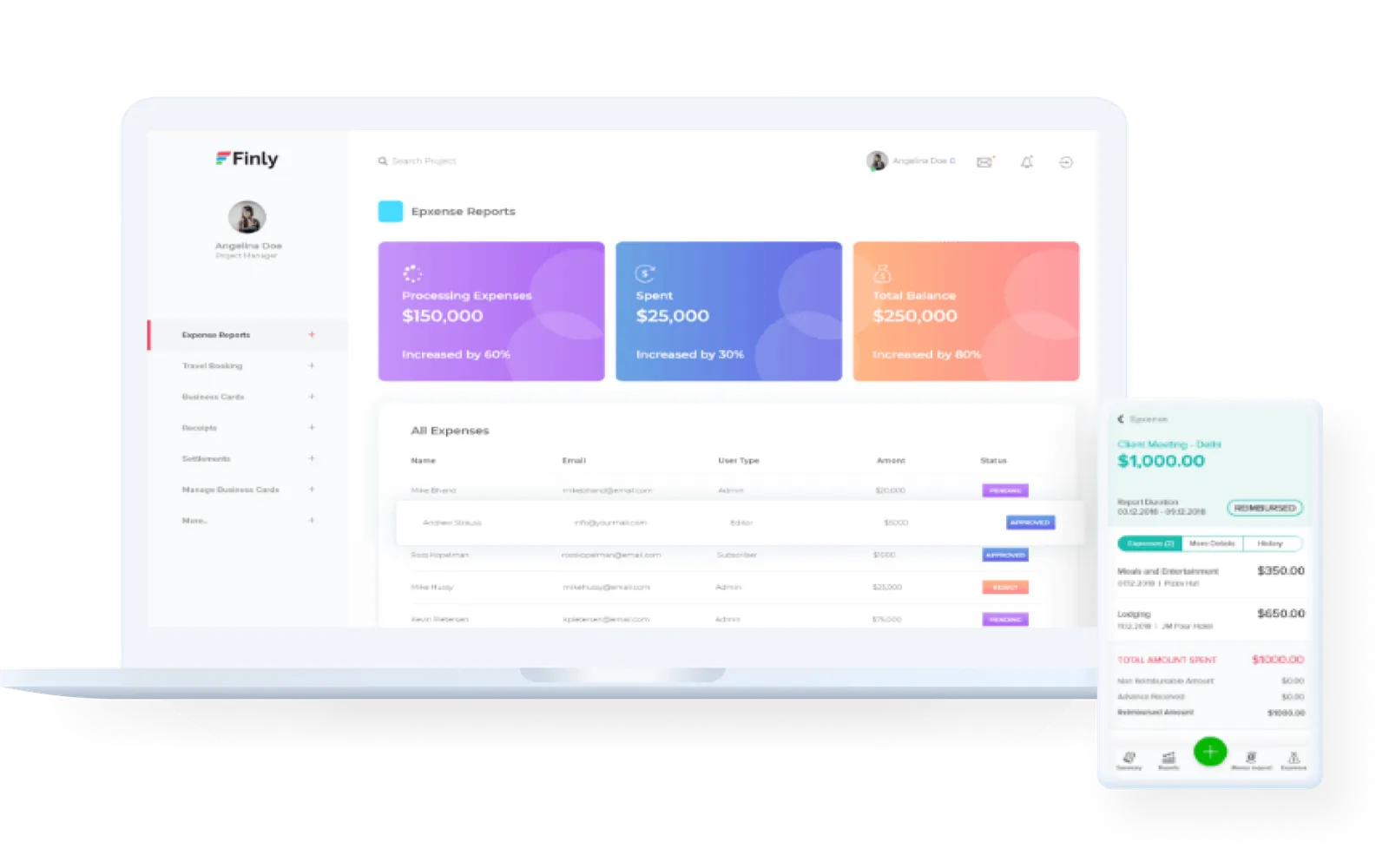

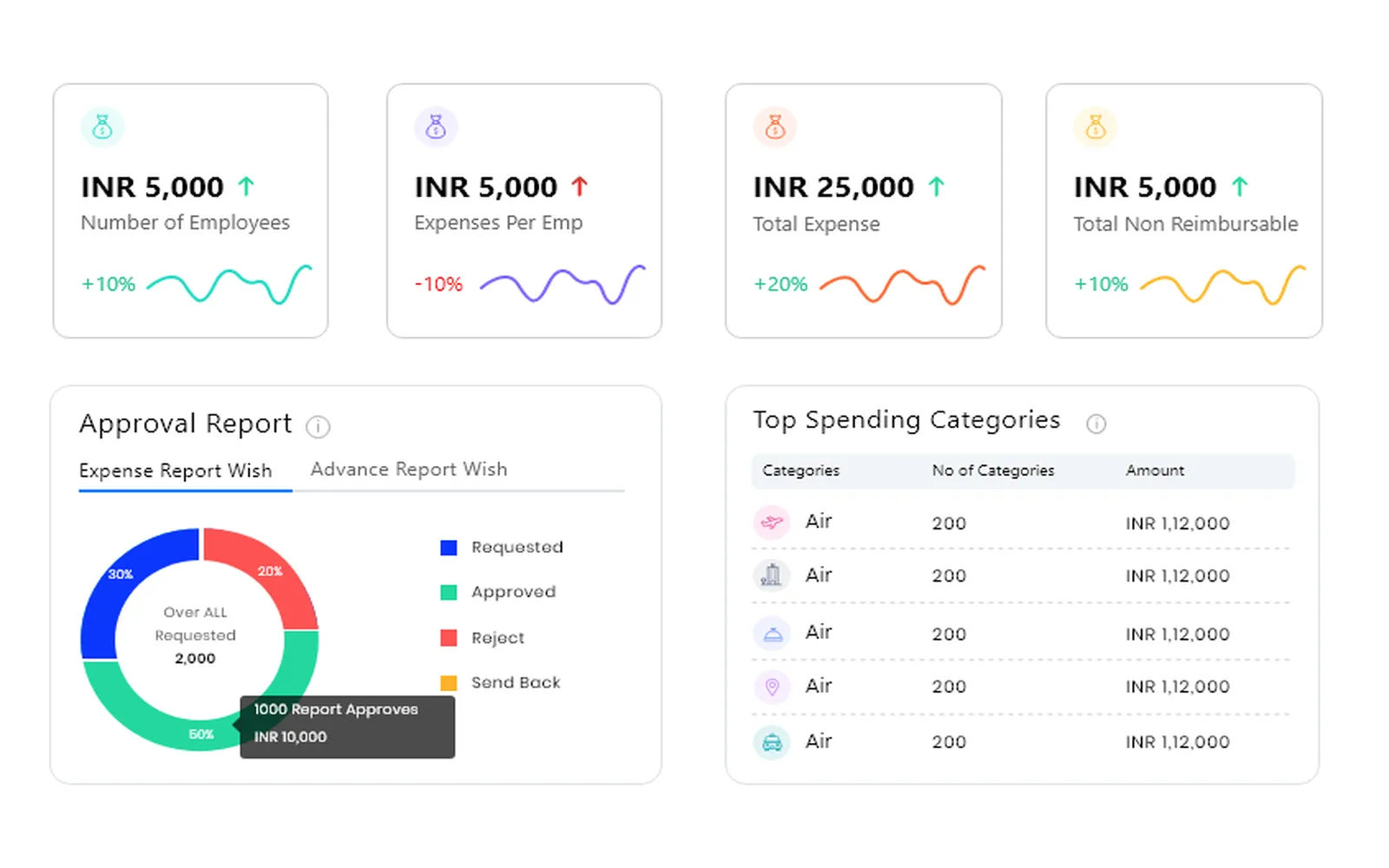

Top Expense Management Tools in 2025

Best Tools for Personal Expense Tracking