2025’s Best Bookkeeping Solutions for Small Businesses

In 2025, the landscape of bookkeeping for small businesses is set to transform with innovative solutions. Cutting-edge software will streamline financial management, ensuring accuracy and efficiency. Enhanced automation features will reduce manual tasks, allowing small business owners to focus on growth. With user-friendly interfaces and robust support, these bookkeeping solutions will empower small enterprises to thrive in a competitive market.

As we approach 2025, small businesses are continuously seeking efficient and cost-effective bookkeeping solutions to manage their financial records. Selecting the right software or service is crucial for maintaining accurate records, ensuring compliance, and ultimately driving growth. Below, we explore the best bookkeeping solutions for small businesses in 2025, highlighting their features, benefits, and how they cater to the unique needs of smaller enterprises.

1. QuickBooks Online

QuickBooks Online remains one of the most popular bookkeeping solutions for small businesses in 2025. Its user-friendly interface and comprehensive features make it an ideal choice for entrepreneurs. It allows users to track income and expenses, create invoices, and generate reports effortlessly.

Key features include:

- Automatic bank and credit card transaction syncing

- Customizable invoices and payment reminders

- Tax preparation assistance

- Multi-currency support

With multiple pricing tiers, QuickBooks caters to various budgets, ensuring that small businesses can find a plan that suits their needs.

2. Xero

Xero is another excellent bookkeeping solution that provides a robust set of features tailored for small businesses. Its cloud-based platform facilitates seamless collaboration between business owners and accountants. Xero's dashboard offers a real-time view of financial health, making it easier for entrepreneurs to make informed decisions.

Notable features include:

- Unlimited users with all plans

- Automated bank feeds

- Expense claims through mobile apps

- Integration with over 800 third-party apps

With its rich feature set and competitive pricing, Xero is a strong contender for small businesses looking for comprehensive bookkeeping solutions.

3. FreshBooks

FreshBooks has established itself as a go-to solution for self-employed individuals and small business owners, particularly those in service industries. Its intuitive interface makes managing finances effortless, allowing users to spend more time focusing on their business operations.

Key features of FreshBooks include:

- Time tracking for billable hours

- Customizable invoicing with recurring billing options

- Expense tracking and receipt scanning

- Client communication tools

FreshBooks offers a free trial, allowing small businesses to test its features before committing to a subscription, further enhancing its appeal as a bookkeeping solution.

4. Wave Accounting

For small businesses looking for a completely free option, Wave Accounting stands out. It provides essential bookkeeping features without the burden of monthly fees. Wave is especially beneficial for freelancers and very small businesses that need a basic solution.

Features of Wave Accounting include:

- Unlimited income and expense tracking

- Invoicing and payment processing

- Bank connection for automatic transaction imports

- Reports for business performance insights

While it lacks some advanced features found in paid solutions, Wave is an excellent starting point for small businesses seeking to manage their finances effectively.

5. Zoho Books

Zoho Books is an affordable, feature-rich bookkeeping solution designed for small businesses. It integrates seamlessly with the Zoho ecosystem, making it ideal for businesses already using other Zoho applications.

Key features include:

- Automated workflows for recurring tasks

- Multi-currency support

- Client portal for easy communication

- Comprehensive reporting tools

Zoho Books offers competitive pricing with multiple tiers, making it accessible for businesses of all sizes while still providing advanced capabilities.

6. Kashoo

Kashoo is a straightforward bookkeeping solution that focuses on simplicity and ease of use. It's designed for small businesses that need essential features without overwhelming complexity.

Key features include:

- Automatic bank reconciliation

- Invoicing and expense tracking

- Mobile access for on-the-go management

- Tax reporting features

Kashoo provides a free trial, allowing users to explore its features before committing, making it an attractive option for small businesses in need of a reliable bookkeeping solution.

7. Bench

Bench offers a unique combination of software and professional bookkeeping services. This solution is ideal for small business owners who prefer to delegate their bookkeeping tasks to professionals while still retaining access to their financial data through Bench's platform.

Key features include:

- Dedicated bookkeeping team

- Monthly financial reports

- Tax-ready financials

- Real-time chat support

Although it comes with a higher price point, the value of having dedicated professionals manage your bookkeeping can be worth the investment for many small business owners.

Conclusion

As we move into 2025, small businesses have a variety of bookkeeping solutions to choose from, each catering to different needs and budgets. Whether you prefer a robust software like QuickBooks Online and Xero or a free option like Wave, the right choice can streamline your financial management and contribute to your business's success. Take the time to evaluate your specific requirements, and consider trying out a few options to find the best fit for your business.

Explore

Top Payroll Software Solutions for Small Businesses in 2025

Top Online Advertising Strategies for Small Businesses in 2025

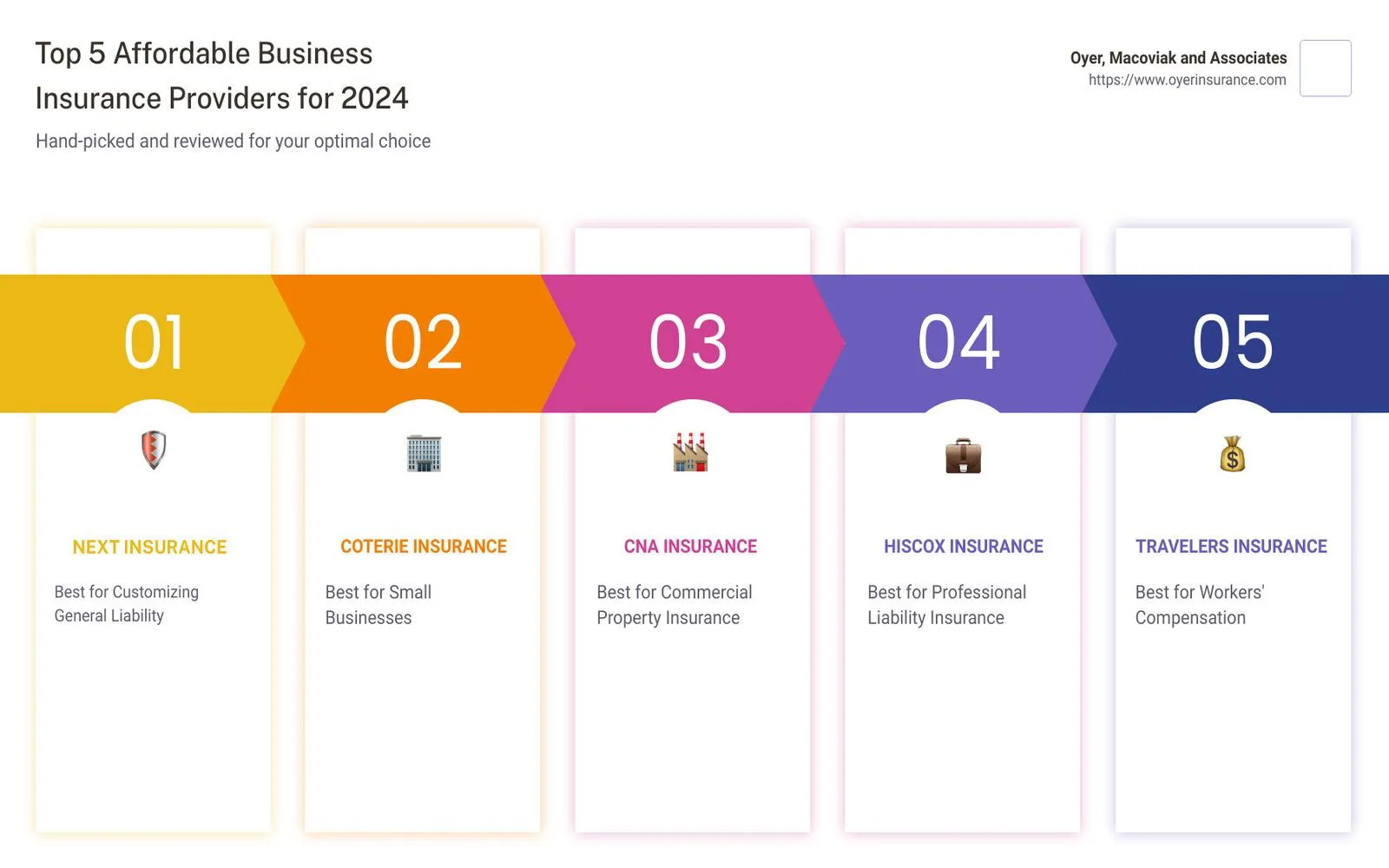

Top Liability Insurance Companies for Small Businesses

Best CRM Software for Small Businesses in 2025

Top Compliance Software Solutions for 2025

Optimize IT Costs with DaaS Solutions

Top Hair Loss Solutions for Men & Women in 2025

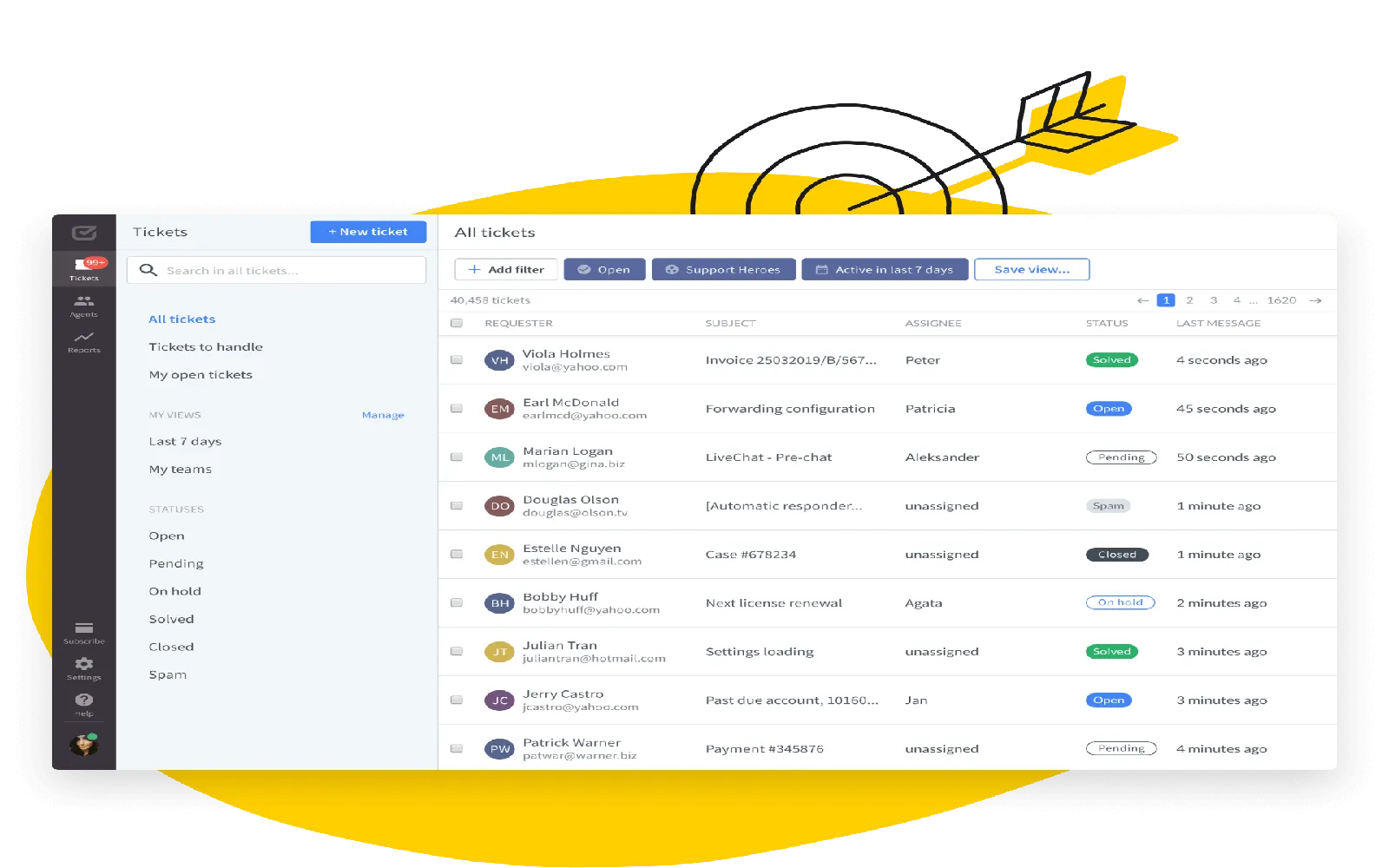

Top Help Desk Software Solutions for Business