Top Payroll Software Solutions for Small Businesses in 2025

Choosing the right payroll software for small businesses in 2025 can make a significant impact on compliance, time savings, and overall employee satisfaction. With advanced automation, AI-powered tax tools, and integration capabilities, the latest payroll platforms are tailored to meet the evolving needs of American small businesses. This guide explores the best payroll solutions to consider and helps you find the right fit for your business.

Why Payroll Software Matters in 2025

Modern payroll tools go beyond paycheck processing—they offer integrated tax filing, benefits management, employee self-service, and detailed reporting. These systems reduce human error and free up time for small business owners to focus on growth.

| Feature | Benefit for Small Businesses |

|---|---|

| Automated Tax Filing | Minimizes IRS penalties and ensures compliance |

| Direct Deposit & Mobile Pay | Enhances employee satisfaction and payment speed |

| Employee Self-Service Portals | Reduces admin workload by allowing employees to manage data |

| Time Tracking Integration | Streamlines payroll calculations from hourly logs |

| Cloud-Based Access | Offers secure access from anywhere, ideal for remote teams |

Top Payroll Software Platforms in 2025

Here's a comparison of the leading payroll platforms in 2025 for small business owners in the U.S.:

| Payroll Software | Key Features | Pricing (Starting) | Best For |

|---|---|---|---|

| Gusto | Automated taxes, benefits, hiring tools | $40/mo + $6/user | All-in-one HR + Payroll |

| QuickBooks Payroll | Intuit integration, same-day direct deposit | $45/mo + $6/user | QuickBooks users |

| ADP Run | Scalable, tax compliance, HR add-ons | Custom pricing | Growing businesses |

| Paychex Flex | Mobile app, HR support, retirement plans | $39/mo + $5/user | Businesses needing HR services |

| OnPay | Full-service payroll + benefits admin | $40/mo + $6/user | Startups and lean teams |

| Patriot Payroll | Affordable, US-based support | $17/mo + $4/user | Budget-conscious small businesses |

| Rippling | Unified employee management platform | $35/mo + $8/user | Tech-savvy businesses |

| Square Payroll | Seamless Square POS integration | $35/mo + $5/user | Retail and foodservice |

| Zenefits | Payroll, compliance, HR, time tracking | $10/mo + $6/user | Integrated HR and payroll |

| SurePayroll | Tax filing, household payroll options | $29.99/mo + $5/user | Contractors & household employers |

How to Choose the Right Payroll Software

Selecting the best payroll system depends on your business size, complexity, and future growth plans.

| Consideration | What to Look For |

|---|---|

| Budget | Consider pricing tiers and hidden fees |

| Integrations | Look for compatibility with your accounting and time tools |

| Customer Support | 24/7 support and onboarding services can ease the transition |

| Scalability | Choose a platform that grows with your team |

| Compliance Tools | Ensure automatic federal, state, and local tax updates |

Benefits of Cloud-Based Payroll for Small Businesses

Cloud-based payroll platforms offer small businesses flexibility, real-time data access, and enhanced security—critical in today's digital-first business environment.

| Benefit | Description |

|---|---|

| Real-Time Updates | Keep payroll records current with minimal manual input |

| Data Security | Encrypted storage protects sensitive employee information |

| Access Anywhere | Manage payroll on-the-go with apps or browser access |

| Easy Collaboration | Accountants and HR managers can log in remotely |

Final Thoughts

In 2025, payroll software for small businesses is more powerful and accessible than ever. Whether you're a startup with a lean team or a growing company scaling quickly, the right payroll platform can save time, reduce risk, and keep your team happy. Compare the features, integrations, and pricing carefully before making your choice.

Explore

How Small Businesses Can Benefit from Call Center Outsourcing

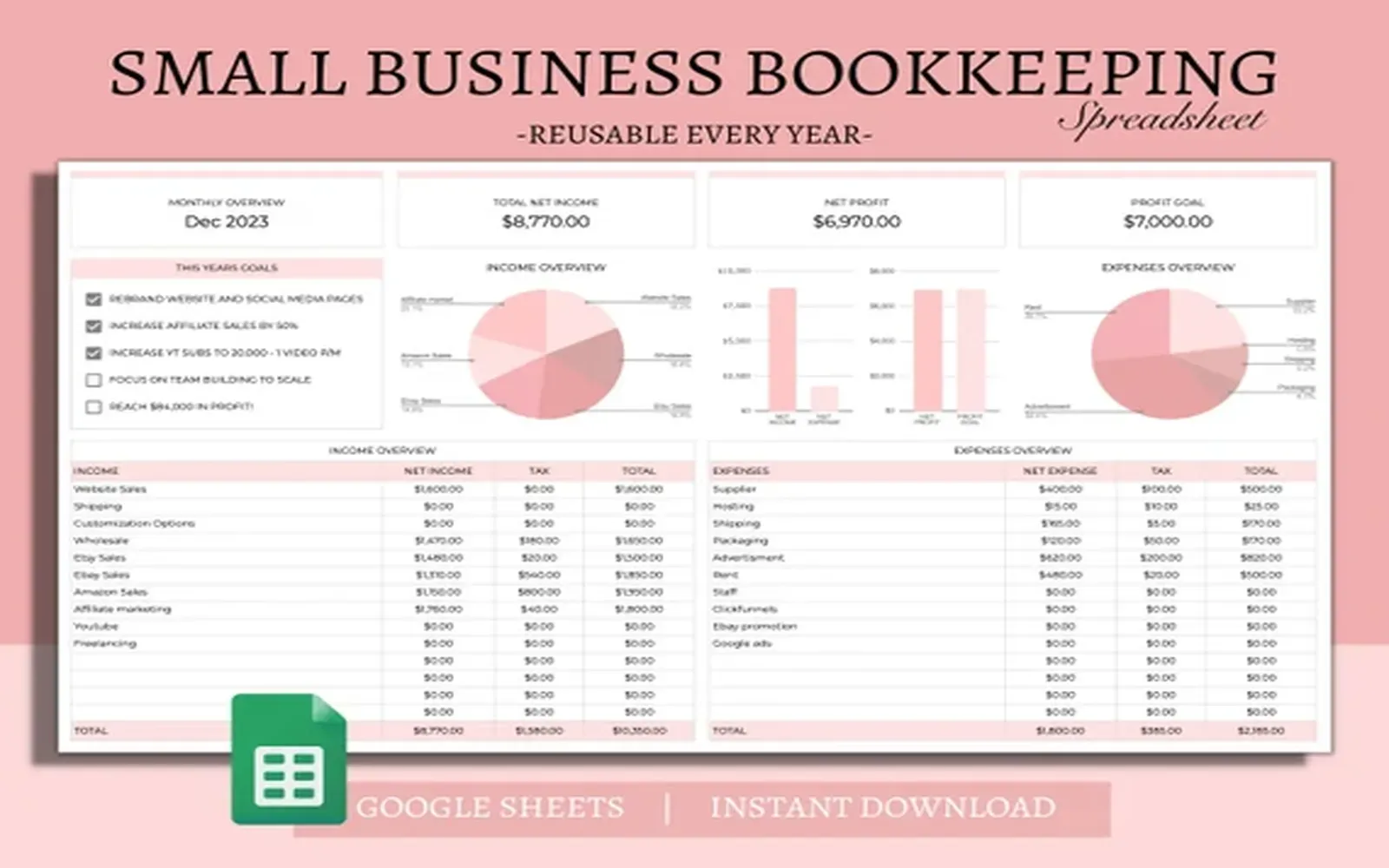

2025’s Best Bookkeeping Solutions for Small Businesses

Best CRM Software for Small Businesses in 2025

Top Online Advertising Strategies for Small Businesses in 2025

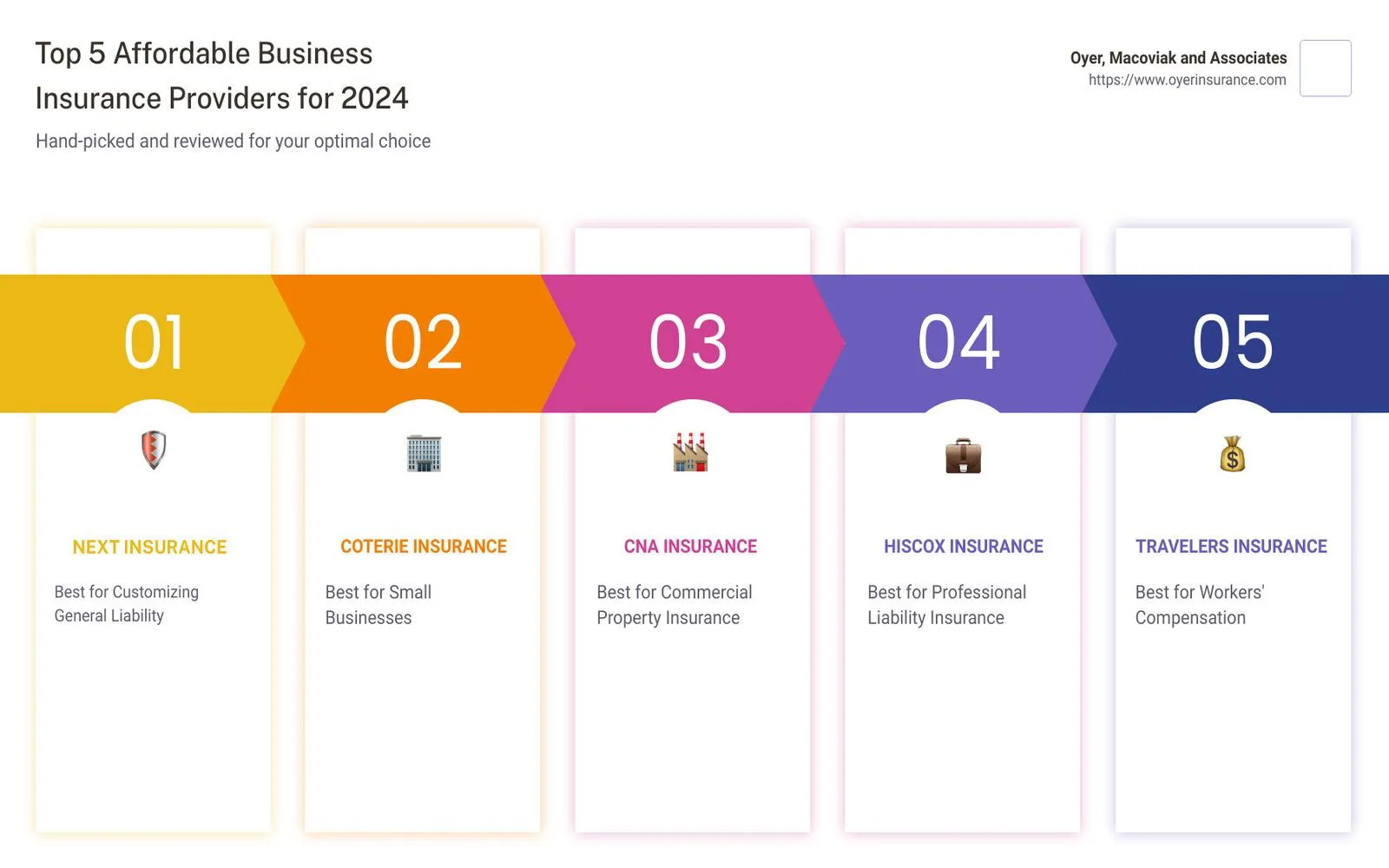

Top Liability Insurance Companies for Small Businesses

Top Compliance Software Solutions for 2025

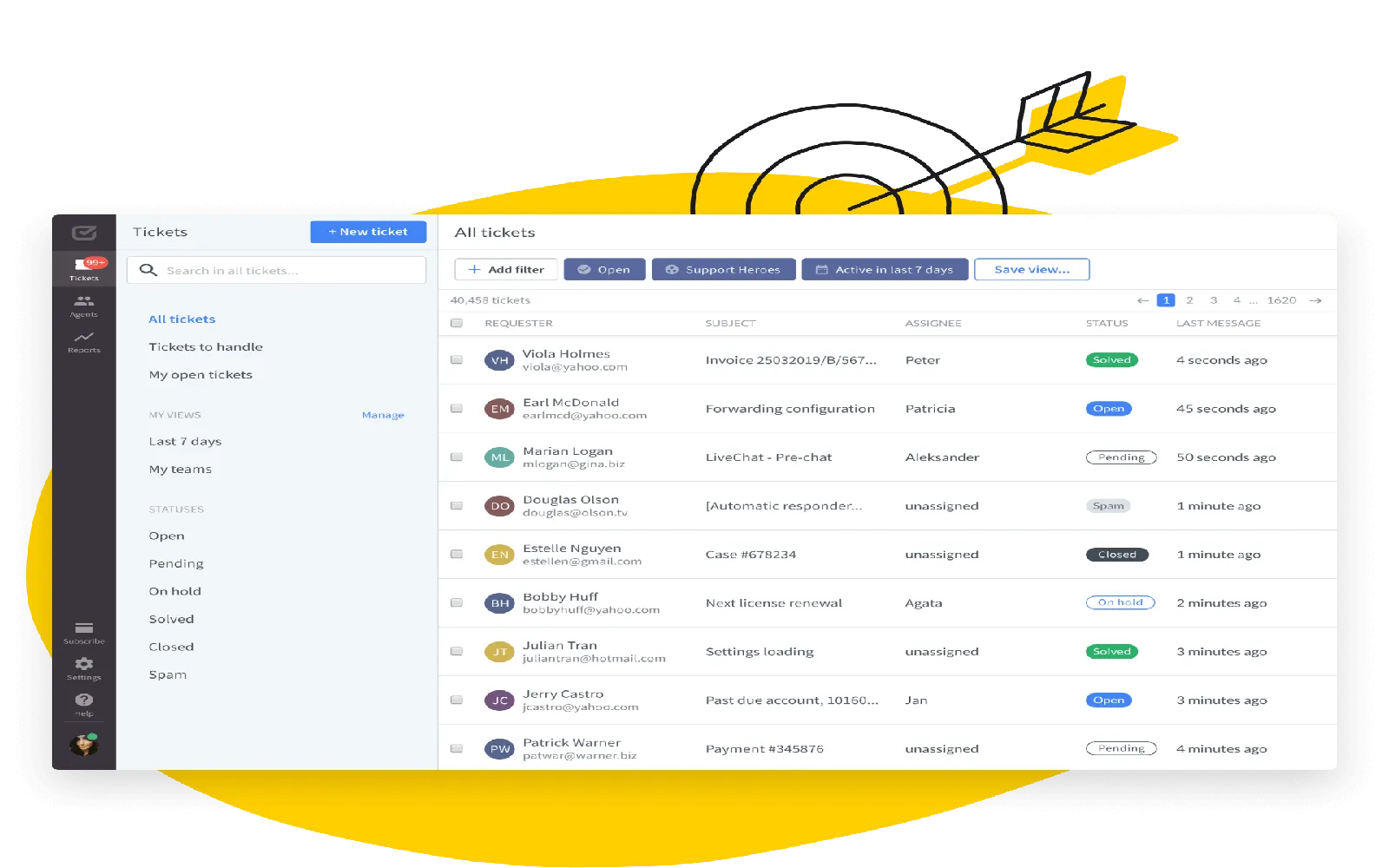

Top Help Desk Software Solutions for Business

Event Planning Software for Small Teams: Affordable and Effective Options