Choosing the Right Health Insurance Plan: A 2025 Guide

Navigating the health insurance landscape in 2025 can feel overwhelming, but selecting the right health insurance plan is critical for both your financial stability and well-being. With rising medical costs and a range of coverage options from private insurers and government marketplaces, U.S. individuals and families need to understand their choices to make informed decisions. This guide breaks down everything you need to know.

Understanding Your Health Insurance Options

There are several types of plans available, each with its own pros and cons. Here’s a quick comparison:

| Plan Type | Key Features | Best For |

|---|---|---|

| HMO (Health Maintenance Organization) | Requires PCP referrals, limited to network providers | People seeking lower premiums and fewer choices |

| PPO (Preferred Provider Organization) | No referrals needed, broader provider access | Those wanting flexibility and nationwide coverage |

| EPO (Exclusive Provider Organization) | No referrals, must use in-network services | Mid-tier budget-conscious individuals |

| HDHP (High Deductible Health Plan) | Lower premiums, higher deductibles, HSA eligible | Healthy individuals or those wanting HSA benefits |

| POS (Point of Service) | Mix of HMO and PPO features | People who want some out-of-network flexibility |

Factors to Consider When Choosing a Plan

Choosing a plan isn’t just about premiums. Evaluate the following:

| Factor | Why It Matters |

|---|---|

| Monthly Premium | Regular cost regardless of use |

| Deductible | Amount paid before insurance starts covering expenses |

| Co-payments/Coinsurance | Your share of costs after deductible |

| Network Coverage | Determines which doctors/hospitals are covered |

| Prescription Coverage | Important if you need regular medications |

| Out-of-Pocket Max | Caps your annual spending for covered services |

| HSA/FSA Eligibility | Offers tax advantages for medical expenses |

How to Compare Health Insurance Plans in 2025

Here’s how to approach plan comparison strategically:

| Step | Action to Take |

|---|---|

| Assess Your Healthcare Needs | Review medical history, medications, and expected usage |

| Estimate Total Annual Costs | Add premiums, deductibles, co-pays, and prescriptions |

| Check Network Providers | Ensure your doctors and hospitals are in-network |

| Review Plan Ratings | Use CMS or state exchanges to check quality and satisfaction |

| Explore Subsidies | Use Healthcare.gov to estimate premium tax credits |

Health Insurance Marketplace vs. Private Insurers

| Source | Pros | Cons |

|---|---|---|

| ACA Marketplace | Tax credits, standardized plans, transparent pricing | May have fewer carrier options in some areas |

| Employer-Sponsored Plans | Often subsidized, convenient payroll deduction | Limited plan selection |

| Private Health Insurers | More plan variety, direct enrollment | May not qualify for ACA subsidies |

| Medicaid/CHIP | Low-cost/free for eligible households | Income and asset eligibility limits |

Tips for Saving on Health Insurance

| Strategy | Potential Benefit |

|---|---|

| Enroll Early | Avoid penalties and get first pick of plans |

| Use Preventive Care | Completely covered under ACA-compliant plans |

| Choose Generic Drugs | Significantly lower out-of-pocket prescription costs |

| Open an HSA or FSA | Reduce taxable income while saving for healthcare expenses |

| Compare Yearly | Plans and prices change—review options during open enrollment |

Explore

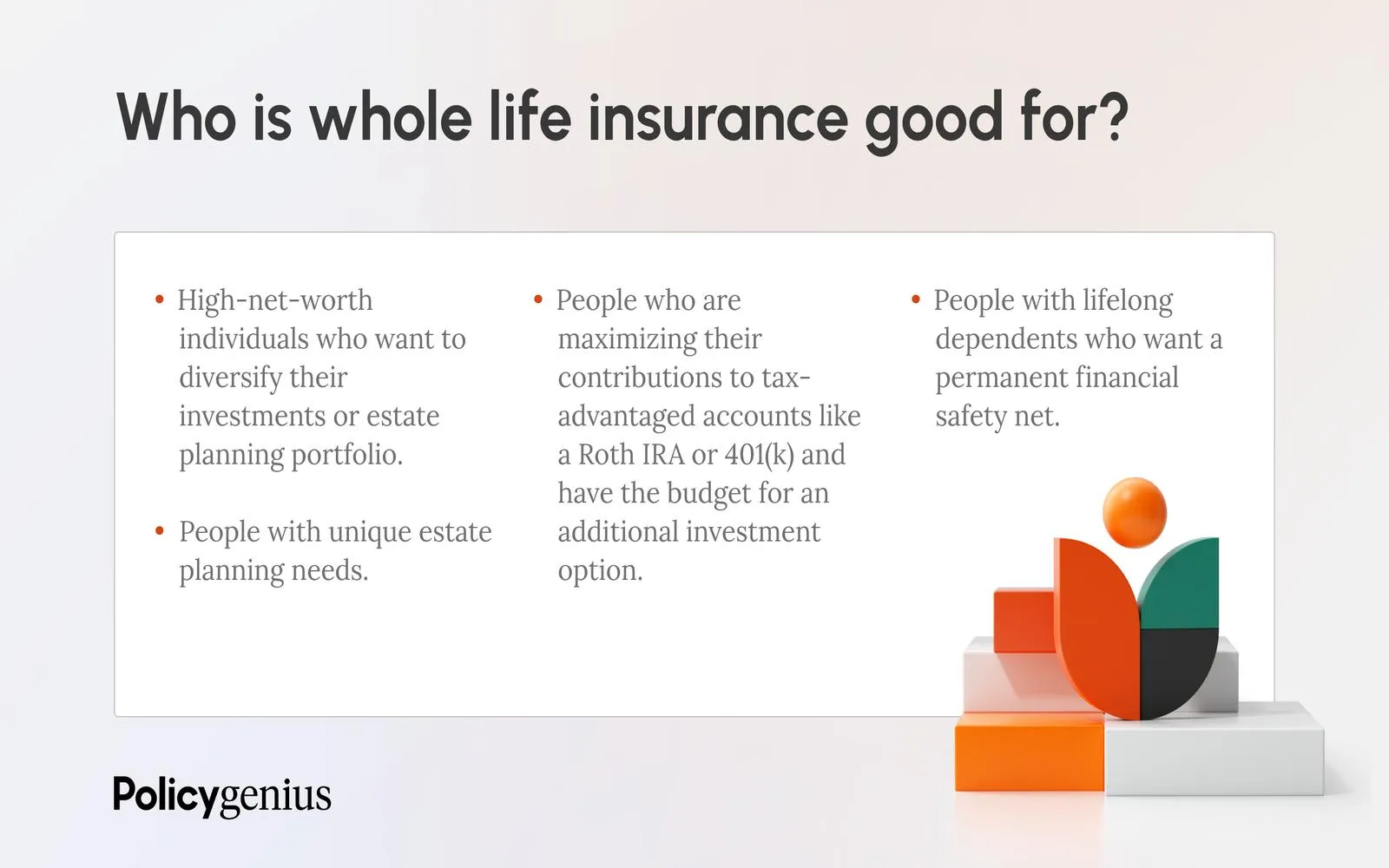

How to Choose the Right Life Insurance Plan

How to Choose the Best Health Insurance Plan

How to Choose a Prepaid vs Postpaid Cell Phone Plan for Your Family

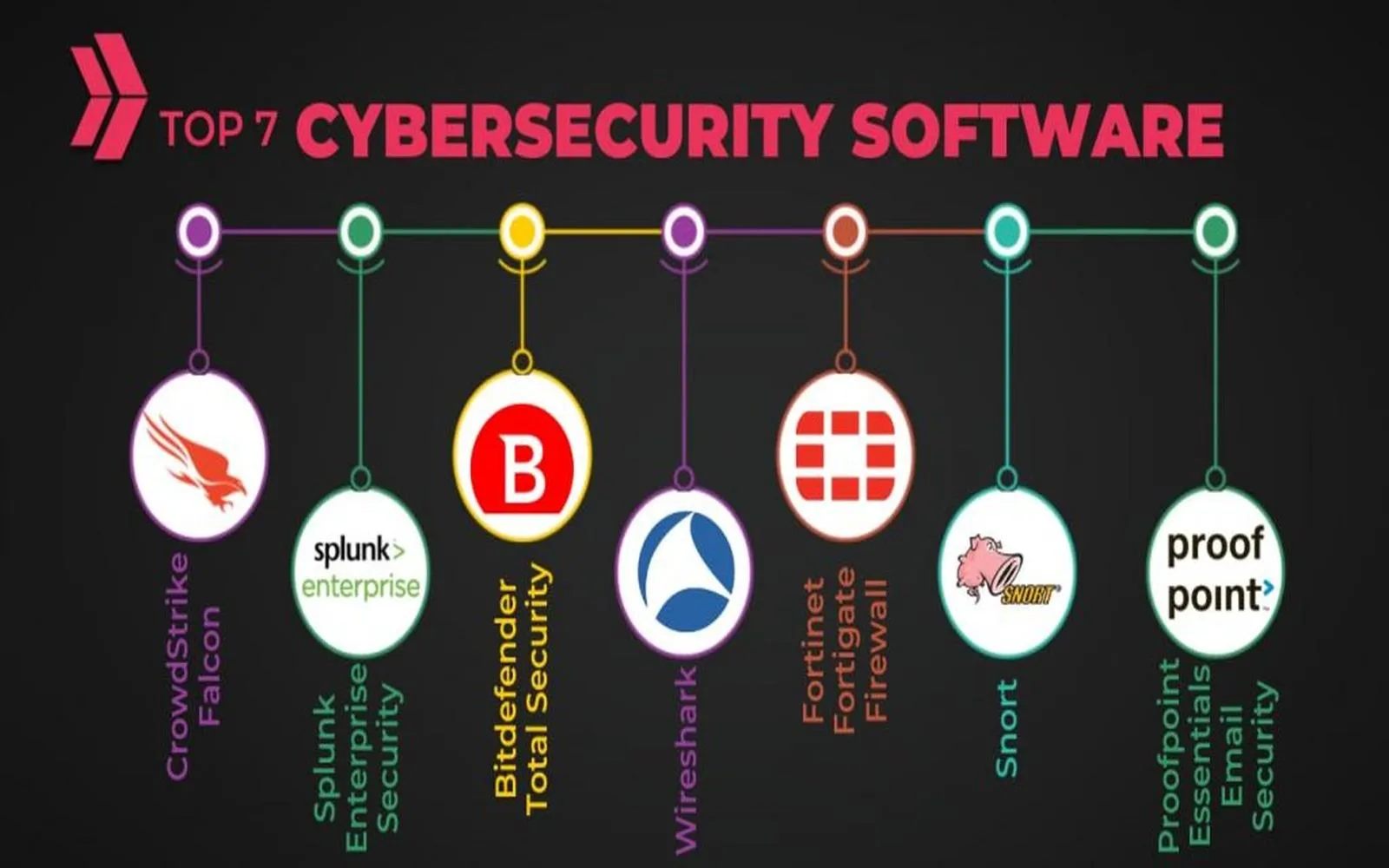

Choosing the Right Web Security Platform

Unlocking Health: Your Comprehensive Guide to Medical Loans for Affordable Care

Humana vs Other Providers: Which Health Plans Fit You Best?

Must-Have Health Monitoring Gadgets for 2025

Why Choosing a Local Law Firm Can Improve Your Case Outcome