Humana vs Other Providers: Which Health Plans Fit You Best?

When considering health insurance options, it's essential to evaluate various providers to determine which plans best suit your needs. Humana health benefits stand out among the competition, but how do they stack up against other major health insurance providers? In this article, we will compare Humana with other popular health insurance providers, helping you make an informed decision about your healthcare coverage.

Understanding Humana Health Benefits

Humana health benefits encompass a wide range of services designed to cater to diverse health needs. With a focus on preventative care, wellness programs, and chronic condition management, Humana aims to promote overall health and well-being among its members. Their plans often include features such as telehealth services, health coaching, and access to a vast network of healthcare providers.

Comparing Health Plans: Humana vs. Other Providers

When examining your options, it's crucial to consider factors such as coverage, cost, and additional services. Below is a comparison of Humana with other leading health insurance providers like Blue Cross Blue Shield, Aetna, and UnitedHealthcare.

| Provider | Key Features | Cost | Network Size |

|---|---|---|---|

| Humana | Preventive care, wellness programs, telehealth | Moderate | Large |

| Blue Cross Blue Shield | Wide range of plans, strong member support | Higher | Very large |

| Aetna | Wellness programs, fitness discounts | Moderate to high | Large |

| UnitedHealthcare | Comprehensive coverage, telemedicine | Moderate to high | Very large |

Cost Considerations

One of the primary concerns for individuals seeking health insurance is cost. Humana's plans are generally positioned as moderate in price, making them a viable option for many families and individuals. It’s important to note that while some competitors like Blue Cross Blue Shield may offer more extensive networks, their higher premiums can be a significant factor for those on a budget. Conversely, Aetna and UnitedHealthcare may also provide comparable benefits, but their costs can vary significantly based on the specific plan selected.

Coverage Options

Coverage options are another vital aspect to consider when comparing Humana to other providers. Humana offers a variety of health plans, including individual and family plans, Medicare Advantage plans, and employer-sponsored insurance. Many plans include essential health benefits such as hospitalization, preventive services, and prescription drug coverage. In comparison, Blue Cross Blue Shield is known for its comprehensive coverage options, which may appeal to those requiring specialized services.

Additionally, Aetna and UnitedHealthcare also provide a range of coverage options, but their plans may differ in terms of flexibility and additional services. For instance, UnitedHealthcare is recognized for its robust telemedicine offerings, making it a good choice for those who value convenient access to healthcare professionals.

Additional Services and Benefits

Beyond standard coverage, the additional services and benefits provided by Humana can make a significant difference in overall satisfaction. Humana emphasizes preventive care, offering programs that encourage regular health screenings and vaccinations. They also provide access to virtual care, which has become increasingly important in today's healthcare landscape.

In contrast, other providers like Aetna and UnitedHealthcare also focus on wellness initiatives, such as fitness discounts and health coaching. However, Humana’s tailored approach to chronic condition management can be particularly beneficial for individuals with ongoing health issues.

Network and Accessibility

The size and accessibility of a provider's network are crucial when selecting a health plan. Humana boasts a large network of healthcare providers, ensuring members have access to a variety of specialists and facilities. This is comparable to Blue Cross Blue Shield and UnitedHealthcare, both of which offer extensive networks across the United States.

Aetna also provides a large network, but members may find that certain services are limited based on their specific plan. It is essential to check the network availability in your area, as this can significantly impact your healthcare experience.

Making the Right Choice for Your Health Needs

Ultimately, the choice between Humana and other health insurance providers depends on your unique health needs and financial situation. If you prioritize preventive care, wellness programs, and a moderate cost, Humana health benefits may be the right fit for you. However, if you require specialized services or have specific health conditions, it may be worth exploring the offerings from Blue Cross Blue Shield, Aetna, or UnitedHealthcare.

Before making a decision, take the time to assess your healthcare needs, budget, and preferences. By doing so, you can ensure that you select a health plan that provides the coverage and support you need for a healthy future.

Explore

Online MHA Programs That Fit Your Busy Schedule

Top Car Insurance Providers in the U.S.: 2025 Rankings

Top Business Internet Providers in the U.S.: A Comparison

Affordable Internet Providers for Small Business in 2025

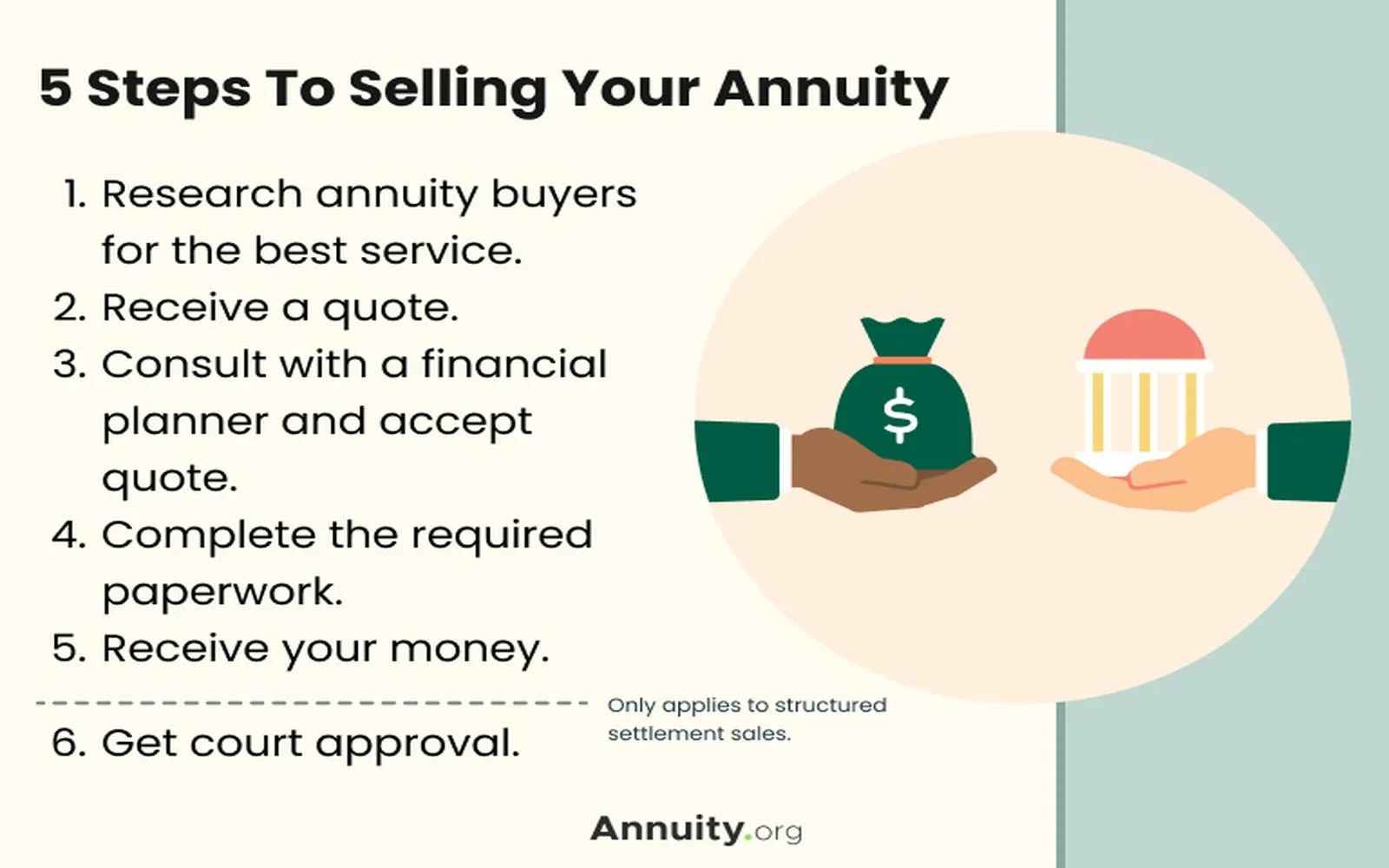

Top Structured Settlement Providers in 2025

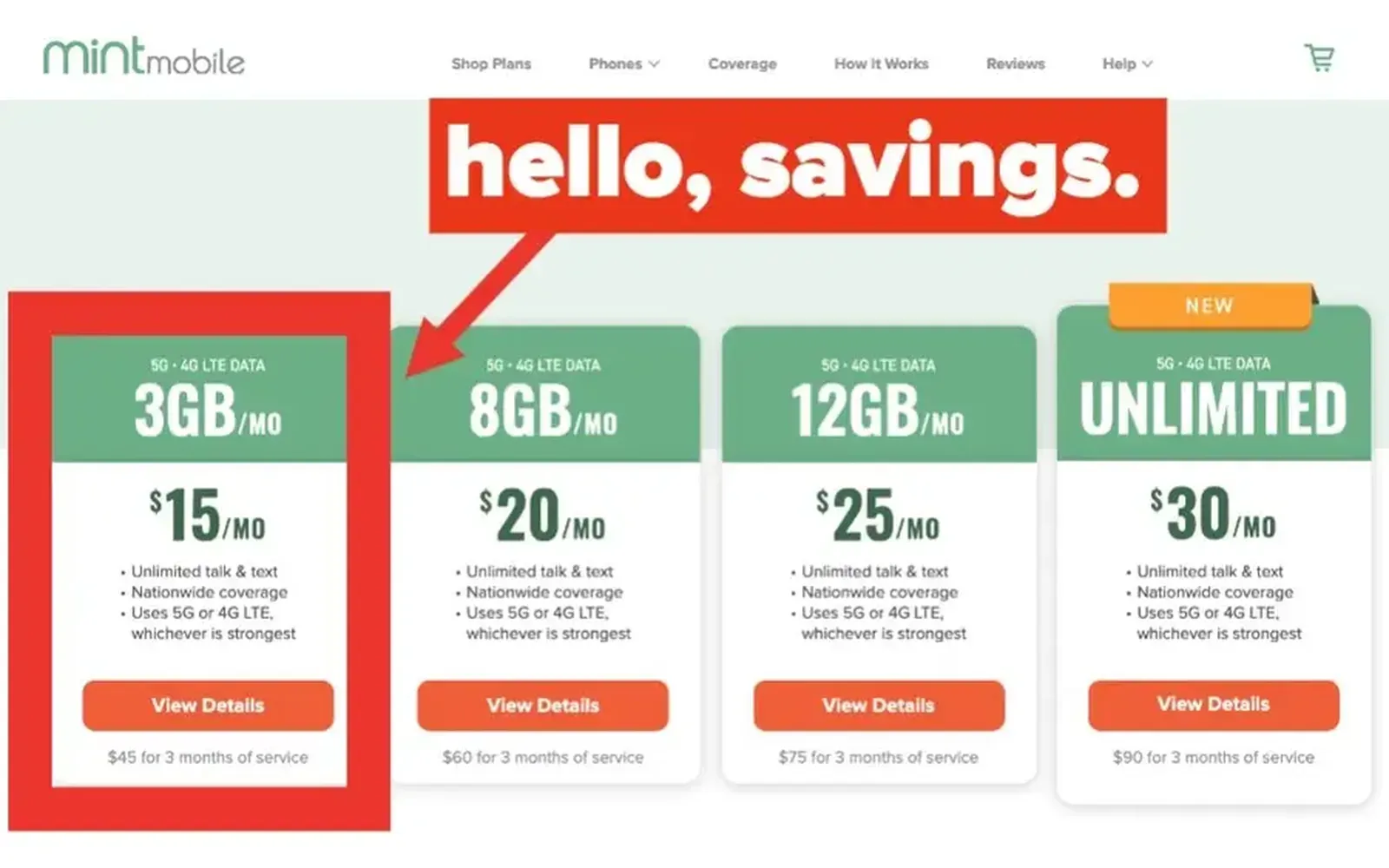

Top 2025 Cell Phone Plans Compared

Choosing the Right Health Insurance Plan: A 2025 Guide

How to Choose the Best Health Insurance Plan