Emergency Fund Essentials: What You Need Saved by 30, 40, 50

An emergency fund is crucial for financial stability. By age 30, aim to save at least three months' worth of expenses; by 40, increase that to six months; and by 50, target a year’s worth. These Personal Finance Tips ensure you’re prepared for unexpected costs, providing peace of mind and financial security in times of crisis.

Having an emergency fund is a crucial aspect of sound personal finance management. It acts as a financial safety net during unexpected circumstances, such as medical emergencies, job loss, or urgent home repairs. But how much should you have saved by specific ages? Here’s a breakdown of the emergency fund essentials you should aim for by your 30s, 40s, and 50s.

Emergency Fund Goals by Age

As you progress through life, your financial responsibilities and potential risks will change. Thus, your emergency fund should evolve accordingly. Below is a guideline of how much you should aim to have saved by certain ages.

| Age | Emergency Fund Goal |

|---|---|

| 30 | 3 to 6 months of expenses |

| 40 | 6 to 9 months of expenses |

| 50 | 9 to 12 months of expenses |

By the age of 30, you should ideally have 3 to 6 months' worth of living expenses saved. As you enter your 40s, it's advisable to increase this amount to 6 to 9 months of expenses. By the time you reach 50, a cushion of 9 to 12 months is recommended. This scaling up accounts for increased financial responsibilities, such as mortgages, children's education, and retirement planning.

Why an Emergency Fund is Essential

Establishing an emergency fund is one of the most vital personal finance tips you can follow. Here are a few reasons why:

- Financial Security: An emergency fund offers peace of mind and financial security, allowing you to handle unforeseen expenses without resorting to high-interest debts.

- Job Loss Preparedness: If you lose your job, having an emergency fund can help you cover essential expenses while you search for new employment.

- Avoiding Debt: With an emergency fund in place, you're less likely to rely on credit cards or loans, helping you avoid debt accumulation.

How to Build Your Emergency Fund

Building an emergency fund may seem daunting, but with a strategic approach, it can be manageable. Here are some effective personal finance tips to help you get started:

- Set a Savings Goal: Determine how much you need to save based on your monthly expenses. This will give you a target to aim for.

- Automate Savings: Set up an automatic transfer from your checking account to your savings account each month. This makes saving effortless.

- Cut Unnecessary Expenses: Review your monthly spending and identify areas where you can cut back. Use these savings to bolster your emergency fund.

- Utilize Windfalls: If you receive a bonus, tax refund, or any unexpected income, consider putting a portion of it directly into your emergency fund.

Where to Keep Your Emergency Fund

Choosing the right account for your emergency fund is just as important as building it. Here are some options:

- High-Interest Savings Accounts: These accounts offer better interest rates than traditional savings accounts, helping your money grow while remaining accessible.

- Money Market Accounts: Money market accounts often provide higher interest rates and check-writing privileges, giving you flexibility in case of emergencies.

- Certificates of Deposit (CDs): While less accessible, CDs can yield higher interest rates. Just ensure the term aligns with your emergency fund needs.

Reassessing Your Emergency Fund

Your emergency fund should not be static. As your life changes, you should reassess your fund regularly. Major life events, such as marriage, having children, or changing jobs, can impact your financial landscape. Make it a point to review your emergency fund at least once a year.

Common Mistakes to Avoid

While building an emergency fund, avoid these common pitfalls:

- Not Saving Enough: Many people underestimate how much they need for emergencies. Always aim for at least the minimum suggested savings for your age.

- Using the Fund for Non-Emergencies: Reserve your emergency fund strictly for emergencies. Using it for planned expenses can derail your financial security.

- Lack of Discipline: Consistently contribute to your fund. Skipping months can set you back significantly.

Conclusion

In conclusion, having an emergency fund is a cornerstone of effective personal finance management. By aiming to save the appropriate amount by your 30s, 40s, and 50s, you can ensure that you are prepared for life's unexpected challenges. Use these personal finance tips to build and maintain your emergency fund, ensuring financial stability and peace of mind for the future.

Explore

Emergency Plumbing Services: When You Shouldn’t Wait

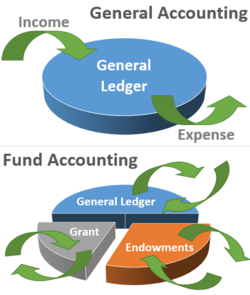

Online Fund Accounting Programs: Flexibility for Busy Learners

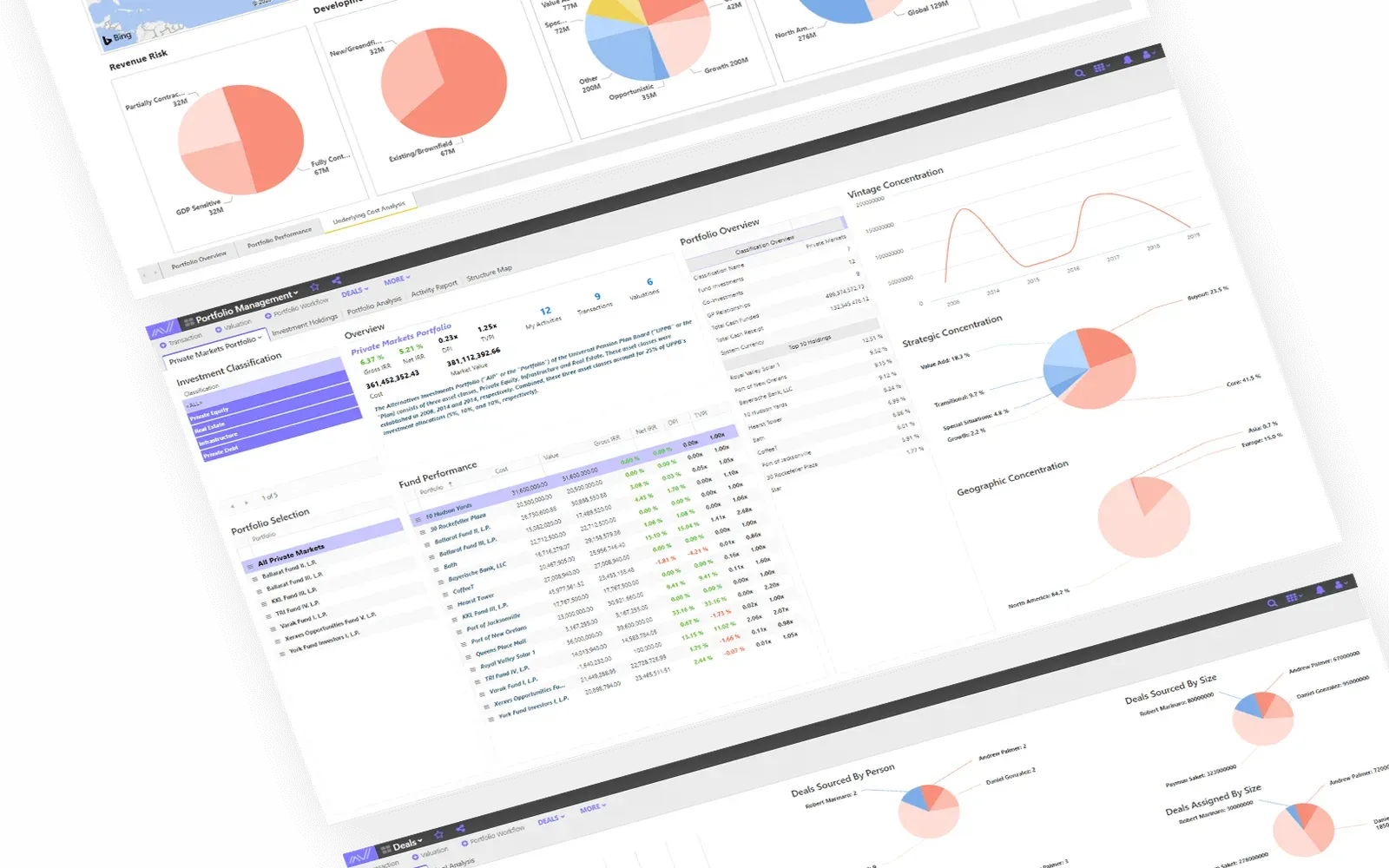

How to Choose the Right Fund Manager Software for Your Investment Firm

Best Startup Business Loans to Fund Your Vision

Best Fund Management Software for Smart Investing

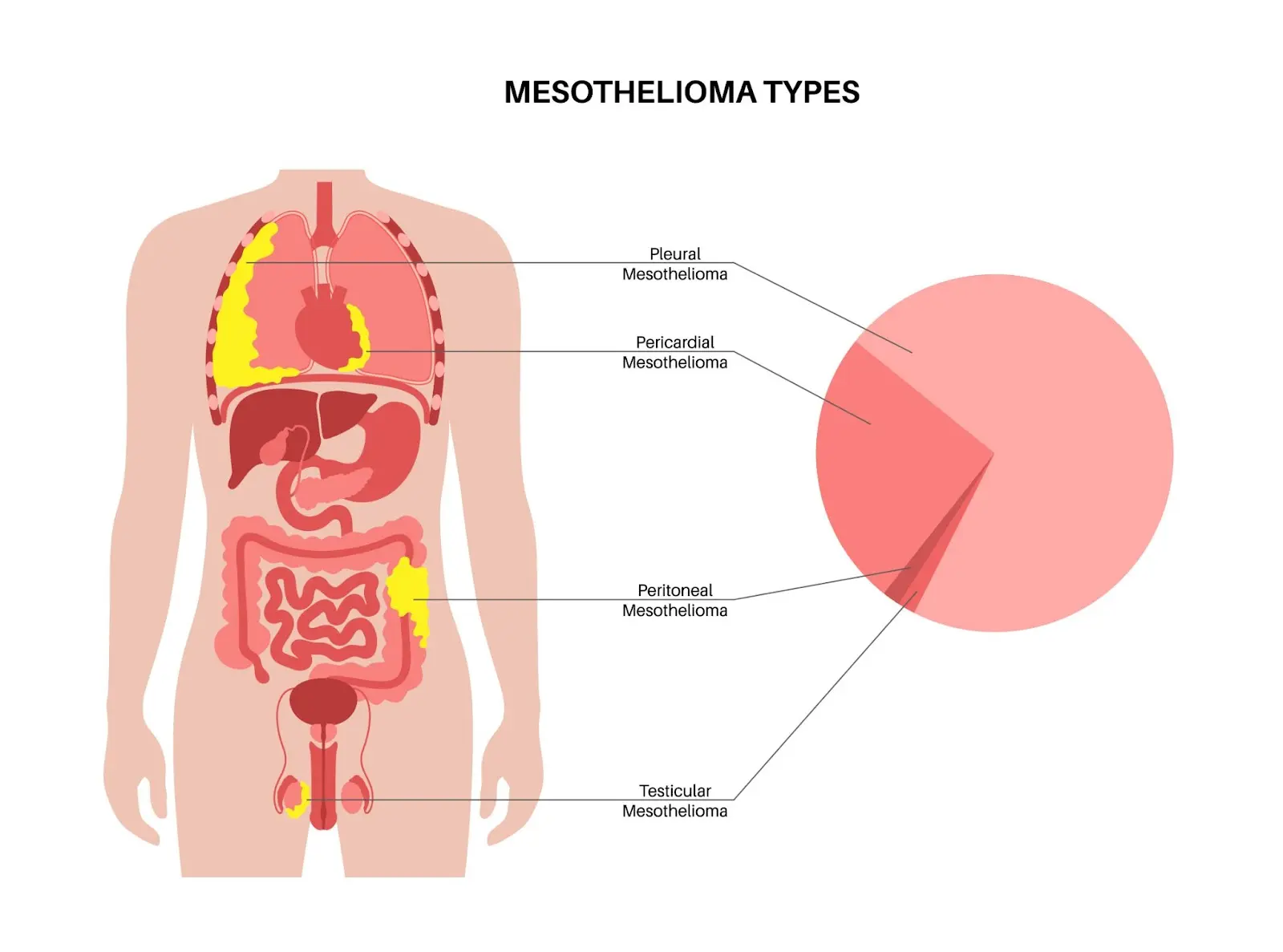

Mesothelioma Treatment Options: What Patients Need to Know

Are Invisible Braces Right for You? A Comprehensive Guide

FHA Loans Explained: Who Qualifies and What You Can Buy