How to Choose the Right Fund Manager Software for Your Investment Firm

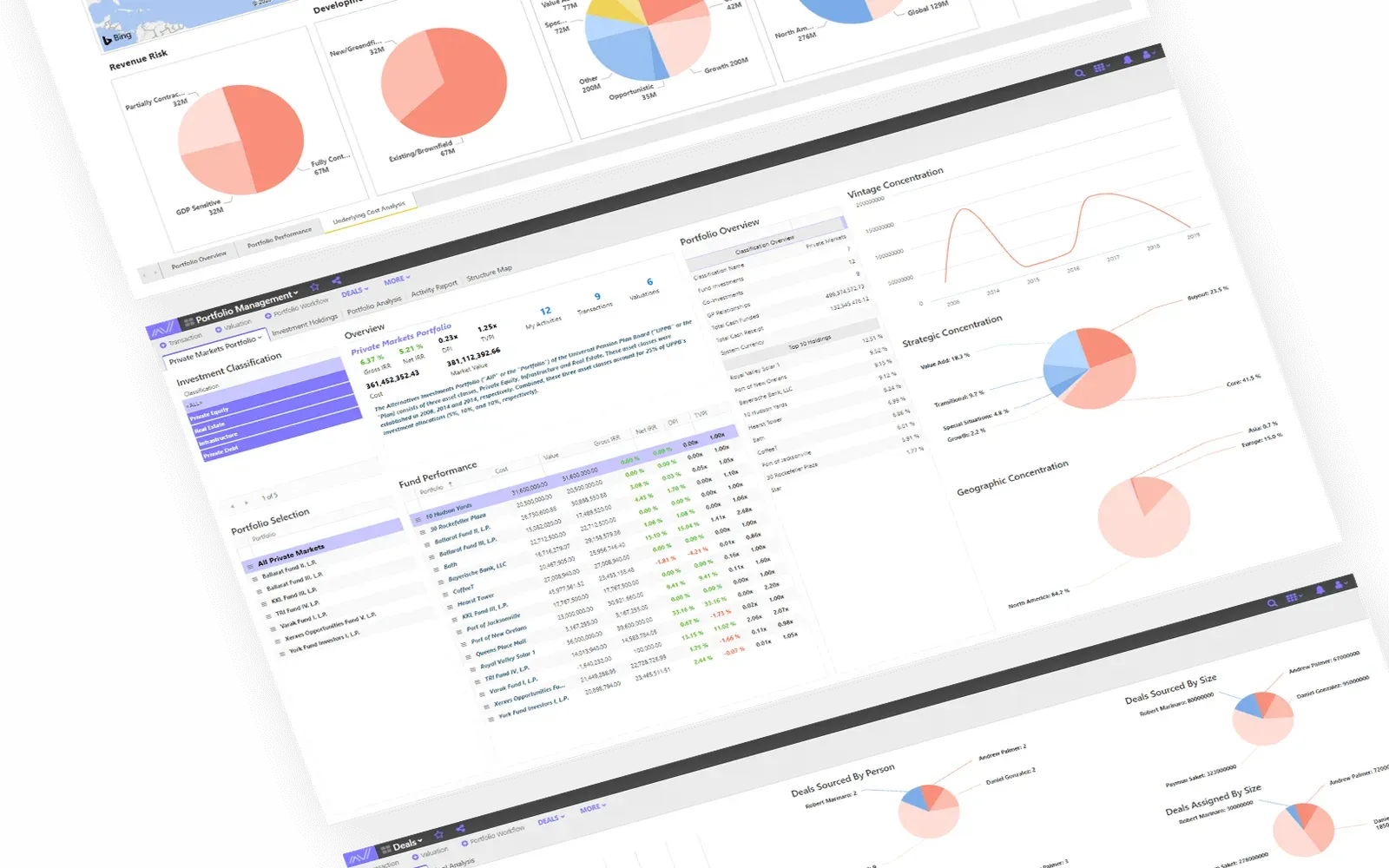

In today’s highly competitive investment landscape, selecting the right fund manager software is critical for improving operational efficiency, regulatory compliance, and client satisfaction. With robust features like portfolio tracking, automated reporting, and performance analytics, the best fund manager software solutions empower investment firms to scale and manage assets more strategically in 2025.

Why Fund Manager Software Matters in 2025

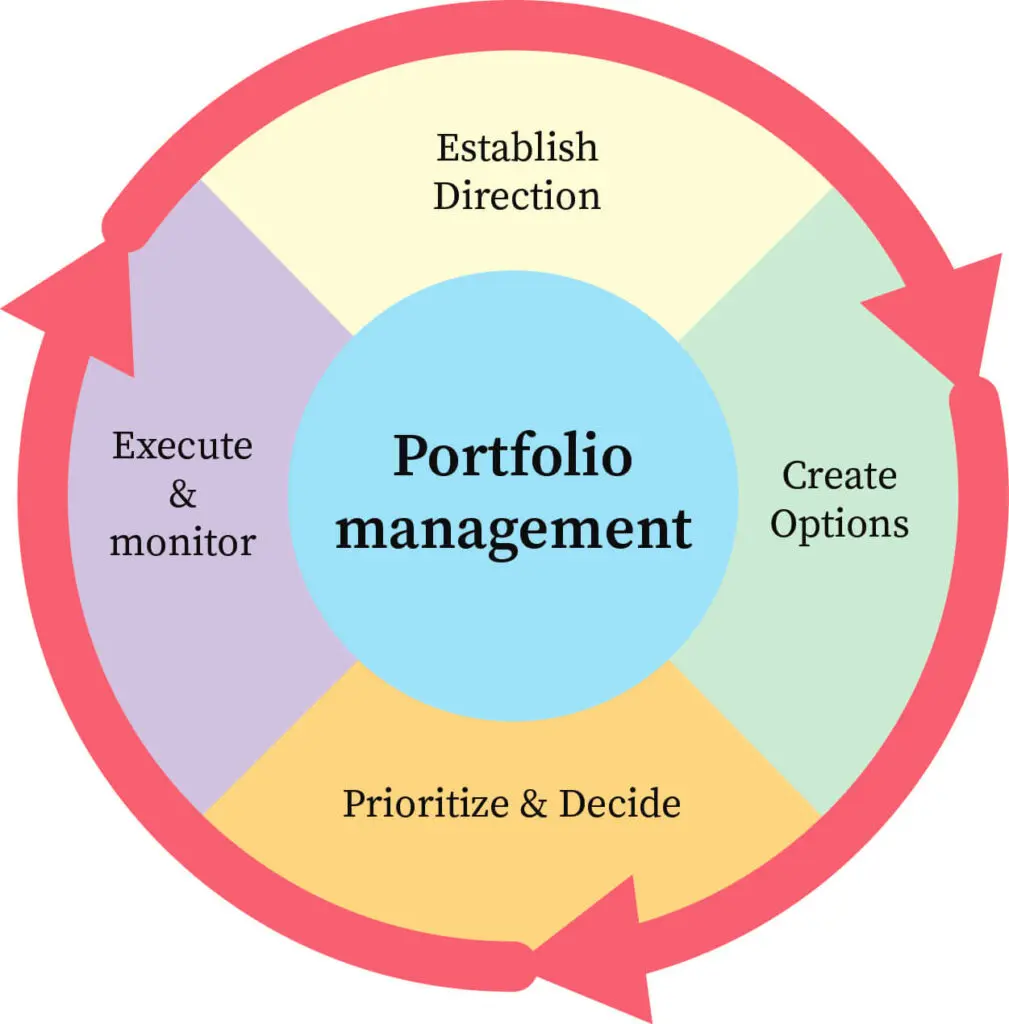

Modern fund manager software centralizes asset management processes and enables investment teams to focus on decision-making rather than manual tasks. These platforms offer everything from real-time reporting and investor communication to compliance tracking—all essential for thriving in today’s regulatory and performance-driven environment.

| Key Benefits | How It Helps Investment Firms |

|---|---|

| Portfolio Consolidation | Manage multiple client portfolios in a centralized dashboard |

| Real-Time Performance Tracking | Make faster decisions with live data visualization |

| Regulatory Compliance Tools | Automate compliance workflows and documentation |

| Investor Reporting Automation | Generate personalized reports and statements quickly |

| Integration with Custodians & CRMs | Seamlessly connect data with other financial tools |

Top Fund Manager Software Platforms in 2025

Here’s a comparison of the leading fund manager software solutions used by U.S. investment firms:

| Software Platform | Best For | Key Features | Pricing Model |

|---|---|---|---|

| Addepar | Multi-asset portfolios | Custom dashboards, client reporting | Custom pricing |

| Morningstar Direct | Investment research & analysis | Performance reporting, fund comparison | Subscription-based |

| Enfusion | Hedge fund managers | Real-time order management, compliance | Tiered pricing |

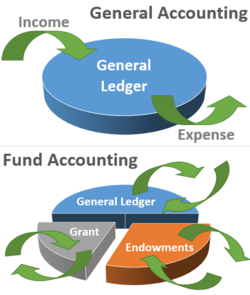

| FundCount | Family offices, PE firms | Fund accounting, investor portal | Custom pricing |

| SEI Wealth Platform | Wealth & asset managers | Unified platform, custody integration | Enterprise pricing |

| Allvue | Private equity & credit funds | Fund accounting, CRM integration | Scalable pricing |

| Backstop Solutions | Institutional investment teams | Investor relations, research management | Subscription-based |

Key Features to Look for in Fund Manager Software

When evaluating options, firms should prioritize software that supports their operational goals, scale, and client base. Here are some of the most essential features to consider:

| Feature | Importance |

|---|---|

| Scalability | Supports firm growth and AUM expansion |

| Data Security & Encryption | Protects sensitive investor and financial data |

| Mobile Accessibility | Enables on-the-go portfolio management |

| Custom Reporting | Offers flexibility in investor and internal reporting |

| White-Labeling | Delivers a branded experience for clients |

| API Integrations | Easily connects with CRMs, custodians, and analytics tools |

How to Match Software to Your Firm’s Needs

Your choice should align with your firm’s size, structure, and investment focus:

- Small Boutique Firms: Look for user-friendly, affordable platforms with strong support.

- Mid-Sized Firms: Prioritize automation, scalability, and CRM integration.

- Large or Institutional Firms: Choose enterprise-grade solutions with advanced reporting and compliance capabilities.

Don’t forget to request demos, read case studies, and ask for references from current users in similar firm sizes.

Final Thoughts

Choosing the best fund manager software in 2025 is a strategic decision that can streamline your investment firm’s workflow, boost client satisfaction, and improve regulatory preparedness. Evaluate your firm's needs, compare features, and invest in a solution that supports your long-term growth.

Explore

How to Choose the Right Portfolio Management Software for Your Business

Best Fund Management Software for Smart Investing

Best Startup Business Loans to Fund Your Vision

Online Fund Accounting Programs: Flexibility for Busy Learners

Emergency Fund Essentials: What You Need Saved by 30, 40, 50

Why Choosing a Local Law Firm Can Improve Your Case Outcome

How to Choose a Cloud Backup Service That Truly Protects Your Data

How to Choose a Prepaid vs Postpaid Cell Phone Plan for Your Family