How Gold IRAs Provide Security for Retirement

As individuals approach retirement, securing their financial future becomes a priority. One increasingly popular option for enhancing retirement security is through the establishment of a Gold IRA. This form of Individual Retirement Account allows individuals to hold physical gold and other precious metals, providing a hedge against inflation and market volatility. In this article, we will explore how Gold IRAs can offer financial stability and security for your retirement years.

Understanding Gold IRAs

A Gold IRA is a self-directed retirement account that allows investors to hold gold, silver, platinum, and palladium in physical form. Unlike traditional IRAs, where investments are typically limited to stocks, bonds, and mutual funds, a Gold IRA diversifies your portfolio by incorporating tangible assets. This diversification is crucial as it can protect against economic downturns that negatively affect paper assets.

The Benefits of Gold IRAs

There are several benefits to investing in a Gold IRA. Here are some of the key advantages:

- Inflation Hedge: Gold has historically been a reliable hedge against inflation. When the value of currency declines, the price of gold typically increases, preserving the purchasing power of your retirement savings.

- Market Stability: Gold is often viewed as a safe haven during times of economic uncertainty. By adding gold to your retirement portfolio, you can reduce volatility and risk.

- Tax Advantages: Like traditional IRAs, Gold IRAs offer tax-deferred growth. This means that you won’t pay taxes on any gains until you withdraw funds during retirement, allowing your investment to grow more efficiently.

- Diverse Asset Class: Including gold and other precious metals in your portfolio can provide diversification. This is important as it reduces reliance on traditional stocks and bonds, which can be affected by the same market forces.

How to Set Up a Gold IRA

Setting up a Gold IRA involves a few key steps:

- Choose a Custodian: You will need to select a custodian who specializes in Gold IRAs. This custodian will manage your account, ensure compliance with IRS regulations, and assist with the purchase and storage of your gold.

- Select Your Metals: Decide which types of precious metals you want to include in your Gold IRA. The IRS has specific requirements for the purity and types of metals that can be held in these accounts.

- Fund Your Account: You can fund your Gold IRA through a rollover from an existing retirement account or by making a direct deposit.

- Purchase Gold: Once your account is funded, you can instruct your custodian to purchase the selected gold and other metals on your behalf.

- Storage: Your gold must be stored in an approved depository that meets IRS standards. This ensures the security and legitimacy of your investment.

Gold IRA vs. Traditional IRA

When considering retirement options, it’s essential to understand the differences between a Gold IRA and a traditional IRA. Below is a comparison table highlighting the key distinctions:

| Feature | Gold IRA | Traditional IRA |

|---|---|---|

| Asset Type | Physical precious metals | Stocks, bonds, and mutual funds |

| Inflation Protection | Strong | Weak |

| Market Volatility | Lower risk | Higher risk |

| Tax Treatment | Tax-deferred | Tax-deferred |

| Regulatory Compliance | Requires specific custodians and storage | Standard financial institutions |

Considerations Before Investing in a Gold IRA

While Gold IRAs offer several advantages, there are also considerations to keep in mind:

- Fees: Gold IRAs often come with higher fees compared to traditional IRAs. Custodial fees, storage fees, and costs associated with purchasing gold can add up.

- Liquidity: Physical gold is less liquid than stocks or bonds. If you need to access cash quickly, selling gold may take more time and effort.

- Market Risk: Although gold can be a stable investment, its price can fluctuate based on market conditions. Investors should be prepared for potential price volatility.

Conclusion

Incorporating a Gold IRA into your retirement planning can provide a valuable layer of security and protection against economic uncertainty. With the potential to hedge against inflation and market fluctuations, gold remains a sought-after asset for many retirement portfolios. However, it’s essential to weigh the benefits against the considerations, ensuring that a Gold IRA aligns with your overall investment strategy. As you make decisions about your retirement, consider how gold and other precious metals can contribute to your financial security in the years to come.

Explore

How Structured Settlement Annuities Provide Long-Term Security

How SSDI Attorneys Help with Social Security Disability Claims

How to Start a Gold IRA: 2025 Investor Guide

AI-Powered Help Desks: Predictive Support and Security Built-In

What to Look for in a Managed Security Service Provider

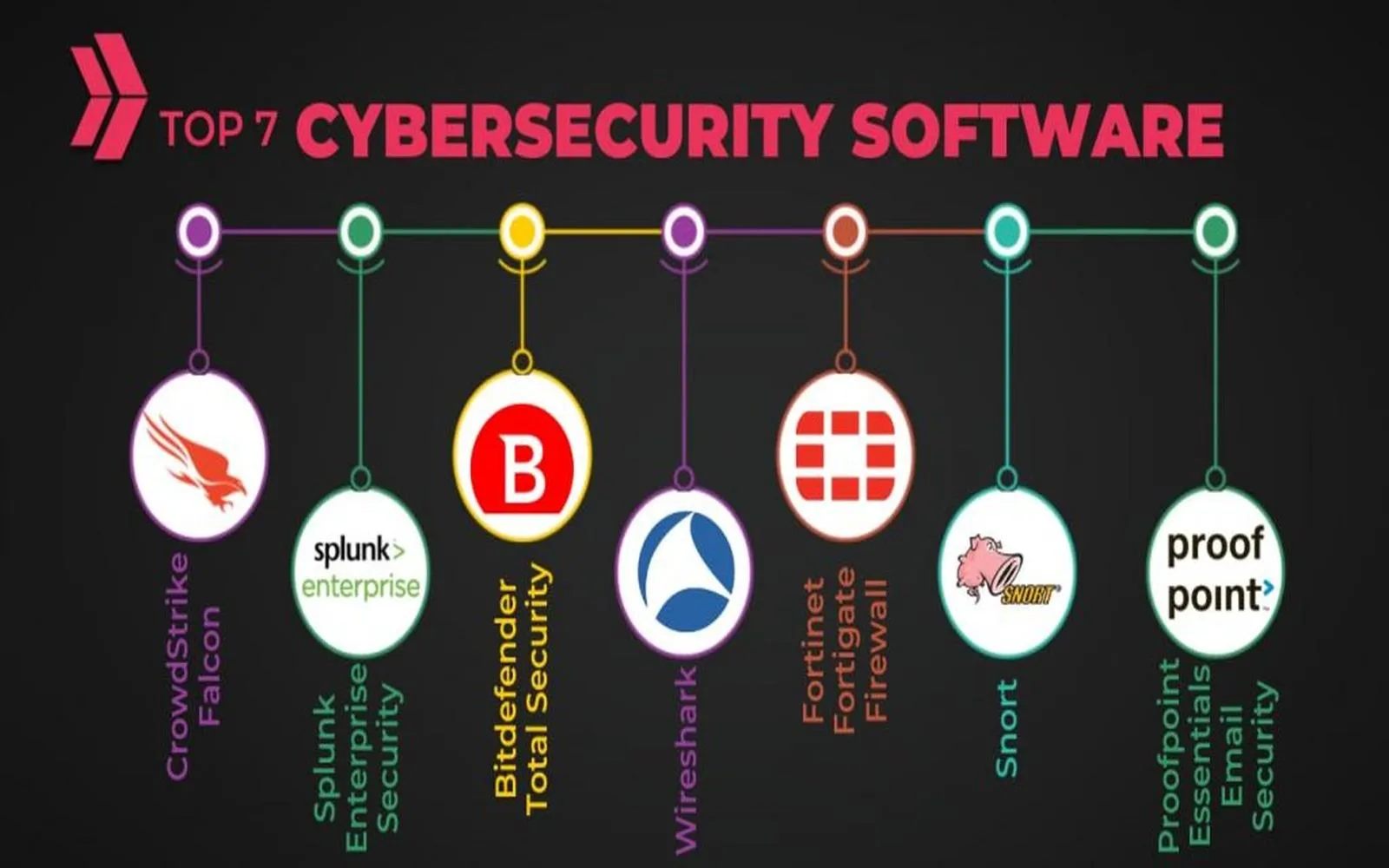

Top Network Security Software for Business Use

Choosing the Right Web Security Platform

Top Online Therapy Platforms for Depression Support