How Structured Settlement Annuities Provide Long-Term Security

Structured settlement payments are a key financial tool for individuals who have received compensation from legal settlements, particularly in personal injury cases. Understanding how these payments work is essential for anyone considering or managing a structured settlement. This guide will walk you through the basics, benefits, and potential drawbacks of structured settlement payments and structured annuity settlements.

What are Structured Settlement Payments?

Structured settlement payments are a series of payments made to an individual over a specified period, rather than a lump sum. These payments are typically funded through an annuity purchased by the defendant’s insurance company as part of a settlement agreement. The idea behind structured settlements is to provide long-term financial security to the recipient, especially if the settlement is related to a personal injury or wrongful death claim.

Benefits of Structured Settlement Payments

One of the main benefits of structured settlement payments is the financial security they offer. Since these payments are typically made over many years, they can help ensure that individuals do not exhaust their funds quickly. Below are some of the primary benefits:

- Tax-Free Income: Payments received from a structured settlement are usually tax-free, which means individuals can benefit from a steady income stream without worrying about tax implications.

- Long-Term Financial Planning: By receiving structured payments, individuals can plan their finances better, as they know when and how much money they will receive over time.

- Protection from Poor Financial Decisions: A lump sum payment can lead to impulsive spending. Structured settlements help mitigate this risk by distributing funds over time.

How Do Structured Settlements Work?

When a legal settlement is reached, a structured settlement is created as part of the compensation agreement. The defendant or their insurer purchases an annuity from a life insurance company. This annuity is designed to provide the plaintiff with a series of scheduled payments, which can be customized based on the recipient's needs.

The payments can be structured in various ways, including:

- Fixed Payments: A set amount is paid at regular intervals, such as monthly or annually.

- Increasing Payments: Payments may start at a lower amount, increasing over time to account for inflation or changing financial needs.

- Deferred Payments: Payments can be delayed for a certain period, allowing the recipient to receive larger sums later on.

Understanding Structured Annuity Settlements

A structured annuity settlement is the financial product that underpins structured settlement payments. It is essentially a contract between the insurance company and the individual, ensuring that future payments are made according to the agreed-upon schedule.

Key features of structured annuity settlements include:

- Guaranteed Payments: The insurance company is legally obligated to make the payments as specified in the annuity contract.

- Lifetime Payments: Depending on the structure, some annuities can provide payments for the lifetime of the recipient, offering additional security.

- Customizable Options: Recipients can often choose the payment frequency, amount, and any additional riders for specific needs (e.g., medical expenses).

Potential Drawbacks of Structured Settlement Payments

While structured settlement payments offer numerous advantages, there are also some potential drawbacks to consider:

- Inflexibility: Once established, structured settlements are difficult to modify. If financial circumstances change, accessing funds can be challenging.

- Inflation Risk: If payments are not structured to increase over time, inflation can erode the purchasing power of the payments.

- Long-Term Commitment: Recipients must commit to the payment schedule, which can be a disadvantage if they require immediate cash for unexpected expenses.

How to Sell Your Structured Settlement Payments

In some cases, individuals may find themselves in need of cash sooner than anticipated. If this happens, it is possible to sell structured settlement payments to a third party. However, this process requires careful consideration and understanding of the implications.

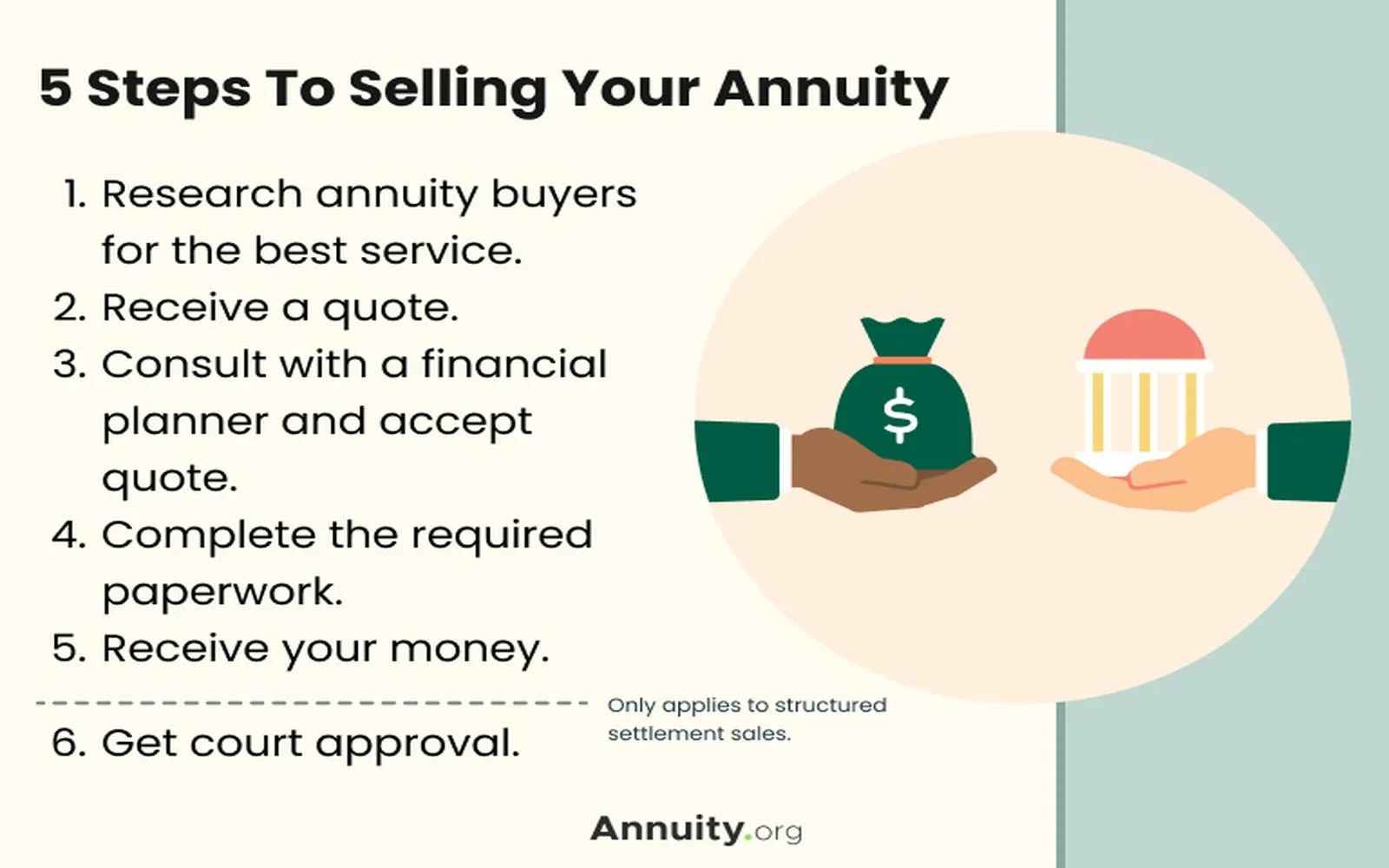

Here are steps to consider if you want to sell your structured settlement:

- Research Buyers: Look for reputable companies that specialize in purchasing structured settlement payments.

- Understand the Terms: Before agreeing to a sale, ensure you fully comprehend the terms, including fees and how much you will receive.

- Legal Approval: In many jurisdictions, selling structured settlement payments requires court approval to protect the seller’s interests.

Conclusion

Structured settlement payments can provide significant benefits for those receiving compensation from legal settlements. Understanding how they work and the role of structured annuity settlements is crucial for making informed financial decisions. While there are drawbacks and considerations to keep in mind, structured settlements can be an effective way to ensure long-term financial stability. If you are considering a structured settlement or thinking about selling your payments, consulting with a financial advisor or legal professional can help you navigate the complexities involved.

Explore

How Gold IRAs Provide Security for Retirement

Best Innovation Stocks for Long-Term Investors

How SSDI Attorneys Help with Social Security Disability Claims

Top Structured Settlement Providers in 2025

AI-Powered Help Desks: Predictive Support and Security Built-In

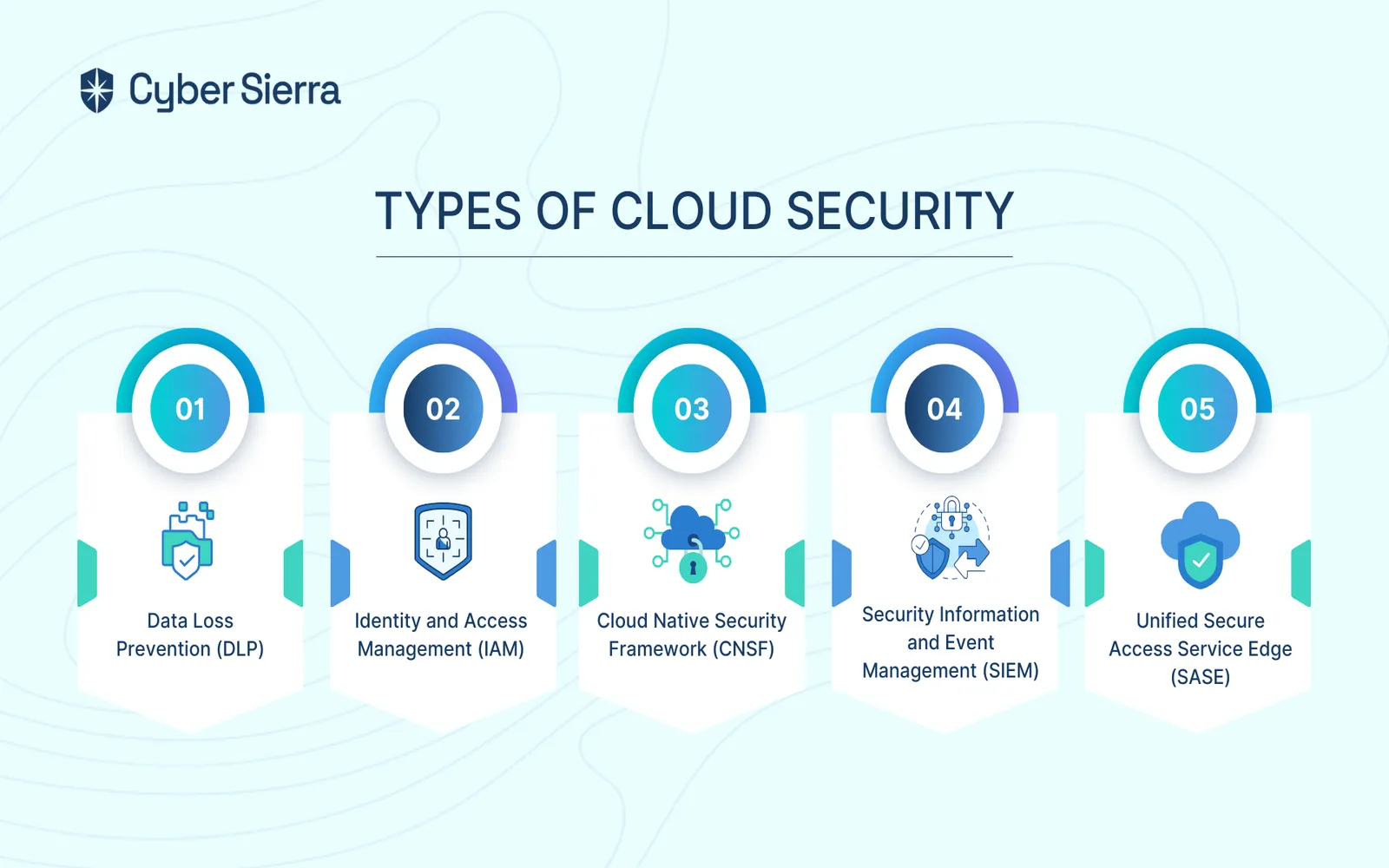

What to Look for in a Managed Security Service Provider

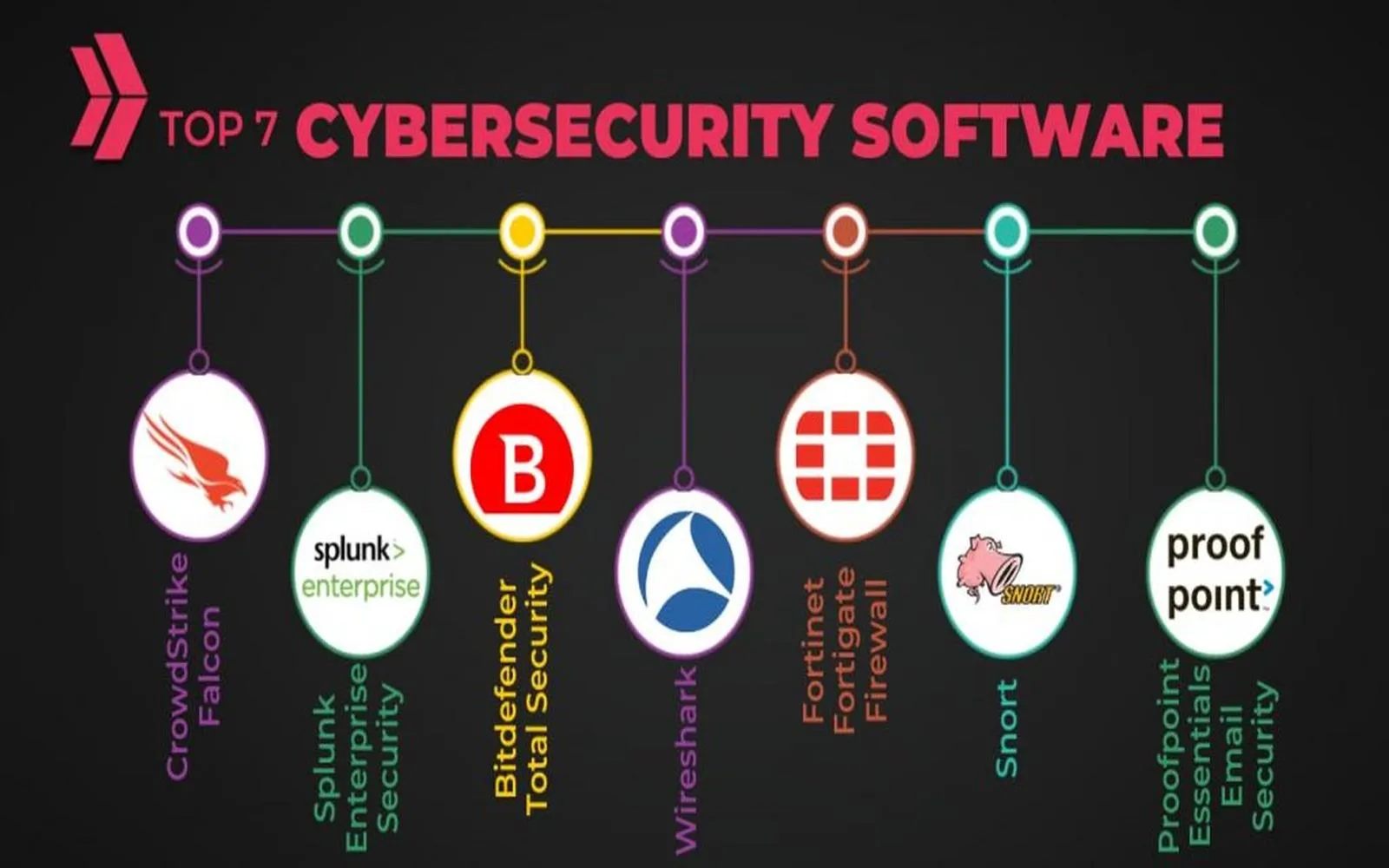

Top Network Security Software for Business Use

Choosing the Right Web Security Platform