Top Dental Insurance Options for Complete Coverage

When seeking dental insurance for comprehensive care, consider plans that offer extensive coverage for preventive, basic, and major services. Look for policies with low deductibles, minimal waiting periods, and a wide network of providers. Top options often include features like orthodontic coverage and no annual limits, ensuring you receive the best dental care without breaking the bank.

Choosing the right dental insurance can be a daunting task, especially with so many options available. The goal is to find a plan that provides comprehensive coverage without breaking the bank. In this article, we will explore the top dental insurance options that offer complete coverage, ensuring you can maintain your oral health without worrying about high out-of-pocket costs.

Understanding Dental Insurance Types

Before diving into specific plans, it’s crucial to understand the different types of dental insurance available. Generally, dental insurance falls into three main categories:

- Preventive Dental Insurance – Covers routine check-ups, cleanings, and x-rays.

- Basic Dental Insurance – Includes coverage for fillings, extractions, and other necessary procedures.

- Major Dental Insurance – Covers more extensive procedures like crowns, bridges, and root canals.

Top Dental Insurance Options

Here are some of the best dental insurance options that provide comprehensive coverage:

1. Delta Dental

Delta Dental is one of the largest dental insurance providers in the United States, offering a variety of plans to meet individual needs. Their plans typically include:

- Preventive services

- Basic services

- Major services

Delta Dental also has a vast network of dentists, making it easy for policyholders to find a provider. Additionally, they offer orthodontic coverage in some plans, which is a significant advantage for families.

2. Cigna Dental Insurance

Cigna offers flexible dental insurance plans that cater to different budgets and needs. Their plans feature:

- No waiting periods for preventive and basic services

- Coverage for major services after a brief waiting period

- Access to a large network of dental providers

Cigna also offers the option of adding orthodontic coverage, making it a great choice for families with children in need of braces.

3. Humana Dental Insurance

Humana provides a range of dental insurance plans, including options with no waiting periods for preventive care. Key features include:

- preventive services

- basic services

- major services

Humana's plans also include a large network of dentists, and some plans offer coverage for orthodontics, which is an added benefit for families.

4. MetLife Dental Insurance

MetLife is another reputable provider that offers a variety of dental insurance plans. Their coverage typically includes:

- Preventive care

- Basic care

- Major services

MetLife also provides the option for orthodontic coverage, making it a solid choice for families looking for comprehensive dental care.

5. Guardian Dental Insurance

Guardian offers a range of plans that include preventive, basic, and major dental services. Their offerings include:

- No waiting periods for preventive and basic services

- Flexible payment options

- Access to a vast network of dental providers

Guardian also provides orthodontic coverage, making it a suitable choice for families seeking complete dental care.

Factors to Consider When Choosing Dental Insurance

When selecting the best dental insurance plan, consider the following factors:

- Coverage Options – Ensure that the plan covers the services you need, including preventive, basic, and major dental work.

- Network of Dentists – Check if your preferred dentist is in the insurance provider's network to avoid higher out-of-pocket costs.

- Waiting Periods – Some plans have waiting periods before you can access certain services, so be sure to understand these terms.

- Monthly Premiums – Compare the monthly premiums and out-of-pocket costs for different plans to find one that fits your budget.

Conclusion

Finding the right dental insurance can significantly improve your oral health while minimizing financial stress. With several options available, including Delta Dental, Cigna, Humana, MetLife, and Guardian, you have a variety of plans to choose from. Remember to consider your specific needs, the coverage options available, and your budget when making your decision. By doing so, you can ensure that you and your family receive the best dental care possible.

Frequently Asked Questions

What is the average cost of dental insurance?

The average monthly premium for dental insurance ranges from $20 to $50, depending on the coverage and provider.

Are orthodontics covered by dental insurance?

Many dental insurance plans offer orthodontic coverage, but it varies by provider, so it's essential to check individual plans.

How often should I visit the dentist?

It is generally recommended to visit the dentist at least twice a year for routine check-ups and cleanings.

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Explore

Private Banking & Wealth Management Options for the Affluent

Affordable SUV Options: Budget-Friendly Picks That Last

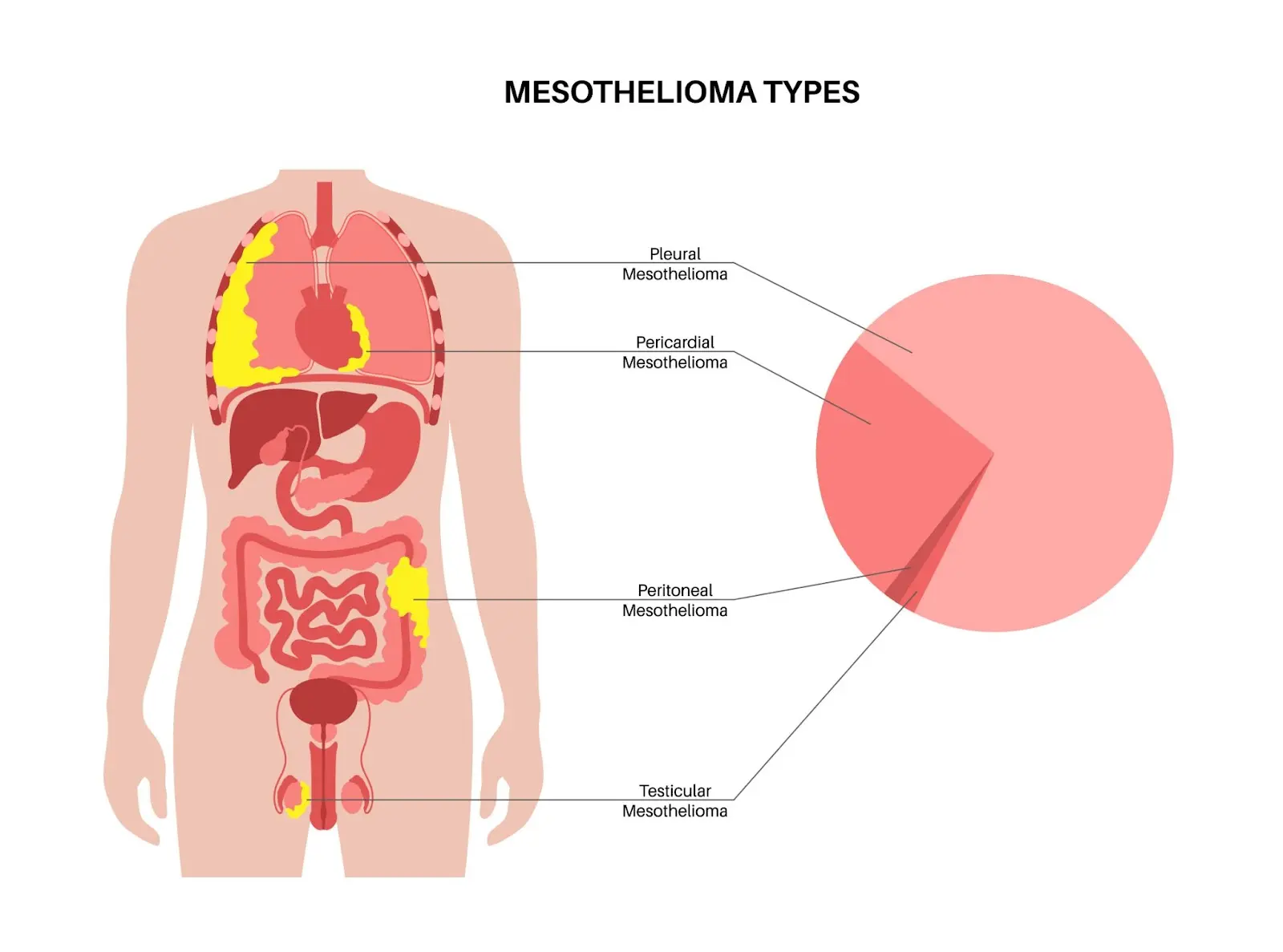

Mesothelioma Treatment Options: What Patients Need to Know

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

Event Planning Software for Small Teams: Affordable and Effective Options

Find the Best Assisted Living Options Near You

Modern Distance Learning Options for 2025

Guide to Hairline Restoration Options Near You