Private Banking & Wealth Management Options for the Affluent

In 2025, the landscape of wealth management is evolving, with top financial advisors specializing in high net worth clients. These experts provide tailored strategies for asset protection, tax optimization, and investment diversification, ensuring that ultra-wealthy individuals navigate complex financial landscapes. Their personalized approach and deep understanding of high net worth management empower clients to achieve long-term financial success.

As we look ahead to 2025, the landscape of financial advisory services for high net worth clients continues to evolve. With increasing complexity in financial markets, tax regulations, and investment opportunities, selecting the right financial advisor is critical for effective high net worth management. This article will explore the top financial advisors catering to high net worth individuals and families, focusing on their unique offerings and strategies that set them apart in the competitive financial services industry.

Understanding High Net Worth Management

High net worth management involves more than just investment advice; it encompasses a comprehensive approach to wealth management. High net worth clients often require tailored services that include estate planning, tax optimization, risk management, and philanthropic strategies. The right financial advisor must not only possess the requisite knowledge and experience but also understand the unique needs of wealthy clients.

Key Features of Top Financial Advisors

When considering financial advisors for high net worth clients, several key features distinguish the best from the rest:

- Personalized Service: High net worth individuals expect personalized attention and customized strategies. Top advisors provide dedicated teams that focus on understanding their clients’ financial goals and personal values.

- Comprehensive Wealth Management: Leading financial advisors offer holistic services that integrate investment management, tax planning, and estate planning to ensure that all aspects of a client’s financial life are aligned.

- Specialized Expertise: Advisors with specific expertise in areas such as alternative investments, international wealth management, or philanthropy can provide valuable insights that enhance the client experience.

- Transparency and Trust: High net worth clients seek advisors who are transparent about fees, investment strategies, and potential risks. Building trust is essential for a successful advisor-client relationship.

Top Financial Advisors for High Net Worth Clients in 2025

Based on comprehensive research and client feedback, here are some of the top financial advisors poised to excel in serving high net worth clients in 2025:

| Firm Name | Key Services | Location |

|---|---|---|

| Wealthfront | Investment Management, Tax Optimization, Estate Planning | California, USA |

| Goldman Sachs Private Wealth Management | Comprehensive Wealth Management, Philanthropic Planning, Family Office Services | New York, USA |

| Morgan Stanley Private Wealth Management | Investment Strategies, Risk Management, Retirement Planning | New York, USA |

| UBS Wealth Management | Tax Planning, Investment Advisory, Estate Planning | Switzerland, Global Presence |

| Charles Schwab | Investment Management, Financial Planning, Tax Strategies | California, USA |

Emerging Trends in High Net Worth Advisory Services

As we move into 2025, several trends are shaping the financial advisory landscape for high net worth clients:

- Increased Focus on ESG Investing: Environmental, Social, and Governance (ESG) investing is becoming increasingly important to high net worth individuals. Advisors are incorporating ESG criteria into investment strategies to align with clients' values.

- Technology Integration: The use of financial technology (fintech) tools is on the rise, enhancing how advisors manage portfolios and communicate with clients. Digital platforms are enabling more efficient reporting and personalized interactions.

- Globalization of Wealth Management: As wealth becomes more international, advisors are expanding their services to include cross-border tax planning and investment opportunities, addressing the complexities of global finance.

- Holistic Wellness Approach: Wealth management is increasingly incorporating elements of mental and physical wellness, recognizing that emotional well-being is crucial for effective financial decision-making.

How to Choose the Right Financial Advisor

Choosing the right financial advisor for high net worth management is a critical decision. Here are some steps to ensure you make an informed choice:

- Assess Credentials: Look for advisors with relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Evaluate Experience: Consider advisors with a proven track record in managing high net worth portfolios and an understanding of the unique challenges faced by wealthy clients.

- Request Referrals: Seek recommendations from peers or family members who have had positive experiences with financial advisors.

- Interview Multiple Advisors: Meet with several advisors to discuss their strategies, philosophies, and service offerings before making a decision.

Conclusion

As the financial landscape continues to evolve, high net worth individuals must remain proactive in managing their wealth. By partnering with top financial advisors who offer personalized, comprehensive services, clients can navigate the complexities of high net worth management effectively. As we approach 2025, the importance of selecting the right advisor cannot be overstated, and the trends highlighted in this article will play a pivotal role in shaping the future of wealth management.

Explore

2025’s Top Online Banks for Easy Digital Banking

Why Online Asset Management Boosts Wealth

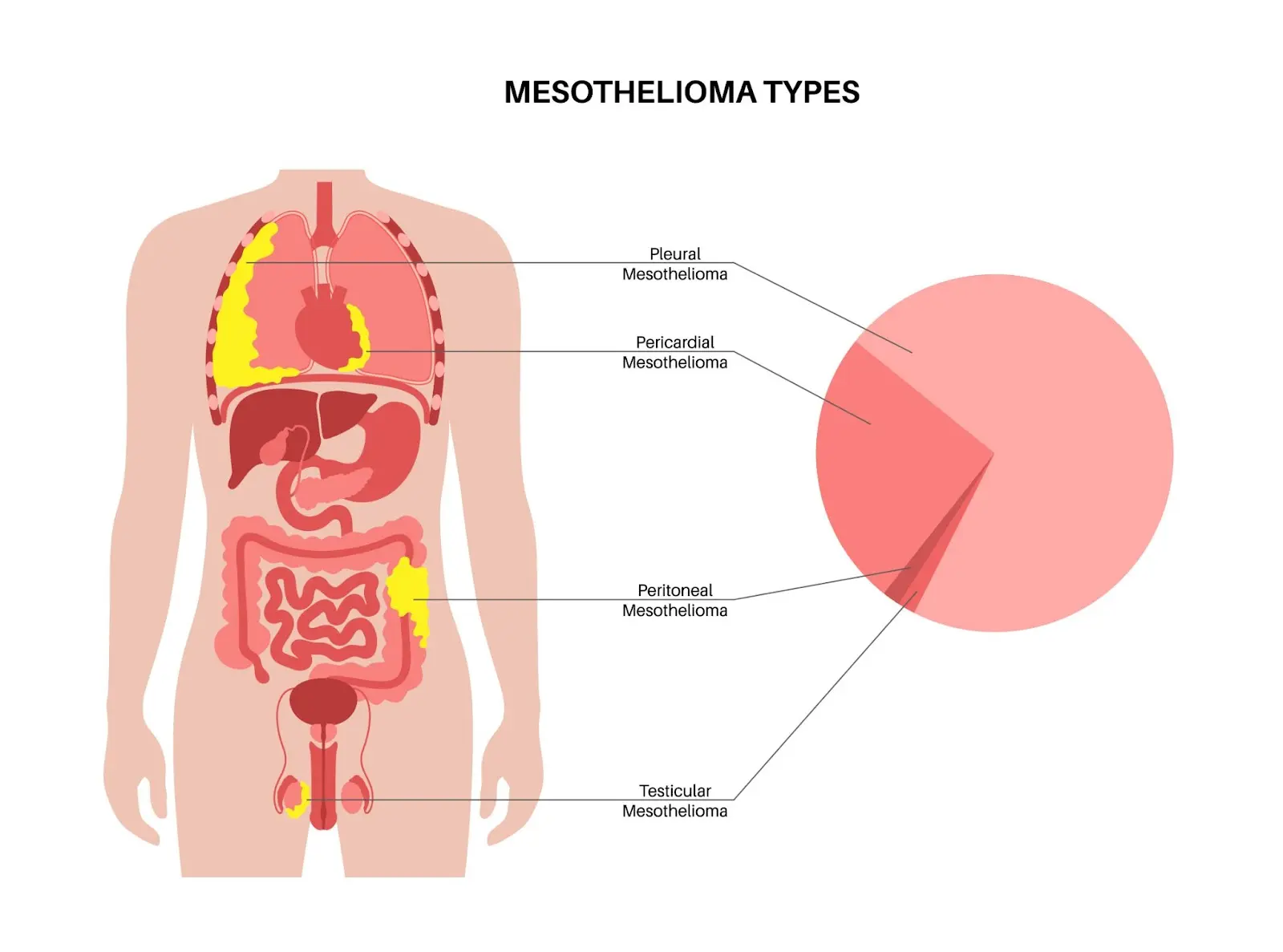

Mesothelioma Treatment Options: What Patients Need to Know

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

Event Planning Software for Small Teams: Affordable and Effective Options

Find the Best Assisted Living Options Near You

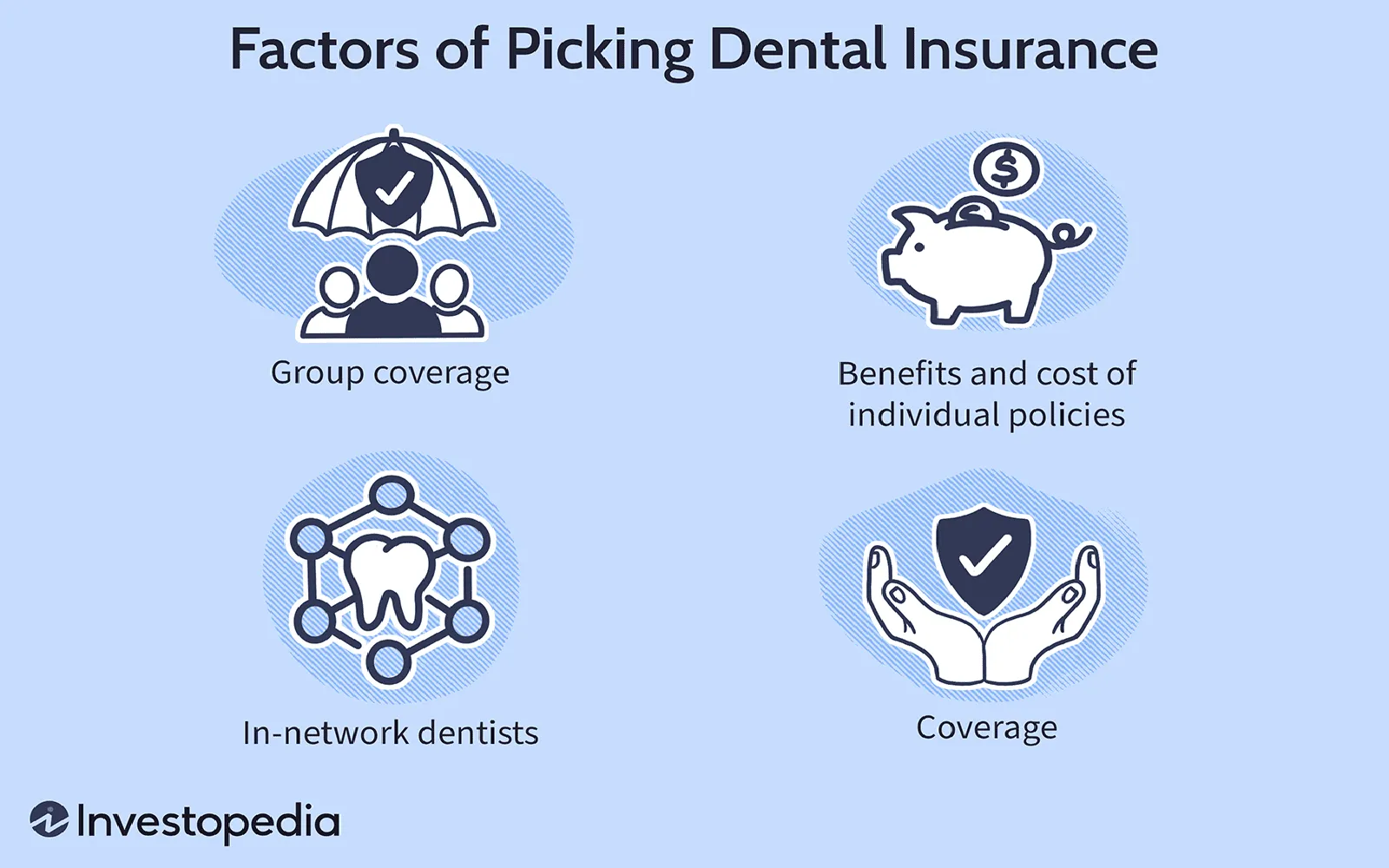

Top Dental Insurance Options for Complete Coverage

Modern Distance Learning Options for 2025