How AI Is Transforming Finance in 2025

In 2025, AI is revolutionizing finance by enhancing risk assessment, automating trading, and personalizing customer experiences. Algorithms analyze vast data sets in real-time, enabling quicker decision-making and more accurate predictions. Additionally, AI chatbots provide 24/7 customer support, while machine learning models detect fraud with unprecedented efficiency. The integration of AI in finance leads to increased efficiency and innovation across the industry.

As we progress into 2025, the financial industry is undergoing a remarkable transformation, largely driven by advancements in artificial intelligence. This shift is reshaping how businesses operate, how consumers interact with financial services, and how data is analyzed to make informed decisions. The integration of AI in finance is not just about automation; it's about enhancing efficiency, accuracy, and customer satisfaction.

The Rise of Predictive Analytics

One of the most significant impacts of AI in finance is the rise of predictive analytics. Financial institutions are leveraging machine learning algorithms to forecast market trends, assess risks, and tailor investment strategies. By analyzing vast amounts of historical data, these AI systems can identify patterns that humans might overlook, allowing for more accurate predictions.

For instance, banks and investment firms are using predictive models to determine creditworthiness, enabling them to make quicker lending decisions. This not only speeds up the process but also reduces the risk of defaults. The ability to predict customer behavior also helps in personalizing services, leading to higher customer retention rates.

Enhanced Fraud Detection

Fraud detection has always been a critical challenge in the finance industry. However, with the help of AI technologies, institutions are now better equipped to combat fraudulent activities. AI algorithms can analyze transaction patterns in real-time, identifying anomalies that may indicate fraud.

This proactive approach to fraud detection not only saves financial institutions millions of dollars but also enhances customer trust. According to recent studies, organizations that have implemented AI-driven fraud detection systems have seen a significant decrease in fraudulent transactions, improving their overall security posture.

AI-Powered Customer Service

Customer service is another area where AI in finance is making waves. Chatbots and virtual assistants powered by AI are becoming commonplace in financial institutions. These tools can handle a multitude of customer inquiries, from basic account questions to more complex financial advice, around the clock.

By utilizing natural language processing (NLP), these AI systems can understand and respond to customer inquiries effectively. This not only improves the customer experience but also allows human agents to focus on more complex issues, thereby enhancing overall service quality. The integration of AI in customer service is expected to reduce operational costs and increase efficiency for financial institutions.

Algorithmic Trading Revolution

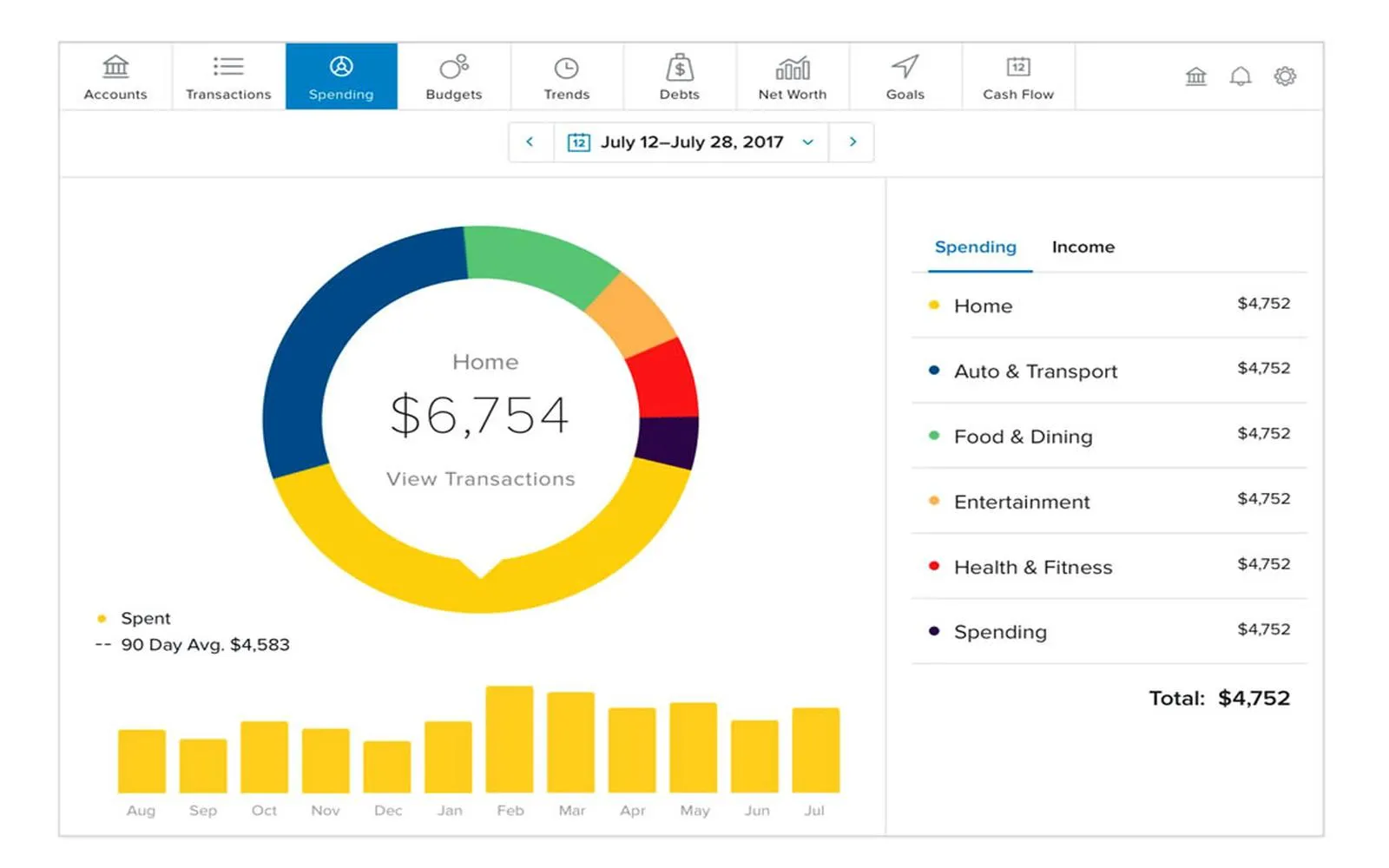

Algorithmic trading has been around for years, but the advancements in AI technologies are revolutionizing this field. In 2025, we see more investors leveraging AI-driven algorithms that can analyze vast datasets in real-time, execute trades at lightning speed, and adapt to changing market conditions.

These algorithms can process information from various sources, including social media sentiment, economic indicators, and geopolitical events, allowing for a more holistic approach to trading. As a result, investors can capitalize on opportunities much faster than traditional trading methods would allow.

Regulatory Compliance Automation

In an industry that is heavily regulated, compliance is a constant challenge for financial institutions. The integration of AI in finance is streamlining the compliance process through automation. AI systems can monitor transactions, analyze regulatory changes, and ensure adherence to compliance requirements with minimal human intervention.

This not only reduces the risk of non-compliance but also saves time and resources. As regulations continue to evolve, AI technologies will enable institutions to adapt quickly, ensuring they remain compliant while focusing on core business activities.

Financial Advisory Services

AI is also transforming financial advisory services. Robo-advisors, which use AI algorithms to manage investment portfolios, are becoming increasingly popular. These platforms provide personalized investment advice based on individual risk profiles and financial goals, often at a lower cost than traditional financial advisors.

In 2025, we anticipate that these AI-driven platforms will become more sophisticated, offering tailored strategies that adapt to market changes in real-time. This democratization of financial advice allows more individuals to access quality investment management, making personal finance more inclusive.

The Future of AI in Finance

The future of AI in finance is promising and full of potential. As these technologies continue to evolve, we can expect to see further innovations that will enhance the way financial institutions operate. The combination of AI with other emerging technologies, such as blockchain and big data analytics, will likely yield even greater efficiencies and improvements in service delivery.

As financial institutions embrace these changes, they will need to remain vigilant about the ethical implications of AI. Ensuring transparency, fairness, and accountability in AI systems will be crucial as they become more integrated into financial decision-making processes.

Conclusion

In conclusion, the transformation of finance through AI technologies in 2025 is profound and far-reaching. From predictive analytics and fraud detection to customer service enhancements and algorithmic trading, AI is reshaping the financial landscape. As we move forward, the ability of financial institutions to adapt and innovate will determine their success in this rapidly changing environment.

Explore

Finance Tips to Secure Your Future in 2025

AI-Powered Virtual Staging: Transforming Listings in 2025

Breathing Easier: Innovative Treatments Transforming COPD Care

Top Online Therapy Platforms for Depression Support

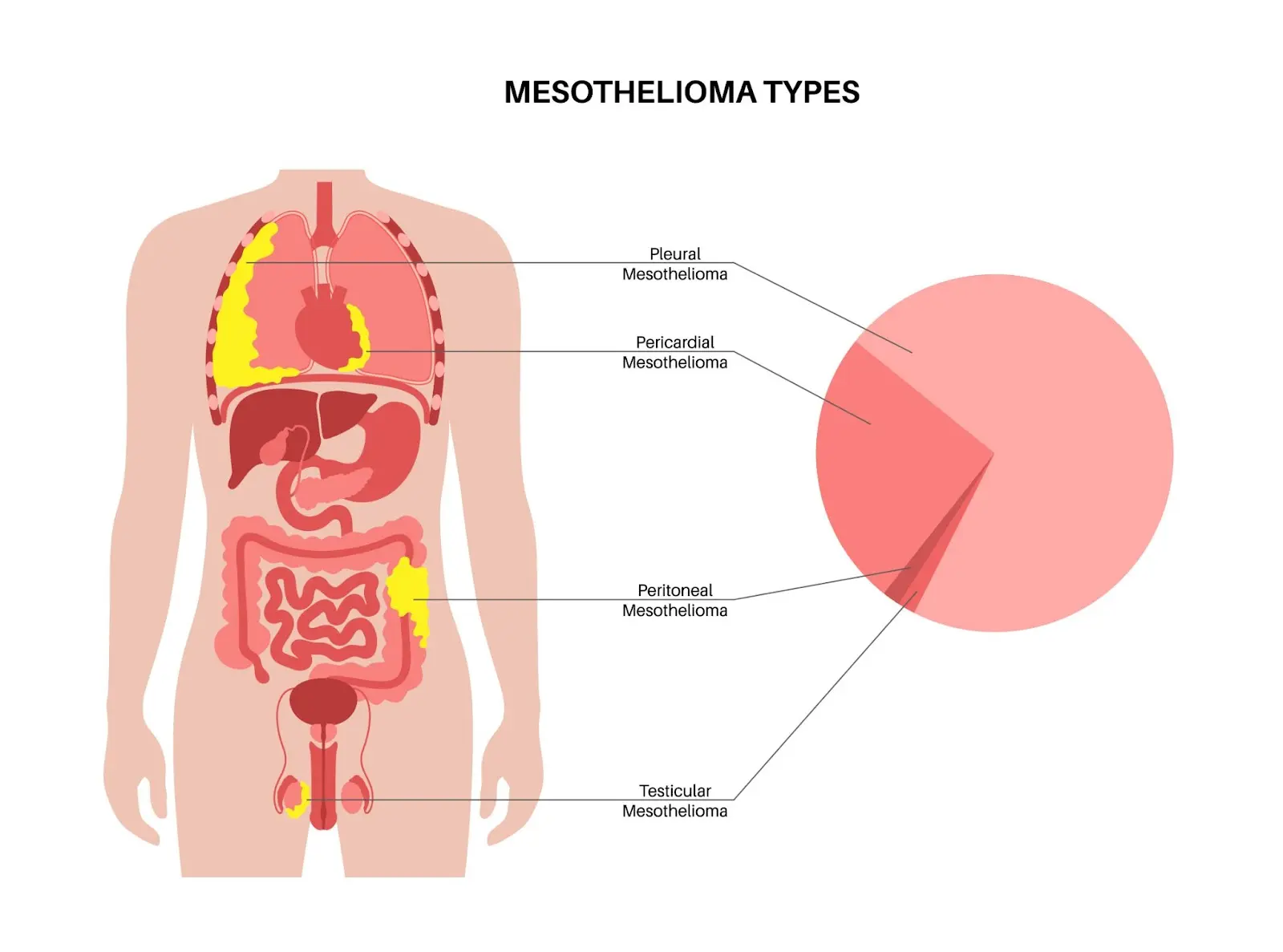

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

How Sewer Cameras and Locators Improve Plumbing Diagnostics