Finance Tips to Secure Your Future in 2025

In 2025, securing your future requires savvy finance strategies. Start by creating a solid budget to track expenses and savings. Prioritize investment in diverse assets to build wealth over time. Consider consulting a financial advisor for personalized guidance. Additionally, leverage pfm tools to monitor your progress and adjust your plans as needed, ensuring a stable and prosperous future.

As we approach 2025, it is crucial to start thinking about your financial future. With the economy constantly evolving, having a robust financial plan is essential. Here are some valuable finance tips that can help you secure your future through effective investment strategies and personal finance management (PFM).

1. Diversify Your Investment Portfolio

Diversification is one of the fundamental principles of investing. By spreading your investments across various asset classes, such as stocks, bonds, real estate, and commodities, you can mitigate risk. A well-diversified portfolio can help protect you against market volatility, ensuring a more stable return on your investment.

2. Understand Risk Tolerance

Before investing, it's vital to understand your risk tolerance. This self-assessment will help you choose the right investment vehicles. Generally, younger investors can afford to take on more risk due to their long investment horizon, while those nearing retirement should adopt a more conservative approach. Consider consulting a financial advisor for personalized advice.

3. Set Clear Financial Goals

Establishing clear financial goals is crucial for effective financial management. Whether your aim is to save for a house, fund your children's education, or prepare for retirement, having specific targets will guide your investment decisions. Use the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) to set your goals.

4. Create a Budget and Stick to It

A well-planned budget is a cornerstone of personal finance management. Track your income and expenses to identify areas where you can cut back. Allocate a portion of your income to savings and investments. Utilizing budgeting apps can simplify this process, helping you stay on track and reach your financial objectives.

5. Consider Passive Income Streams

Creating multiple streams of income can significantly enhance your financial stability. Explore options such as rental properties, dividend stocks, or even starting a side business. Passive income allows you to earn money without actively working, providing financial security and freedom.

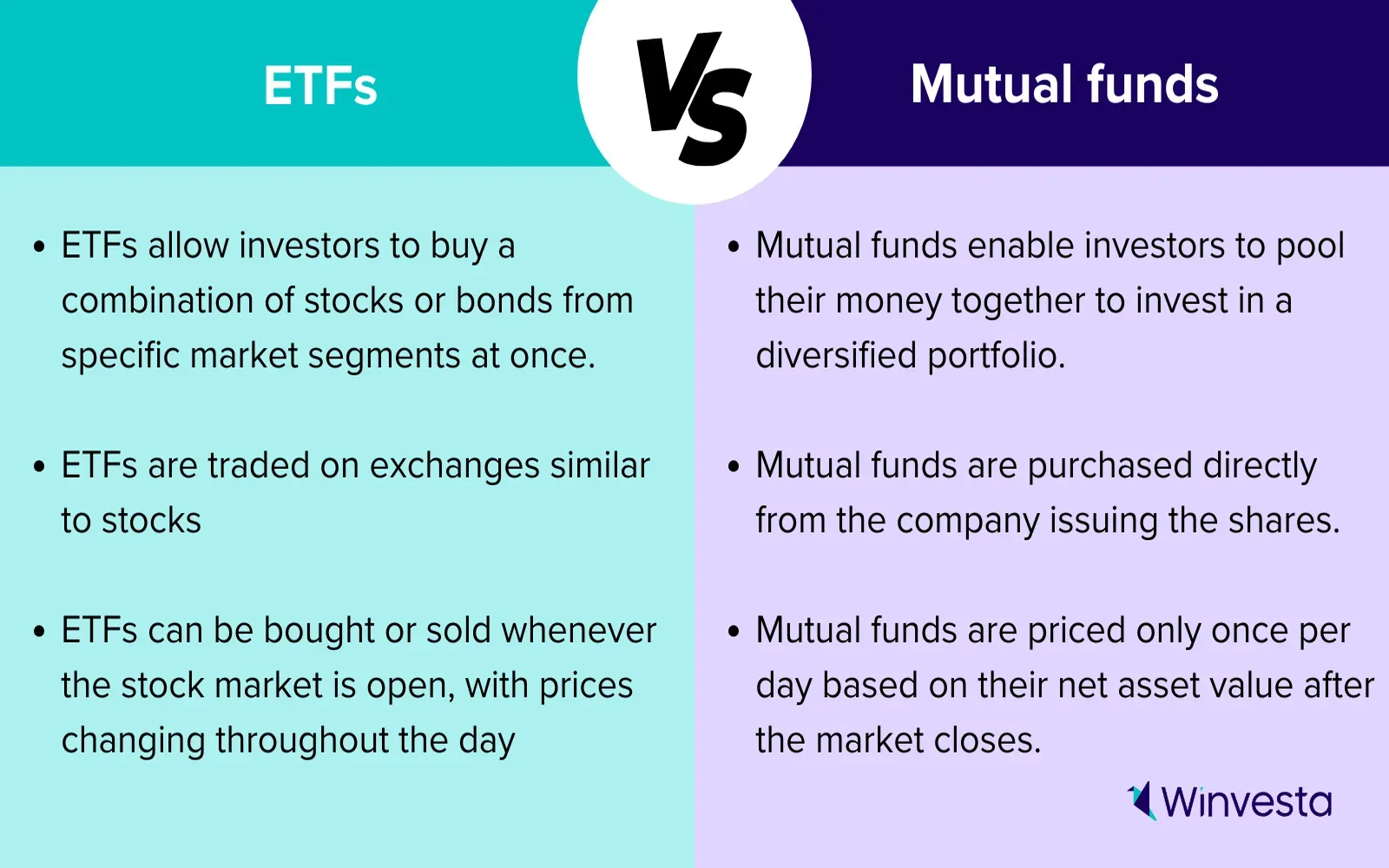

6. Educate Yourself About Financial Products

Knowledge is power when it comes to finance and investment. Take the time to educate yourself about different financial products, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Understanding these options will empower you to make informed decisions and maximize your investment returns.

7. Monitor Your Investments Regularly

Regularly reviewing your investment portfolio is essential to ensure it aligns with your financial goals. Market conditions can change, and so can your risk tolerance and financial needs. Schedule time each quarter to assess your investments and make necessary adjustments.

8. Take Advantage of Retirement Accounts

Make the most out of retirement accounts like 401(k)s and IRAs. These accounts often come with tax advantages that can help your investments grow more efficiently. Contributing regularly, especially when your employer offers matching contributions, can significantly boost your retirement savings.

9. Stay Informed About Economic Trends

Keeping an eye on economic trends can help you make better investment decisions. Monitor interest rates, inflation, and market volatility. Understanding how these factors affect your investments will allow you to adapt your strategy accordingly. Subscribe to financial news outlets or follow relevant blogs to stay updated.

10. Seek Professional Guidance

If you find financial planning overwhelming, don’t hesitate to seek professional help. A financial advisor can provide tailored advice based on your unique situation and help you navigate complex investment landscapes. While there may be a cost involved, the long-term benefits can outweigh the initial expense.

Table: Key Elements of a Strong Financial Plan

| Element | Description |

|---|---|

| Diversification | Spreading investments across various asset classes to mitigate risk. |

| Risk Tolerance | Understanding how much risk you can handle based on your financial situation. |

| Financial Goals | Setting specific, measurable targets for your finances. |

| Budgeting | Creating a plan to track income and expenses and allocate funds wisely. |

| Passive Income | Establishing additional income sources that do not require active involvement. |

| Education | Staying informed about financial products and investment opportunities. |

| Monitoring | Regularly reviewing your investments to ensure they align with your goals. |

| Retirement Accounts | Utilizing accounts with tax advantages for long-term savings. |

| Economic Awareness | Keeping updated on economic trends that may impact your investments. |

| Professional Guidance | Seeking help from financial advisors when needed. |

In conclusion, securing your financial future by 2025 requires proactive planning and informed decision-making. By diversifying your investments, understanding your risk tolerance, setting clear financial goals, and staying educated about financial products, you can build a strong foundation for your financial future. Remember, the earlier you start planning, the more secure your future will be.

Explore

Financial Planning Tips to Secure Your 2025 Goals

How AI Is Transforming Finance in 2025

How to Choose a Secure Online File Storage Provider

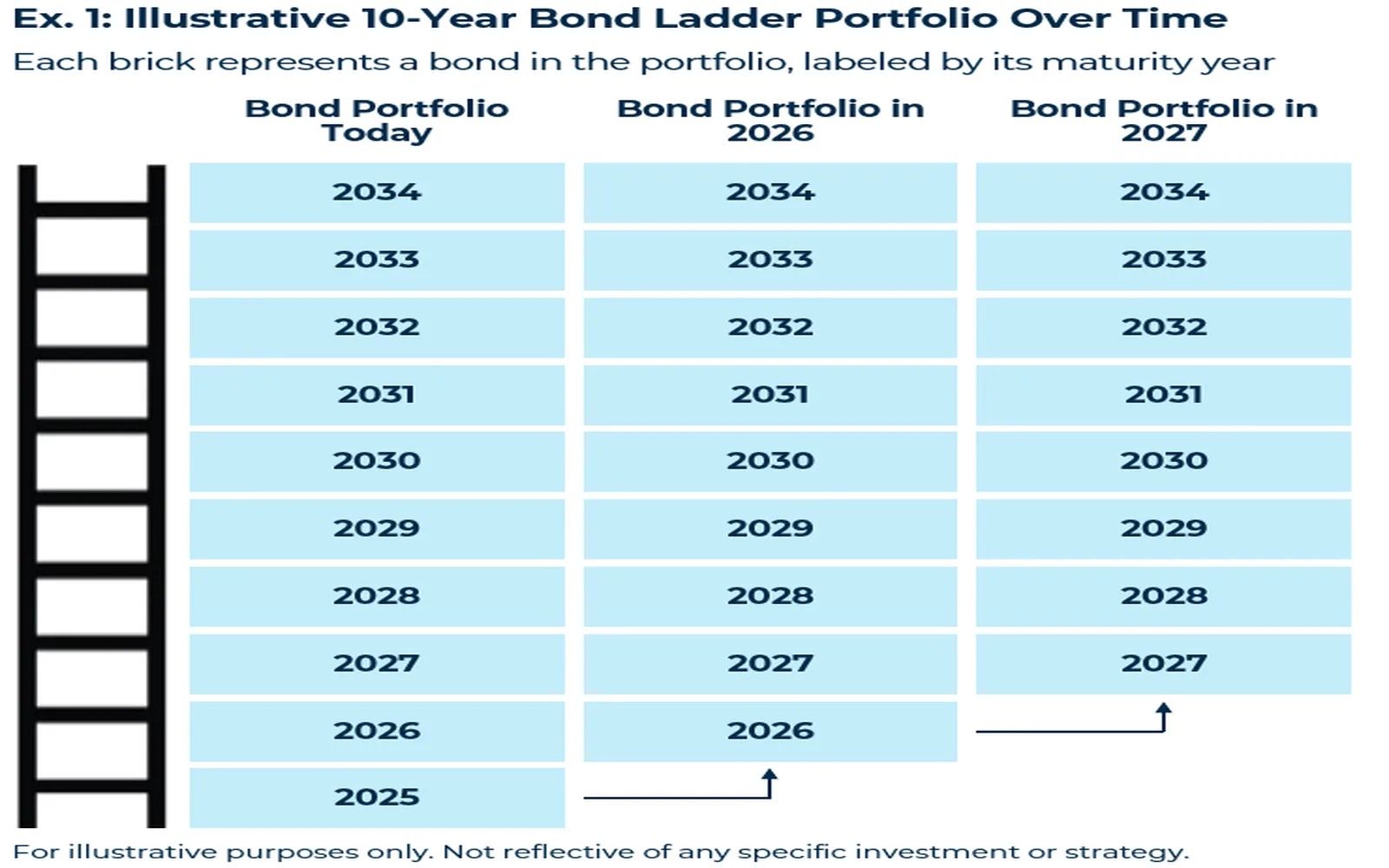

2025 Bond Laddering Tips for Income & Risk Control

Insider Tips for the Best Cruise Deals

Investing in ETFs: 2025 Strategies and Tips

Unlocking Potential: Exploring the Future of Homeschool Programs

Unlocking Success: Pursue a Master's in Business Intelligence for a Data-Driven Future