How to Choose the Best Car Insurance Provider

Choosing the right car insurance provider is a crucial decision that can significantly impact your financial security and peace of mind. The right coverage not only protects you in case of accidents but also ensures that you are compliant with state laws. With numerous options available, it's essential to know how to evaluate potential providers effectively. Below are key considerations to guide you in selecting the best car insurance provider.

Understand Your Coverage Needs

Before you start comparing insurance quotes, you must assess your own coverage needs. Consider factors such as your vehicle's value, how often you drive, and whether you have any additional drivers on your policy. The primary types of coverage include:

- Liability insurance - Covers damages to other people’s property and medical expenses in case of an accident.

- Collision insurance - Pays for damage to your car resulting from a collision, regardless of fault.

- Comprehensive insurance - Protects against damages not caused by collision, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP) - Covers medical expenses for you and your passengers, regardless of fault.

Research the Reputation of Providers

Once you have a clear idea of your coverage needs, the next step is to research potential car insurance providers. Look for companies with strong financial stability and excellent customer service ratings. Websites like J.D. Power and Consumer Reports provide insights into customer satisfaction and claims handling. Additionally, check online reviews and ratings to gauge the overall reputation of the providers you are considering.

Compare Quotes

Comparing quotes from multiple car insurance providers is vital to ensure you get the best deal. When obtaining quotes, make sure to compare similar coverage levels to get an accurate idea of costs. Many insurance companies offer online quote tools that make this process easier. Here’s a simple table to help you compare features and costs:

| Insurance Provider | Annual Premium | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|

| Provider A | $1,200 | $100,000 / $300,000 | Included | Included |

| Provider B | $1,000 | $50,000 / $100,000 | Included | Excluded |

| Provider C | $1,500 | $250,000 / $500,000 | Included | Included |

Evaluate Discounts and Benefits

Many car insurance providers offer various discounts that can significantly reduce your premium. Common discounts include:

- Multi-car discount - Savings for insuring multiple vehicles.

- Safe driver discount - For drivers with a clean driving record.

- Bundling discount - For purchasing multiple types of insurance (like home and auto) from the same provider.

- Good student discount - For students who maintain a high GPA.

Make sure to inquire about available discounts when you receive your quotes, as they can lead to substantial savings.

Check Customer Support Options

Excellent customer service is essential when dealing with car insurance providers. In the event of an accident or claim, you want a provider that is easy to reach and responsive. Check for the following customer support options:

- 24/7 customer service availability.

- Online chat or claims submission options.

- A user-friendly mobile app for managing your policy.

Reading customer reviews can also give you insight into the level of support you can expect from the provider.

Understand the Claims Process

Before finalizing your choice, understand the claims process of each provider. A transparent and straightforward claims process can save you time and stress after an accident. Look for reviews specifically mentioning claims experiences, and ask potential providers about their average claim settlement time.

Read the Fine Print

Finally, always read the policy documents carefully before signing. Pay attention to the terms and conditions, coverage limits, exclusions, and deductibles. Understanding the details of your policy can help you avoid surprises when you need to file a claim.

In conclusion, selecting the best car insurance provider involves careful consideration of your needs, thorough research, and comparison of available options. By understanding your coverage requirements, evaluating providers’ reputations, and taking advantage of discounts, you can find an insurance policy that offers both value and peace of mind. Make sure to follow these steps to ensure that you make an informed decision that suits your unique situation.

Explore

How to Choose a Secure Online File Storage Provider

How to Choose a Car Accident Insurance Lawyer

What to Look for in a Managed Security Service Provider

How to Choose the Best Health Insurance Plan

Top Car Insurance Providers in the U.S.: 2025 Rankings

How to Choose the Best Online Supplement Store: A Shopper’s Guide

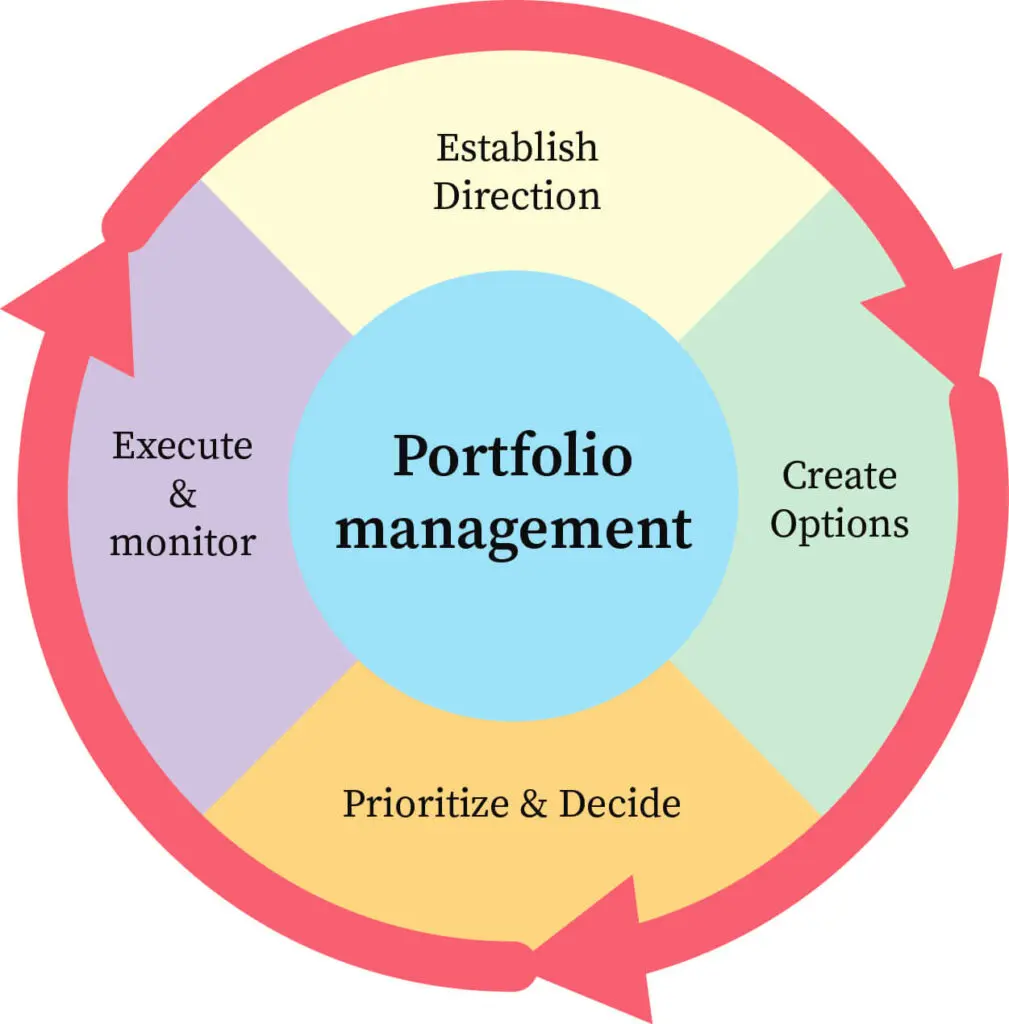

How to Choose the Right Portfolio Management Software for Your Business

How to Choose the Right Fund Manager Software for Your Investment Firm