Why Online Asset Management Boosts Wealth

In today's fast-paced financial landscape, online asset management has emerged as a game-changer for individuals and institutions alike. As investors look for ways to enhance their portfolios, the integration of technology into asset management offers unprecedented benefits. This article explores how online asset management can significantly boost wealth and streamline the investment process.

Understanding Online Asset Management

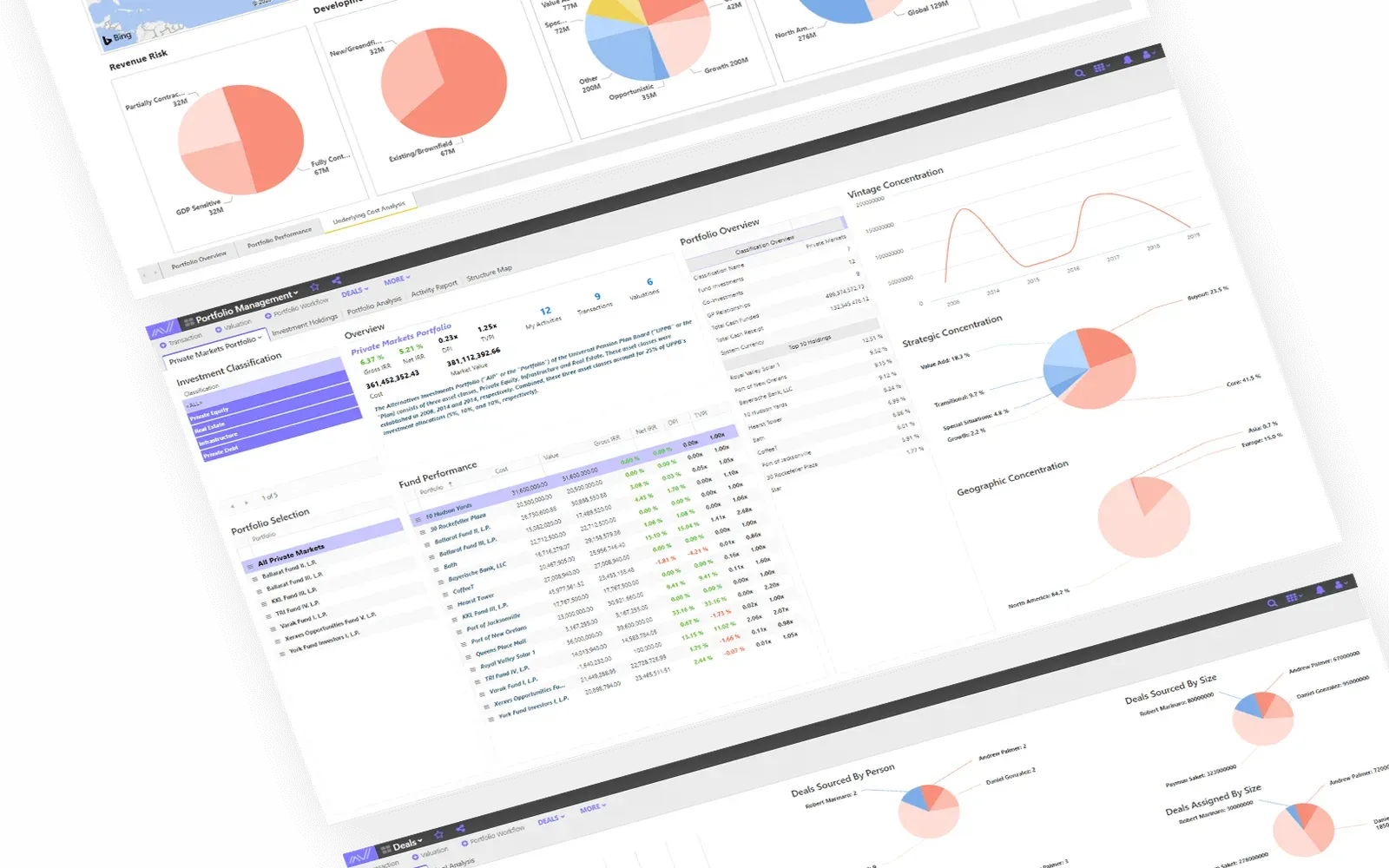

Online asset management refers to the digital approach to managing and optimizing investments. This modern method utilizes sophisticated algorithms, data analytics, and user-friendly platforms to help investors make informed decisions. With the rise of financial technology, asset management firms are leveraging online tools to provide comprehensive services that cater to a diverse clientele.

Advantages of Online Asset Management

The transition from traditional to online asset management comes with a host of advantages that can greatly enhance wealth-building strategies. Below are some key benefits:

- Cost Efficiency: One of the most significant advantages of online asset management is its cost-effectiveness. By minimizing overhead costs associated with physical offices and staffing, firms can pass these savings on to investors. This allows for lower fees, which can lead to higher net returns over time.

- Accessibility: Online platforms provide 24/7 access to account information, investment performance, and market analysis. Investors can monitor their portfolios anytime, anywhere, making it easier to react to market changes swiftly.

- Personalization: Many online asset management services offer customizable investment strategies tailored to individual goals and risk tolerances. This personalized approach helps investors create portfolios that align closely with their financial objectives.

- Diverse Investment Options: Investors can explore a wider range of investment products through online platforms, including stocks, bonds, ETFs, and alternative investments. This variety enables better diversification, which is crucial for managing risk and enhancing returns.

How Online Asset Management Boosts Wealth

Online asset management can directly contribute to wealth growth through several mechanisms:

1. Data-Driven Decisions

With access to real-time data and advanced analytical tools, online asset management allows investors to make informed decisions based on market trends and performance metrics. This data-driven approach can lead to more strategic investments, ultimately boosting wealth.

2. Automated Rebalancing

Many online asset management platforms offer automated rebalancing features, which help maintain an optimal asset allocation over time. By automatically adjusting the portfolio based on market fluctuations and predefined criteria, investors can ensure that their investments remain aligned with their risk tolerance and goals.

3. Educational Resources

Online asset management platforms often provide a wealth of educational resources, including webinars, articles, and market analysis. These resources empower investors to make smarter choices and understand the intricacies of asset management better, leading to more profitable investment strategies.

4. Enhanced Risk Management

Advanced risk assessment tools available in online asset management platforms allow investors to gauge the potential risks associated with their portfolios. By understanding risk exposure, investors can make adjustments that align with their financial goals, reducing the likelihood of substantial losses.

Comparative Analysis: Traditional vs. Online Asset Management

To illustrate the differences between traditional and online asset management, consider the following table:

| Feature | Traditional Asset Management | Online Asset Management |

|---|---|---|

| Cost | Higher fees due to physical infrastructure | Lower fees with minimal overhead |

| Accessibility | Limited to office hours | 24/7 access to accounts and resources |

| Customization | Standardized portfolios | Personalized investment strategies |

| Data Utilization | Basic analytics | Advanced data analytics and insights |

Choosing the Right Online Asset Management Platform

When selecting an online asset management platform, investors should consider several factors:

- Reputation: Research the firm’s history, reviews, and regulatory standing to ensure reliability.

- Investment Options: Look for platforms that offer a diverse range of investment products suitable for your goals.

- Fees: Compare fee structures to find a platform that offers value without unnecessary costs.

- Customer Support: Evaluate the level of customer service provided, as timely support can be critical in investment decisions.

The Future of Asset Management

The future of asset management is undoubtedly leaning towards digital innovation. As technology continues to evolve, online asset management will likely incorporate artificial intelligence and machine learning to enhance decision-making processes further. This evolution will make wealth management even more efficient and accessible to a broader audience.

In conclusion, online asset management is reshaping the landscape of wealth building. By leveraging technology, investors can enjoy numerous benefits, from cost savings to enhanced decision-making capabilities. As the industry continues to grow, adopting online asset management tools may prove to be a pivotal strategy for anyone looking to boost their wealth in today’s dynamic market.

Explore

Why Choosing a Local Law Firm Can Improve Your Case Outcome

How to Choose the Right Portfolio Management Software for Your Business

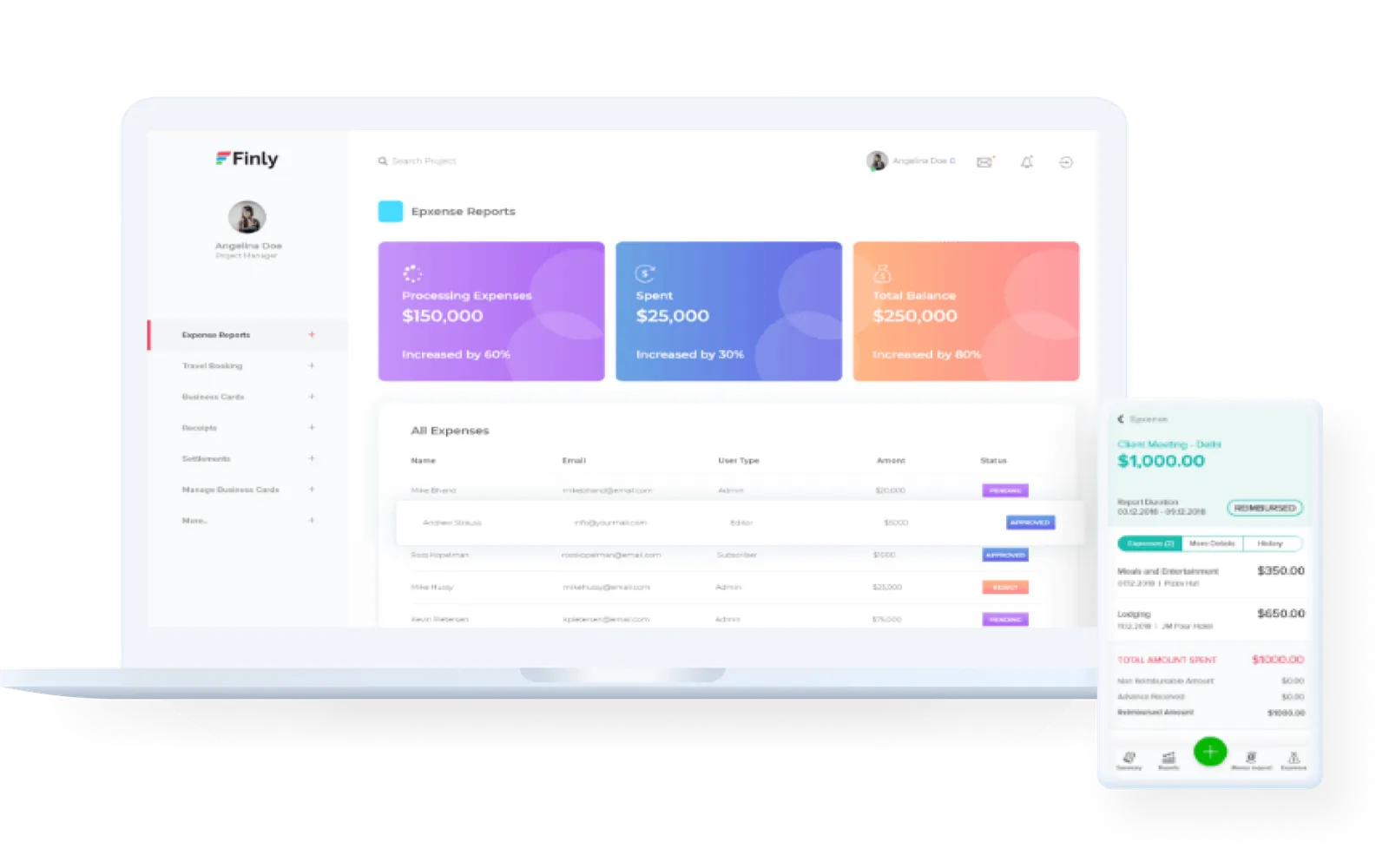

Top Expense Management Tools in 2025

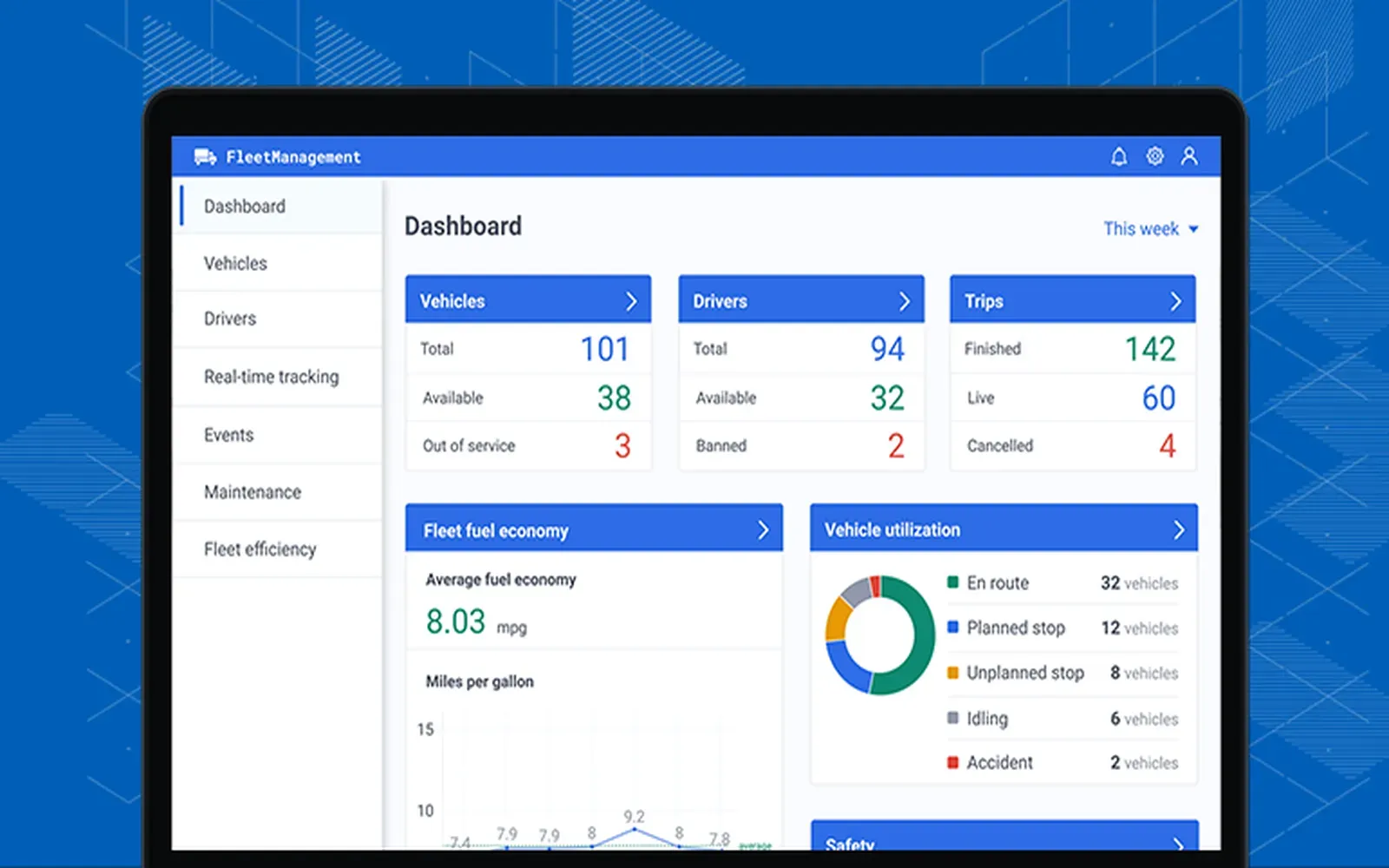

Best Fleet Management Systems in 2025

Best Fund Management Software for Smart Investing

Top Online Therapy Platforms for Depression Support

How to Choose the Best Online Supplement Store: A Shopper’s Guide

Top Online Advertising Strategies for Small Businesses in 2025