Top Structured Settlement Providers in 2025

In 2025, the landscape of structured settlement providers showcases the top firms offering innovative solutions for those looking to buy structured annuity settlement. These companies prioritize customer satisfaction and transparent processes, ensuring that individuals receive fair value for their structured settlement. Advanced technology and personalized service are key features, making the transition smoother for those wanting to sell structured annuity settlements.

In 2025, the structured settlement industry continues to evolve, providing individuals with various options for receiving their compensation. As more people seek financial stability through structured settlements, understanding the top providers in the market becomes crucial. Here, we will explore the leading structured settlement providers and the benefits of choosing a buyer structured annuity settlement.

Understanding Structured Settlements

A structured settlement is a financial arrangement where an injury victim receives compensation in periodic payments rather than a lump sum. This approach offers numerous advantages, including tax benefits and financial security over time. For individuals considering selling their structured settlements, a buyer structured annuity settlement can provide immediate cash flow to address urgent financial needs.

Criteria for Choosing a Structured Settlement Provider

When selecting a structured settlement provider, consider the following criteria:

- Reputation: Look for companies with a solid reputation and positive reviews.

- Customer Service: Ensure they provide excellent customer support throughout the process.

- Fees and Charges: Understand the fees involved in selling your structured settlement.

- Offers: Compare offers from different buyers to get the best deal for your structured annuity.

- Expertise: Choose providers with extensive experience in structured settlements.

Top Structured Settlement Providers in 2025

Here’s a look at some of the leading structured settlement providers in 2025:

| Provider | Overview | Special Features |

|---|---|---|

| J.G. Wentworth | One of the most recognized names in the structured settlement industry, J.G. Wentworth offers various financial solutions. | Fast cash offers, excellent customer service, and a user-friendly online platform. |

| Peachtree Financial Solutions | Peachtree specializes in purchasing structured settlements and annuities, providing tailored solutions for sellers. | Flexible payment options and a strong focus on customer satisfaction. |

| Stone Street Capital | Stone Street Capital is known for its transparent practices and straightforward process for selling structured settlements. | Competitive offers and a reputation for reliability. |

| Novation Settlement Solutions | Novation offers a personalized approach to structured settlements and is known for its integrity. | Comprehensive financial education resources for clients. |

| Fairfield Funding | With years of experience, Fairfield Funding provides quick cash options for individuals looking to sell their structured settlements. | Fast processing times and excellent client testimonials. |

The Benefits of Selling Your Structured Settlement

Choosing to sell your structured settlement can offer several benefits:

- Immediate Cash: Selling your structured settlement provides immediate cash, which can be used to pay off debts, cover medical expenses, or make significant purchases.

- Financial Flexibility: Receiving a lump sum allows for greater financial flexibility and the ability to invest in opportunities that may arise.

- Debt Relief: Many individuals face unexpected financial hardships; selling a structured settlement can help alleviate debt stress.

- Emergency Expenses: Life can be unpredictable; having access to cash for emergencies can provide peace of mind.

How to Sell Your Structured Settlement

If you decide to sell your structured settlement, follow these steps:

- Assess Your Needs: Determine how much cash you need and how selling your settlement fits into your financial plan.

- Research Buyers: Investigate various structured settlement providers to find reputable buyers.

- Request Quotes: Contact multiple buyers to get quotes for your structured settlement.

- Review Offers: Compare the offers, looking closely at the fees and terms involved.

- Consult a Financial Advisor: Before making a final decision, consult with a financial advisor to ensure you understand the implications of selling your structured settlement.

- Complete the Sale: Once you select a buyer, complete the necessary paperwork to finalize the sale.

Final Thoughts

As you navigate the structured settlement landscape in 2025, understanding the top providers and the benefits of a buyer structured annuity settlement will empower you to make informed decisions about your financial future. Proper research and careful consideration of your options can lead to a more secure financial situation and peace of mind.

Explore

Top Car Insurance Providers in the U.S.: 2025 Rankings

Top Business Internet Providers in the U.S.: A Comparison

Humana vs Other Providers: Which Health Plans Fit You Best?

Affordable Internet Providers for Small Business in 2025

Top Online Therapy Platforms for Depression Support

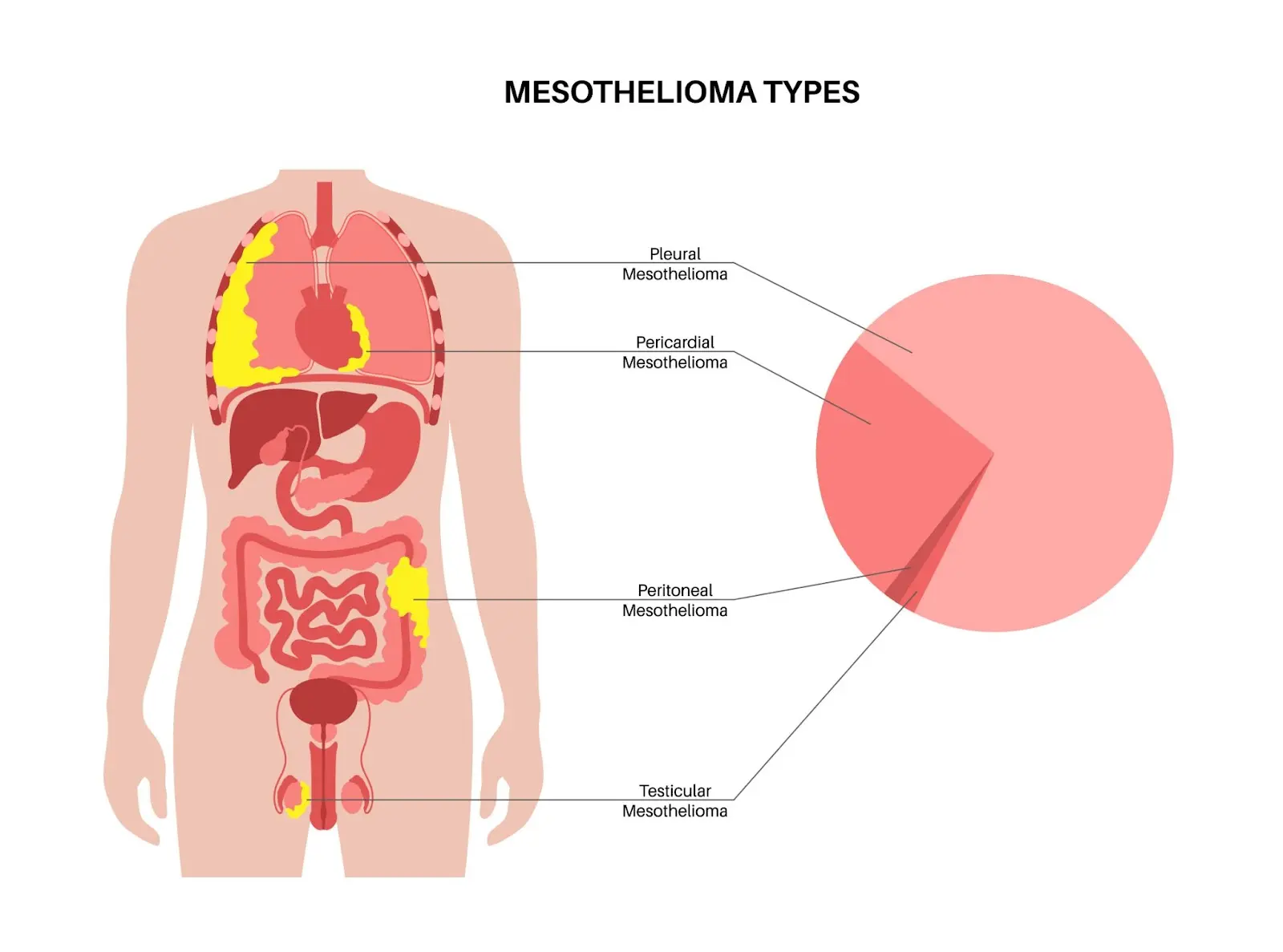

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options