Best Fund Management Software for Smart Investing

When it comes to achieving optimal investment outcomes, choosing the right Fund Management Software is crucial. Investors and fund managers are increasingly relying on technology to streamline processes, enhance decision-making, and improve overall efficiency. With a plethora of options available, selecting the best software can be challenging. In this article, we will explore the top fund management software solutions that cater to smart investing needs, discussing their features, benefits, and what sets them apart in the competitive market.

Key Features of Fund Management Software

Before diving into specific software options, it’s essential to understand the key features that make Fund Management Software effective. These features typically include:

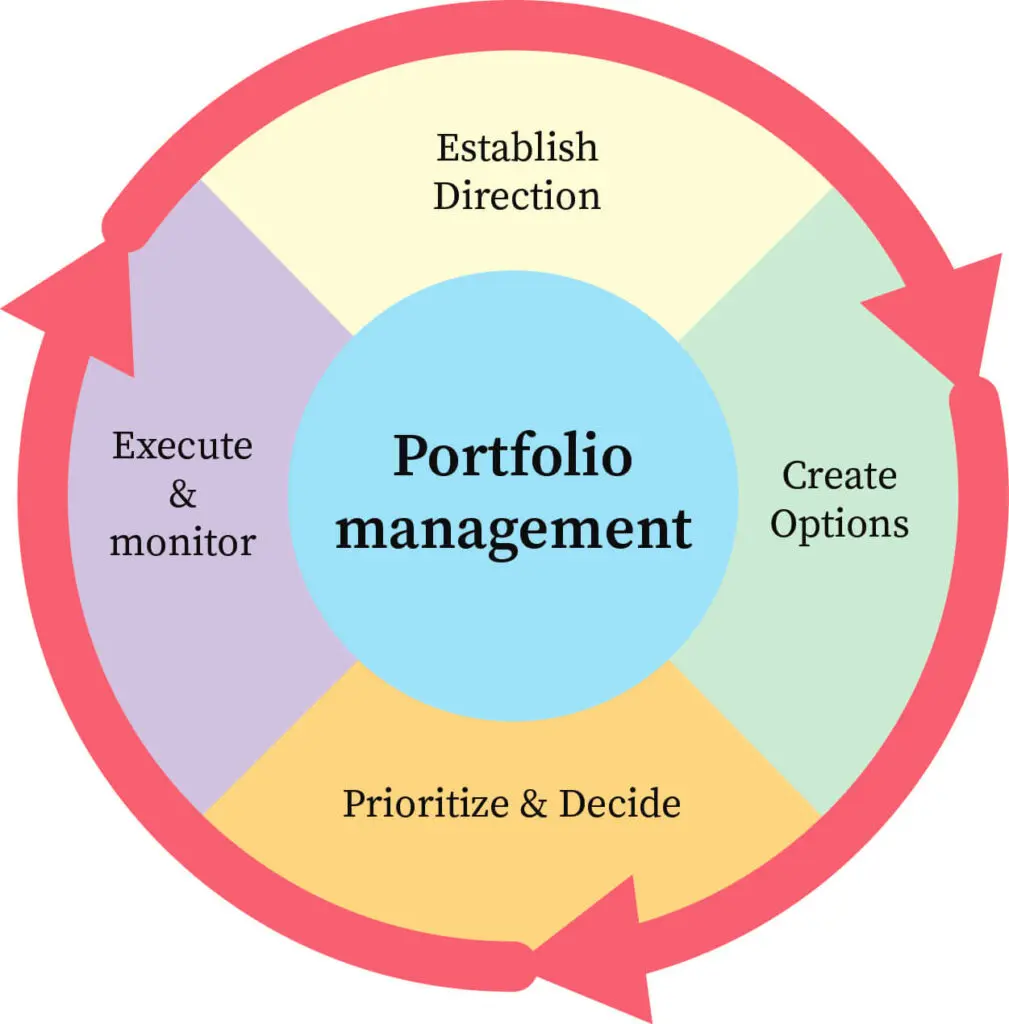

- Portfolio Management: Tools that allow managers to track and analyze investment portfolios, assess performance, and make informed adjustments.

- Compliance and Risk Management: Features that ensure adherence to regulations and help identify potential risks within investment strategies.

- Reporting and Analytics: Robust reporting capabilities that provide insights into fund performance, investor performance, and market trends.

- Integration Capabilities: Ability to integrate with other financial tools and platforms for seamless data transfer and management.

- User-Friendly Interface: Easy navigation and accessibility for users of varying tech-savviness.

Top Fund Management Software Solutions

Let’s explore some of the best Fund Management Software options available in the market today:

1. Morningstar Direct

Morningstar Direct is a leading fund management solution known for its comprehensive data and research capabilities. Key features include:

- Extensive investment research and analysis tools.

- Customizable reporting options for performance tracking.

- Collaboration tools for teams working on fund management.

With its user-friendly interface and powerful analytics, Morningstar Direct is an excellent choice for fund managers looking to optimize their investment strategies.

2. BlackRock Aladdin

BlackRock Aladdin is a sophisticated platform designed for institutional asset managers and investors. Some of its notable features are:

- Integrated risk management tools.

- Advanced portfolio management capabilities.

- Real-time analytics for better decision-making.

Aladdin’s ability to analyze risk and performance across various asset classes makes it a strong contender for serious investors.

3. eFront

eFront is tailored for alternative investments and is particularly beneficial for private equity and real estate. Its features include:

- End-to-end investment management processes.

- Investor relationship management tools.

- Customizable dashboards for performance tracking.

eFront’s focus on alternative assets sets it apart, making it ideal for firms looking to diversify their portfolios.

4. Enfusion

Enfusion provides a cloud-based fund management solution that supports both portfolio management and accounting. Key features include:

- Real-time data access and reporting.

- Integrated trade execution and compliance tools.

- Support for multi-asset classes.

Enfusion’s cloud-based nature allows for easy scalability, making it suitable for firms of all sizes.

5. SS&C Advent

SS&C Advent offers a comprehensive suite of solutions for investment management, focusing on efficiency and performance. Its features include:

- Robust portfolio management and accounting tools.

- Performance measurement and attribution analytics.

- Client reporting capabilities.

With a long history in the industry, SS&C Advent is trusted by many investment firms for its reliability and performance.

Benefits of Using Fund Management Software

Investing in Fund Management Software comes with numerous advantages:

- Improved Efficiency: Automating repetitive tasks frees up time for fund managers to focus on strategy and decision-making.

- Enhanced Accuracy: Automated calculations and data entry reduce the risk of human error, leading to more reliable reporting.

- Better Compliance: Built-in compliance tools ensure that funds adhere to regulations, minimizing legal risks.

- Data-Driven Insights: Advanced analytics provide critical insights that help managers make informed investment decisions.

Choosing the Right Fund Management Software

When selecting the best Fund Management Software for your needs, consider the following factors:

- Specific Needs: Determine whether you require a solution focused on traditional assets, alternative investments, or a mix of both.

- Budget: Evaluate the cost of software against your firm's budget and projected ROI.

- User Experience: A user-friendly interface will ensure that your team can adopt the software seamlessly.

- Customer Support: Reliable support is essential for resolving technical issues and maximizing software utilization.

Conclusion

In the fast-paced world of investment, having the right Fund Management Software can make all the difference. By leveraging technology, fund managers can enhance their decision-making, improve efficiency, and ultimately drive better investment outcomes. Whether you opt for Morningstar Direct, BlackRock Aladdin, eFront, Enfusion, or SS&C Advent, each of these solutions offers unique features tailored to meet the diverse needs of investors. Assess your requirements carefully, and choose the software that aligns best with your investment strategy.

Explore

How to Choose the Right Fund Manager Software for Your Investment Firm

Online Fund Accounting Programs: Flexibility for Busy Learners

Emergency Fund Essentials: What You Need Saved by 30, 40, 50

Best Startup Business Loans to Fund Your Vision

Strategies for Tax-Efficient Investing in 2025

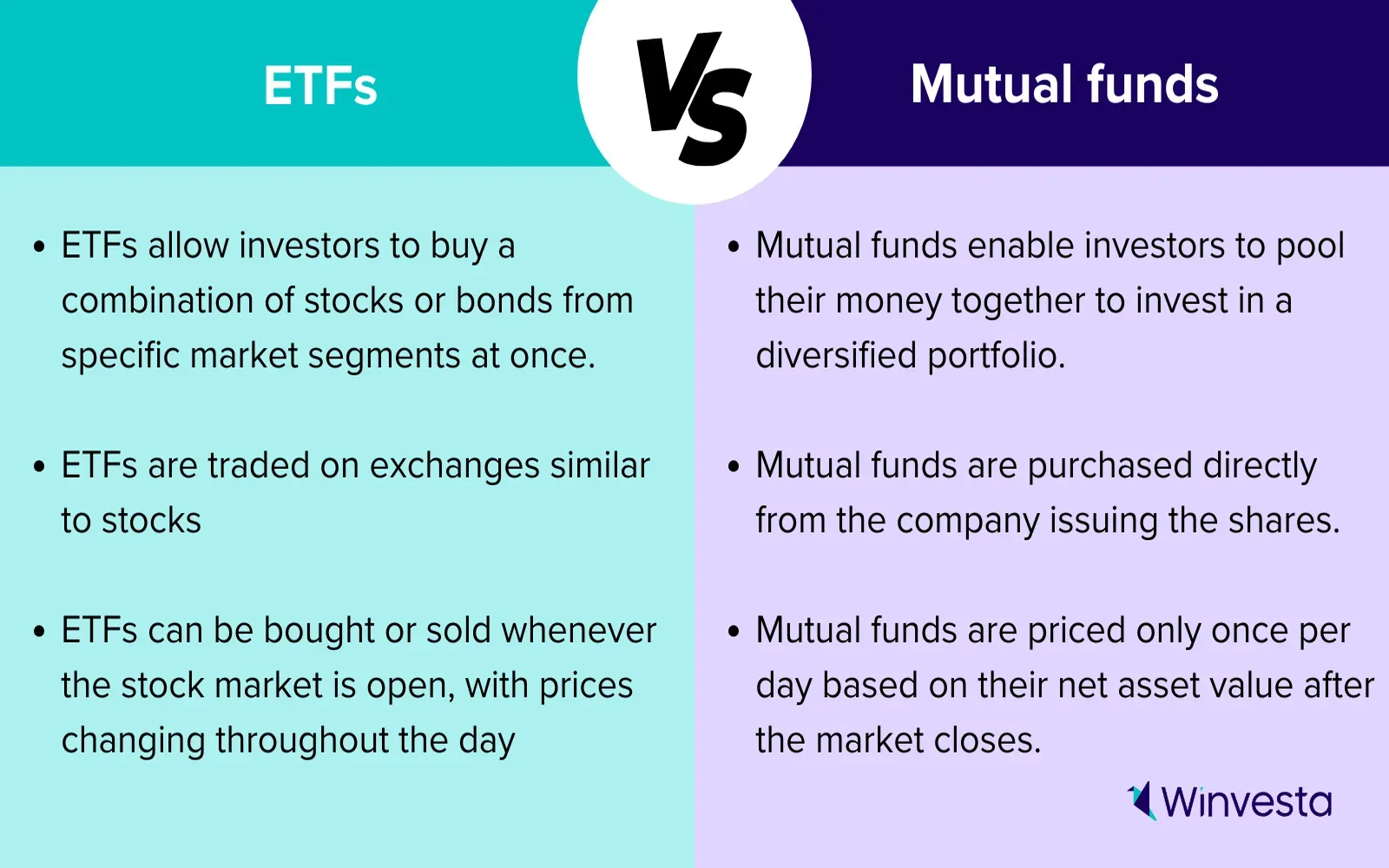

Investing in ETFs: 2025 Strategies and Tips

Hybrid Crossover SUVs 2025: The Smart Choice for Efficient and Versatile Driving

How to Choose the Right Portfolio Management Software for Your Business