Best Innovation Stocks for Long-Term Investors

Investing in high-potential tech stocks can lead to significant returns as the digital landscape evolves. Companies focusing on artificial intelligence, cloud computing, and cybersecurity are particularly promising. Keeping an eye on these innovative players not only supports your portfolio but also positions you to benefit from the ongoing technological transformation shaping our future. Stay informed and ready to invest!

As the technology sector continues to evolve, it presents a wealth of opportunities for investors. Identifying high-potential tech stocks can be a game-changer for your portfolio. With the rapid pace of innovation and increasing reliance on technology in various industries, certain stocks stand out as must-watch candidates. Below, we explore some of these stocks, their potential, and the factors driving their success.

Key Factors Driving Tech Stock Performance

Understanding what drives the performance of tech stocks is crucial for making informed investment decisions. Several factors contribute to the potential of tech companies, including:

- Innovation: Companies that continuously innovate tend to outperform their competitors.

- Market Demand: High demand for technology solutions can propel stock prices upward.

- Financial Health: Companies with strong balance sheets and revenue growth are generally more resilient.

- Industry Trends: Emerging trends such as artificial intelligence, cloud computing, and cybersecurity can create significant opportunities.

Top High-Potential Tech Stocks to Watch

Now, let’s dive into some of the high-potential tech stocks that investors should keep an eye on:

| Company | Sector | Market Capitalization | Growth Potential |

|---|---|---|---|

| Palantir Technologies | Data Analytics | $40 billion | High, driven by government and enterprise contracts |

| Cloudflare | Cybersecurity | $25 billion | High, with increasing demand for web security solutions |

| Zoom Video Communications | Video Conferencing | $20 billion | Moderate, expanding into new communication tools |

| Snowflake | Cloud Data Warehousing | $70 billion | High, as businesses shift towards data-driven decision-making |

| NVIDIA | Semiconductors | $800 billion | Very high, due to AI and gaming demand |

Palantir Technologies: A Leader in Data Analytics

Palantir Technologies is a prominent player in the data analytics space. The company specializes in big data solutions for both government and commercial sectors. With the increasing need for data-driven decision-making, Palantir’s cutting-edge platforms are gaining traction. Additionally, their contracts with various government agencies further solidify their market position, making them a high-potential tech stock to consider.

Cloudflare: The Cybersecurity Challenger

As cyber threats become more sophisticated, companies like Cloudflare are stepping up to provide essential cybersecurity solutions. Their platform offers protection against a wide range of online threats, making it a vital service for businesses of all sizes. With a market capitalization of around $25 billion and a consistent growth trajectory, Cloudflare is positioned to benefit from the rising importance of internet security, making it a stock worth monitoring.

Zoom Video Communications: Evolving Beyond Video Calls

Zoom Video Communications gained immense popularity during the pandemic, but its future potential extends beyond video conferencing. The company is expanding its offerings to include a comprehensive suite of communication tools. Although its growth may be moderate compared to other tech stocks, Zoom's ability to adapt and innovate keeps it relevant in a competitive market.

Snowflake: Revolutionizing Data Management

Snowflake has transformed the way organizations manage and analyze their data. With its cloud-based data warehousing solutions, it allows businesses to harness the power of data more effectively. As more companies migrate to cloud services, Snowflake stands to benefit significantly. Its robust growth potential, reflected in its increasing market capitalization, makes it a high-potential tech stock for investors to watch.

NVIDIA: The Powerhouse of AI and Gaming

NVIDIA is a titan in the semiconductor industry, particularly known for its graphics processing units (GPUs). The company's technology is at the forefront of artificial intelligence and gaming, sectors that are experiencing explosive growth. With a staggering market capitalization of around $800 billion, NVIDIA's continuous innovation and expansion into new markets position it as one of the most promising tech stocks available today.

Conclusion: Staying Informed and Strategic

Investing in high-potential tech stocks requires vigilance and strategic thinking. By keeping an eye on the factors that influence tech stock performance and monitoring key players like Palantir, Cloudflare, Zoom, Snowflake, and NVIDIA, investors can position themselves for success. The tech sector is dynamic, and staying informed about emerging trends will enable you to make sound investment decisions. Remember, the key to successful investing lies in thorough research and a keen understanding of market movements.

Explore

How Structured Settlement Annuities Provide Long-Term Security

Top Real Estate Crowdfunding Sites for U.S. Investors

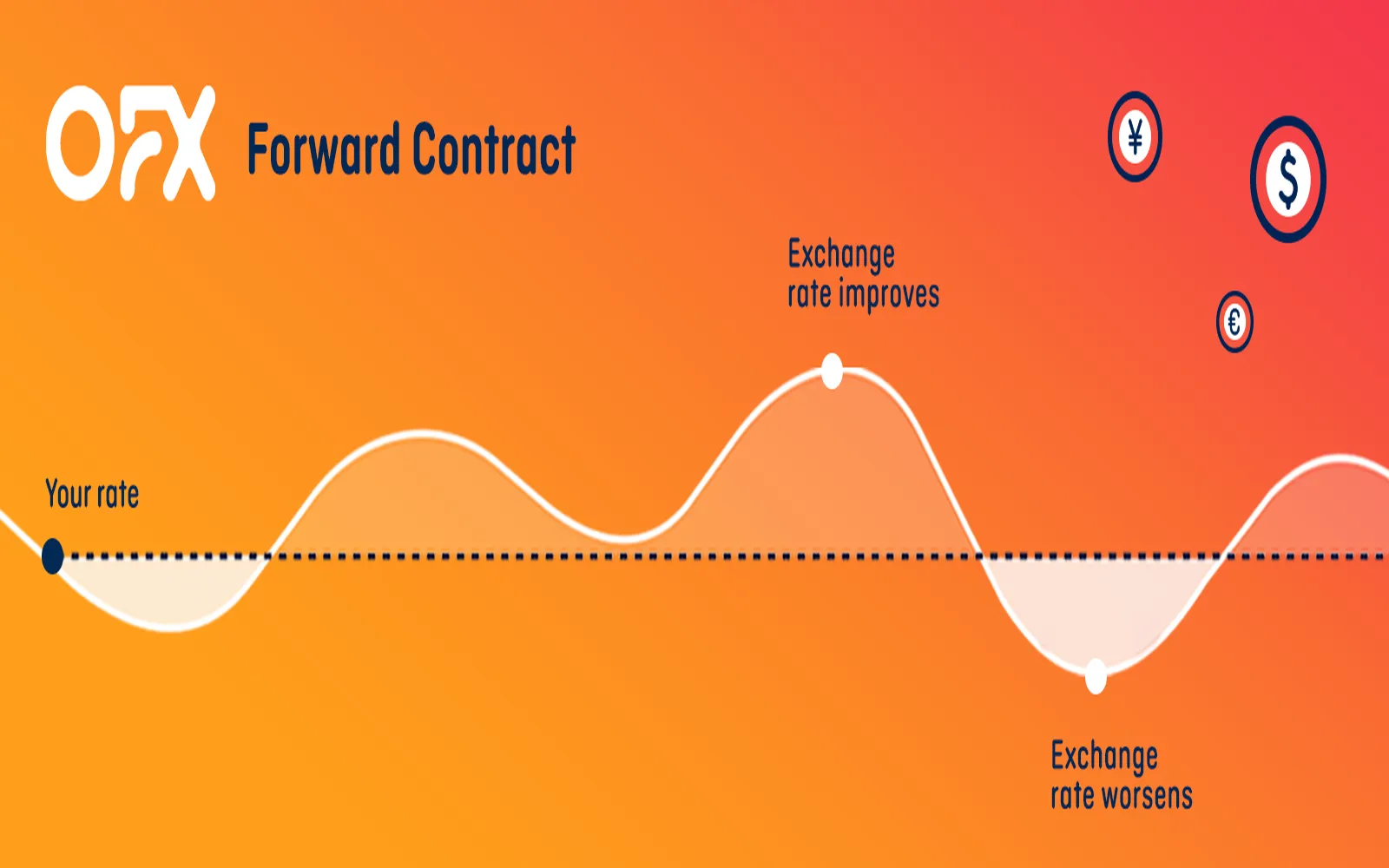

Currency Hedging Strategies for Investors in 2025

Revving Up Innovation: The Evolution and Future of Honda's Automotive Legacy

Top Online Therapy Platforms for Depression Support

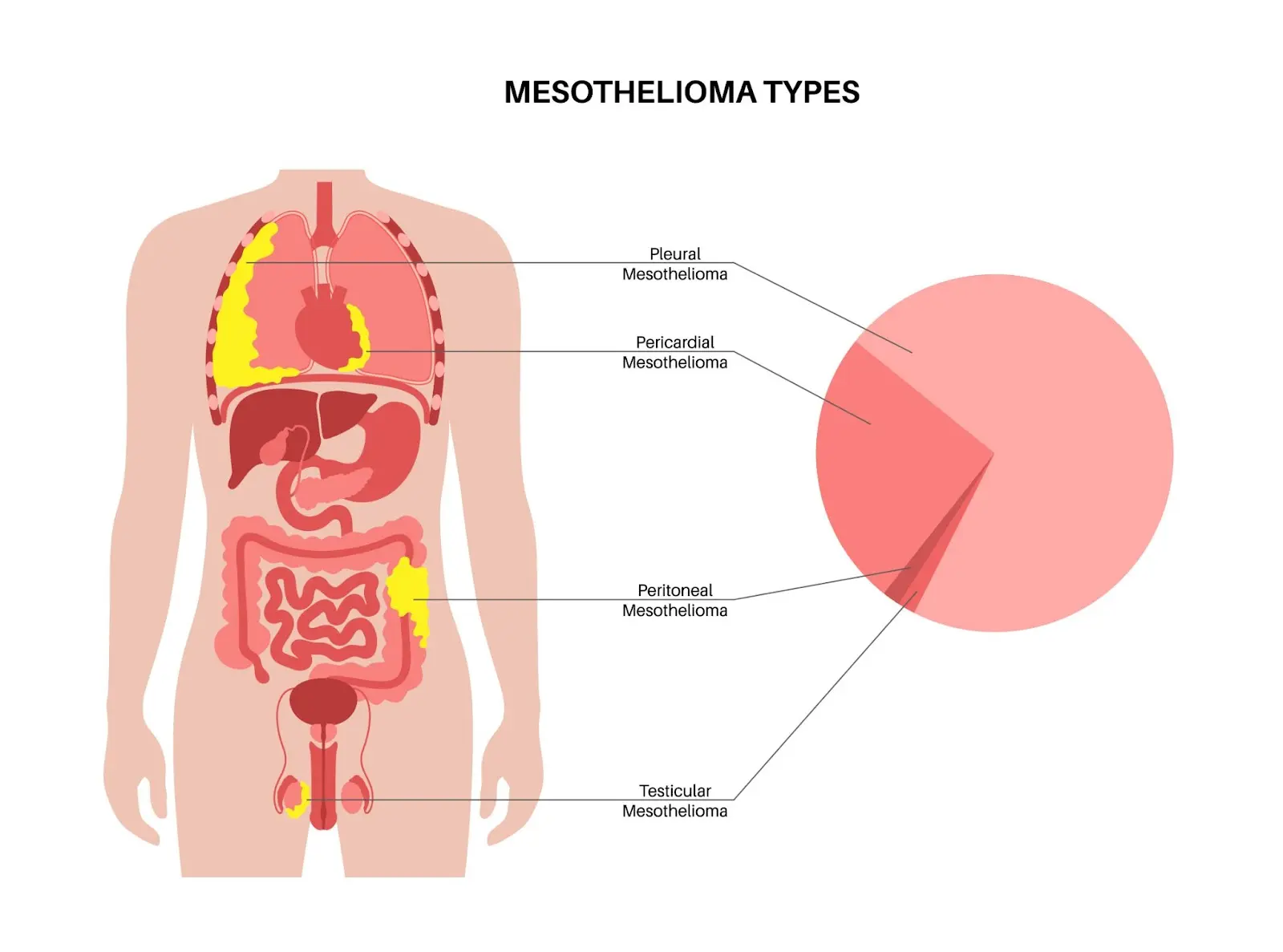

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options