Currency Hedging Strategies for Investors in 2025

In 2025, savvy investors are leveraging currency hedging strategies to mitigate risks associated with fluctuating exchange rates. By utilizing financial instruments like forwards, options, and swaps, they can protect their portfolios from adverse currency movements. These investment techniques enable greater stability and predictability, ensuring that returns remain robust amid global market volatility and enhancing overall portfolio performance.

In the ever-evolving landscape of investment finance, currency hedging has become a critical strategy for investors looking to protect themselves from fluctuations in foreign exchange rates. As we approach 2025, understanding the latest currency hedging strategies will be essential for minimizing risk and maximizing returns. This article will delve into the most effective currency hedging techniques for investors, helping them navigate the complexities of the global market.

Understanding Currency Hedging

Currency hedging involves taking a position in the foreign exchange market to offset potential losses in an investment due to currency fluctuations. Investors often utilize various instruments, such as options, forwards, and futures, to create a protective strategy. The importance of effective hedging cannot be overstated, especially as geopolitical tensions and economic uncertainties continue to impact currency values.

Why Investors Hedge

Investors hedge their currency exposure for multiple reasons. One of the primary motivations is to protect their investments from adverse currency movements that can erode profits. Additionally, hedging can provide a level of certainty in cash flows, which is particularly important for businesses operating internationally or investors holding assets in foreign currencies.

Key Currency Hedging Strategies for 2025

As we look ahead to 2025, several currency hedging strategies stand out, each with its unique advantages and considerations:

1. Forward Contracts

Forward contracts are agreements to exchange currencies at a predetermined rate on a specific future date. This strategy allows investors to lock in exchange rates, providing protection against unfavorable currency movements. Forward contracts are particularly useful for companies with known future cash flows in foreign currencies.

2. Options Contracts

Options contracts provide the right, but not the obligation, to exchange currencies at a predetermined rate. This flexibility makes options an attractive choice for investors who wish to hedge against currency risk while still benefiting from favorable exchange rate movements. In 2025, the use of options is expected to grow, particularly as volatility in currency markets increases.

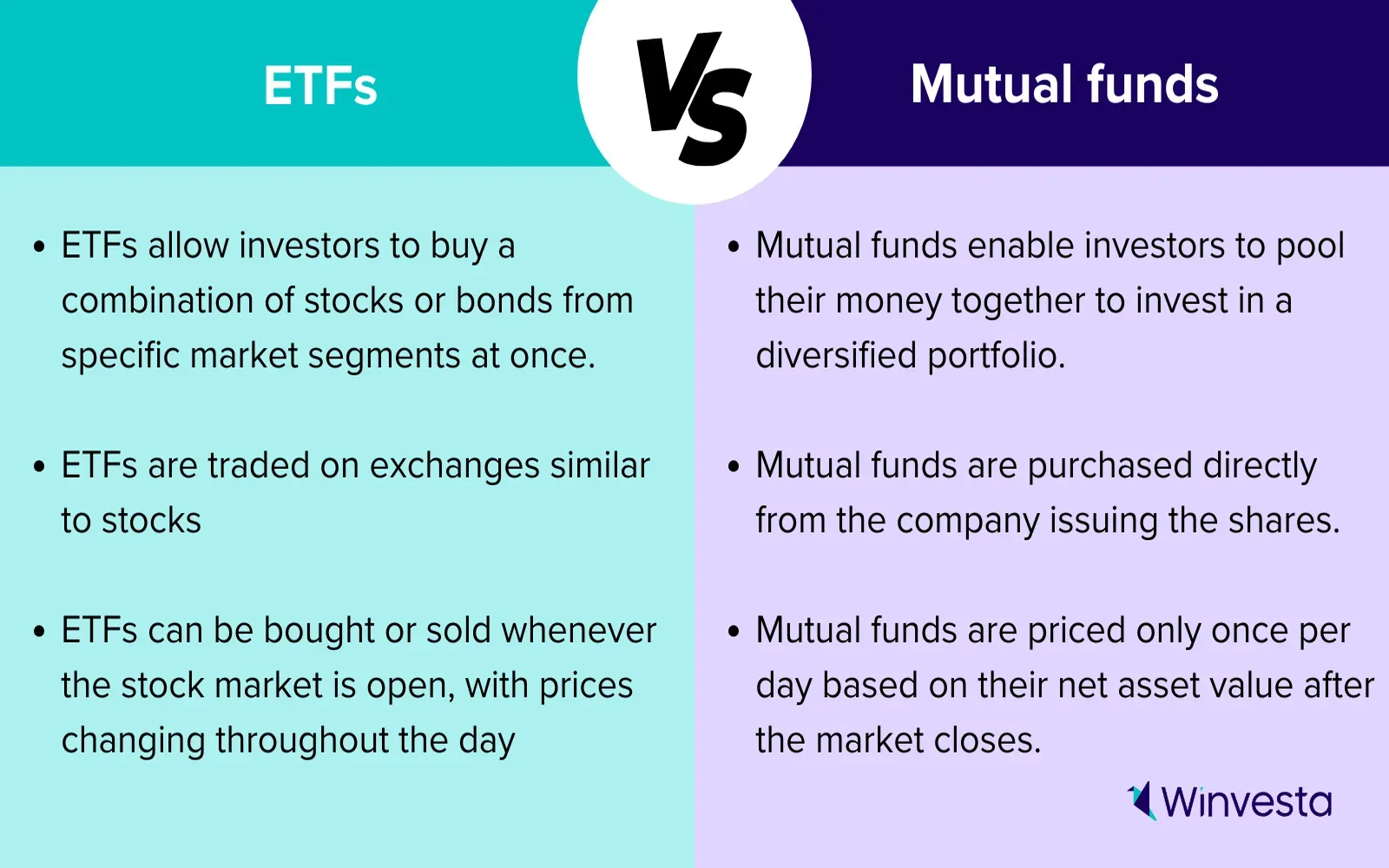

3. Currency ETFs

Currency exchange-traded funds (ETFs) are an increasingly popular way for investors to gain exposure to foreign currencies without directly trading them. These funds typically hold a basket of currencies and can be used to hedge against specific currency risks. In 2025, the rise of currency ETFs will likely provide investors with more accessible and diversified hedging options.

4. Diversification Across Currencies

Diversifying investments across multiple currencies can also serve as an effective hedging strategy. By holding a portfolio that includes assets in various currencies, investors can mitigate the impact of a decline in any single currency. This approach requires careful analysis and understanding of global economic trends.

5. Cross-Currency Swaps

Cross-currency swaps involve exchanging principal and interest payments in one currency for those in another. This strategy is commonly used by corporations and institutional investors to manage currency risks related to their debt obligations. As interest rates and currency values fluctuate, cross-currency swaps can provide an effective means of hedging.

Considerations for Implementing Hedging Strategies

While currency hedging can protect against risk, investors should consider several factors before implementing their strategies:

- Market Conditions: Understanding current and projected economic conditions is crucial. Currency values can be influenced by interest rates, inflation, and geopolitical events.

- Costs: Hedging strategies often come with associated costs, including transaction fees and premiums for options. Investors need to weigh these costs against the potential benefits of protection.

- Risk Tolerance: Each investor's risk tolerance will influence their choice of hedging strategy. Conservative investors may prefer more straightforward approaches like forward contracts, while more aggressive investors might explore options or ETFs.

Conclusion

As we approach 2025, the importance of currency hedging in investment finance cannot be overstated. With increasing market volatility and the potential for economic shifts, investors must adopt robust hedging strategies to safeguard their portfolios. By utilizing forward contracts, options, currency ETFs, diversification, and cross-currency swaps, investors can effectively manage their currency risks and enhance their investment outcomes. Staying informed and adapting strategies will be key to navigating the complexities of the global financial landscape.

Explore

Top Online Advertising Strategies for Small Businesses in 2025

Strategies for Tax-Efficient Investing in 2025

Investing in ETFs: 2025 Strategies and Tips

Top Online Therapy Platforms for Depression Support

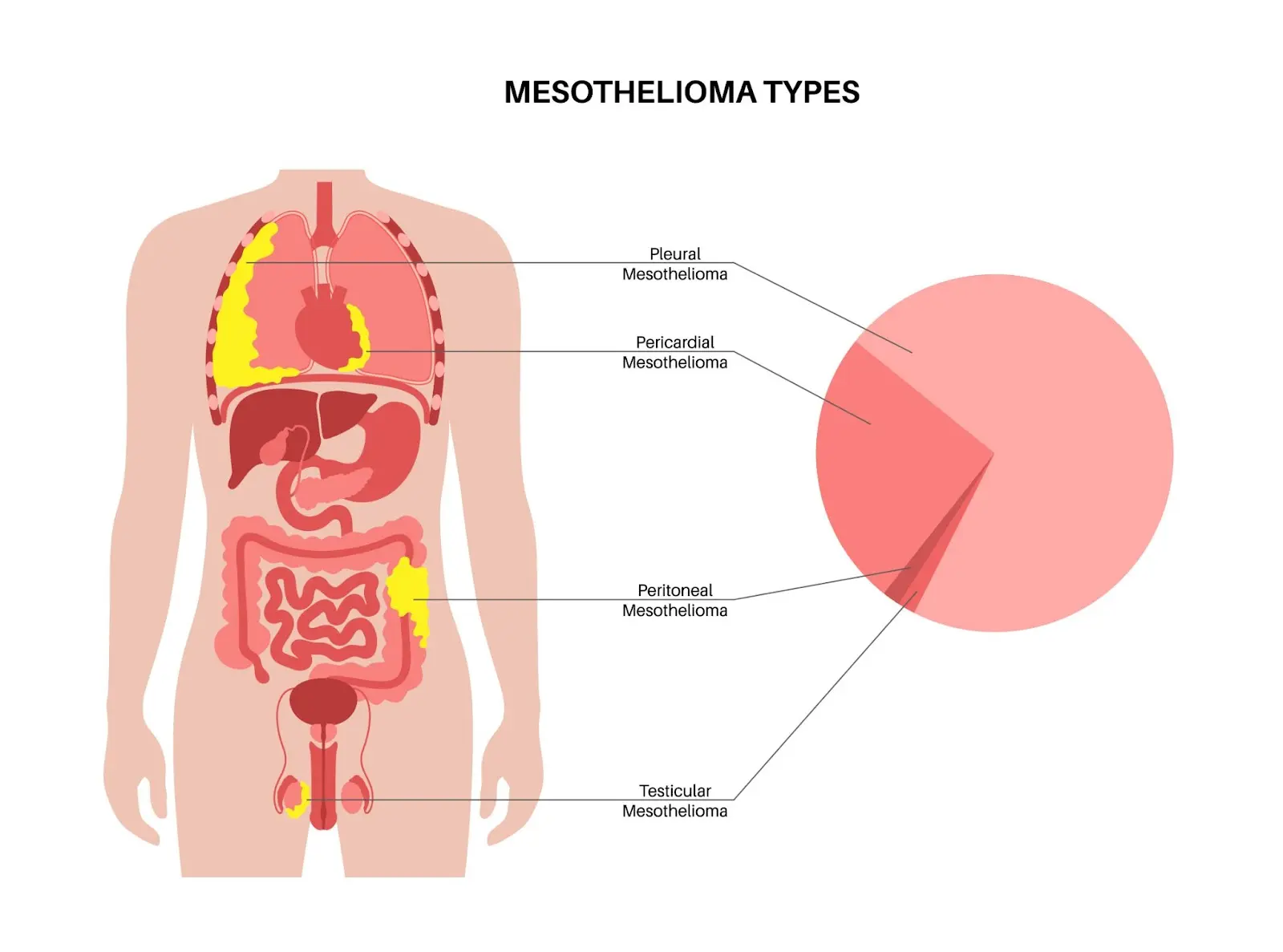

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

How Sewer Cameras and Locators Improve Plumbing Diagnostics