Building Credit from Scratch: Cards Designed for Beginners

Building credit from scratch can be daunting, but beginner-friendly credit cards make it accessible. These cards typically have lower credit limits and easier approval requirements, helping newcomers establish a positive credit history. By using these cards responsibly, such as making timely payments and keeping balances low, users can develop their credit score and unlock better financial opportunities in the future.

Understanding Credit and Its Importance

Building credit from scratch can seem like a daunting task, especially for young adults or those who have never had a credit account before. Credit is essential in today’s financial landscape as it affects various aspects of life, including loan approvals, interest rates, and even employment opportunities. Understanding how to build credit is crucial for anyone looking to achieve financial independence and stability.

What is Credit?

Credit is essentially a trust agreement between a lender and a borrower. It allows individuals to borrow money or access goods and services with the promise of future repayment. Credit scores, which range from 300 to 850, are numerical representations of an individual's creditworthiness, calculated based on their credit history. A higher score indicates a lower risk to lenders, while a lower score may result in denied applications or higher interest rates.

The Components of a Credit Score

Your credit score is influenced by several factors, including:

- Payment History (35%): This is the most significant factor, reflecting whether you've paid your bills on time.

- Credit Utilization (30%): This measures the amount of credit you’re using compared to your total available credit. Keeping this ratio below 30% is generally advisable.

- Length of Credit History (15%): A longer credit history can positively impact your score, as it provides more data on your borrowing behavior.

- Types of Credit (10%): Having a mix of credit types, such as revolving credit (credit cards) and installment loans (car loans, student loans), can be beneficial.

- New Credit (10%): Opening several new accounts in a short period can negatively affect your score, as it may indicate financial distress.

Getting Started: The First Steps to Building Credit

For beginners, the first step to building credit is to understand the importance of responsible credit use. Here are some actionable steps to get started:

- Open a Secured Credit Card: A secured credit card requires a cash deposit that serves as your credit limit. This is a great option for beginners, as it allows you to build credit while minimizing the bank's risk.

- Apply for a Credit Builder Loan: Some banks and credit unions offer credit builder loans, which are designed to help individuals establish credit. The loan amount is held in a savings account until it’s paid off, and your payments are reported to credit bureaus.

- Become an Authorized User: If you have a trusted friend or family member with good credit, ask if they can add you as an authorized user on their credit card. Their positive payment history can help improve your credit score.

- Open a Retail Store Card: Many retail stores offer credit cards that are easier to obtain than standard credit cards. However, be cautious of high-interest rates and ensure you can pay off the balance each month.

Choosing the Right Credit Card for Beginners

When selecting a credit card as a beginner, it's essential to choose one that aligns with your financial habits and goals. Here are some options that are particularly well-suited for those just starting:

Secured Credit Cards

Secured credit cards are often the best choice for individuals looking to build credit from scratch. These cards require a cash deposit that serves as collateral and your credit limit. This deposit reduces the risk for the lender, making it easier for beginners to get approved.

Many secured credit cards also report to all three major credit bureaus (Equifax, Experian, and TransUnion), which is essential for building a credit history. Look for cards with low fees and a reasonable interest rate.

Student Credit Cards

If you’re a college student, student credit cards can be an excellent option. These cards are specifically designed for young adults with limited credit history and often have lower credit limits and fewer fees. They can help you build credit while providing you with the opportunity to learn about responsible credit use.

Retail Store Credit Cards

Retail store credit cards can be easier to obtain than traditional credit cards. If you frequently shop at a specific store, consider applying for their credit card. Just be mindful of the high-interest rates that often accompany these cards, and ensure you pay off your balance in full each month to avoid accumulating debt.

Building Credit Responsibly

Once you have a credit card, it’s essential to use it responsibly. Here are some tips for maintaining good credit habits:

- Pay Your Bills on Time: Late payments can significantly impact your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Keep Your Credit Utilization Low: Aim to use no more than 30% of your available credit at any given time. This demonstrates to lenders that you can manage credit responsibly.

- Monitor Your Credit Report: Regularly check your credit report for accuracy and to track your progress. You are entitled to one free credit report per year from each of the three major bureaus.

- Avoid Unnecessary Hard Inquiries: When you apply for new credit, lenders conduct a hard inquiry on your credit report, which can temporarily lower your score. Limit your applications to only when necessary.

The Role of Credit Scores in Your Financial Future

As you build your credit, it’s essential to understand how your credit score can affect your financial future. A good credit score can lead to lower interest rates on loans, better insurance premiums, and even improved job prospects. For example, many landlords check credit scores as part of their tenant screening process, and employers may review credit reports for certain positions.

Common Myths About Credit Building

There are several misconceptions about building credit that can hinder progress. Here are a few common myths debunked:

- Myth: You Need to Carry a Balance to Build Credit: Many people believe that carrying a balance on their credit card will improve their credit score. In reality, paying your balance in full each month is the best way to maintain a good credit score.

- Myth: Closing Old Accounts Will Improve Your Score: Closing old credit accounts can actually hurt your credit score by reducing your average account age and increasing your credit utilization ratio.

- Myth: You Only Need to Build Credit If You Plan to Borrow: Building credit is beneficial for everyone, not just those looking to borrow money. A good credit score can help you secure better rates on insurance and rental applications.

Resources for Building Credit

Many resources are available to help you understand and build your credit. Here are some valuable tools and services to consider:

- Credit Counseling Services: Non-profit credit counseling agencies can provide guidance on budgeting, credit management, and debt repayment strategies.

- Credit Monitoring Services: Many companies offer credit monitoring services that alert you to changes in your credit report and provide educational resources.

- Financial Literacy Programs: Look for local workshops or online courses that focus on credit education and financial management.

Conclusion: The Journey to Building Credit

Building credit from scratch is a journey that requires patience, discipline, and a commitment to responsible financial habits. By understanding the fundamentals of credit, selecting the right credit card, and practicing good credit management, you can establish a solid credit history that will benefit you for years to come. Remember, the key to successful credit building is to stay informed, remain proactive, and make financial decisions that align with your long-term goals.

Explore

How Travel Credit Cards Can Maximize Your Rewards

Best Rewards Credit Cards: Maximize Your Benefits

How to Pick the Best Credit Card in 2025

Top Online Therapy Platforms for Depression Support

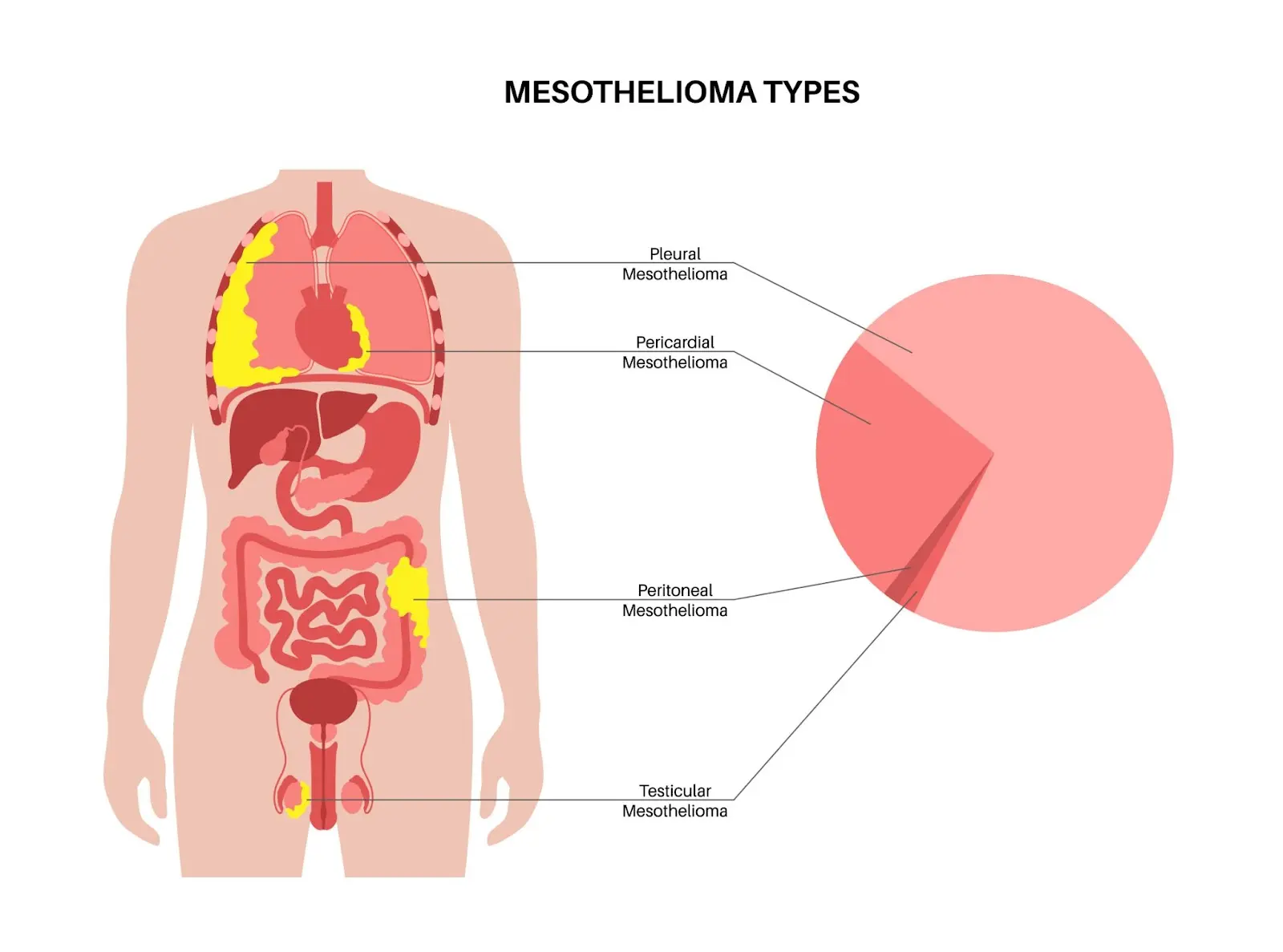

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options

How Sewer Cameras and Locators Improve Plumbing Diagnostics