How to Pick the Best Credit Card in 2025

In 2025, picking the best credit card involves assessing your financial needs and goals. Start by evaluating Choose Credit Card options based on rewards, interest rates, and fees. Consider your spending habits and look for cards that offer bonuses in categories you frequently use. Always read the terms carefully to ensure the Choose Credit Card aligns with your lifestyle and enhances your financial benefits.

When it comes to managing your finances in 2025, choosing the right credit card can significantly impact your financial health. With a myriad of options available, understanding how to select the best credit card tailored to your needs is essential. Here are some key factors to consider when deciding which credit card to choose.

Understand Your Spending Habits

Before you dive into the world of credit cards, take a moment to analyze your spending habits. Are you someone who frequently travels, or do you primarily use your card for everyday purchases? By understanding where you spend the most, you can choose a credit card that maximizes your rewards and benefits. For instance, if you travel often, a card that offers travel rewards or airline miles might be the best fit.

Evaluate the Reward Programs

Credit cards often come with various reward programs that can be enticing. Some cards offer cash back on every purchase, while others provide points for travel, dining, or shopping. When you choose a credit card, make sure to evaluate the reward programs carefully. Look for cards that offer higher rewards in categories where you spend the most. For example, if you dine out frequently, a card that offers bonus points for restaurant spending would be advantageous.

Compare Fees and Interest Rates

Another critical aspect to consider when selecting a credit card is the fees and interest rates associated with it. Annual fees, foreign transaction fees, and late payment fees can add up quickly. Make sure to read the fine print and understand the costs involved. Additionally, compare the interest rates on different cards. A card with a lower interest rate can save you money if you ever carry a balance.

Look for Introductory Offers

Many credit cards come with attractive introductory offers, such as 0% APR for the first year or bonus rewards points for signing up. These promotions can provide significant value if they align with your financial goals. When you choose a credit card, take note of any introductory offers that could benefit you in the short term, but also consider the long-term benefits of the card.

Check for Additional Perks

In addition to rewards and fees, look for extra perks that might sway your decision. Some cards offer benefits like travel insurance, purchase protection, extended warranties, or access to exclusive events. If these perks align with your lifestyle, they can add substantial value to the card. Always weigh these additional features when you choose a credit card.

Assess Your Credit Score

Your credit score plays a significant role in determining which credit cards you can qualify for. Before applying for a new card, check your credit score to ensure it meets the requirements for the card you’re considering. Cards with better rewards generally require higher credit scores. If your score needs improvement, focus on building it up before applying to ensure you have access to the best options available.

Read Customer Reviews

Customer reviews can offer valuable insights into the pros and cons of different credit cards. Take the time to research online reviews and testimonials before making a decision. Look for feedback regarding customer service, ease of use, and the overall user experience. This information can help you make a more informed choice when you choose a credit card.

Consider Your Financial Goals

Your financial goals will also guide your decision in picking a credit card. If you're looking to build credit, a secured credit card may be a good option. On the other hand, if you're focused on maximizing rewards for travel or cashback, seek out cards that align with those goals. Always keep your long-term financial objectives in mind while evaluating your options.

Table of Popular Credit Cards in 2025

| Card Name | Rewards Type | Annual Fee | Introductory Offer |

|---|---|---|---|

| Travel Rewards Card | 2x points on travel | $95 | 60,000 bonus points after spending $3,000 in the first 3 months |

| Cash Back Card | cash back on all purchases | $0 | $200 cash back after spending $1,000 in the first 3 months |

| Student Credit Card | 1x point on all purchases | $0 | 5% cash back on first $500 spent in the first 3 months |

| Low Interest Card | $49 | 0% APR for the first 12 months |

Final Thoughts

Choosing the best credit card in 2025 involves careful consideration of your personal needs, spending habits, and financial goals. By evaluating rewards programs, fees, and additional perks, you can narrow down your options effectively. Remember to check your credit score and read customer reviews to make an informed decision. With the right credit card in hand, you’ll be better positioned to manage your finances and enjoy the benefits that come with it.

Explore

How to Pick Reliable Antivirus Software in 2025

How to Pick the Best PPC Agency for Your Business

How Travel Credit Cards Can Maximize Your Rewards

Building Credit from Scratch: Cards Designed for Beginners

Best Rewards Credit Cards: Maximize Your Benefits

Top Online Therapy Platforms for Depression Support

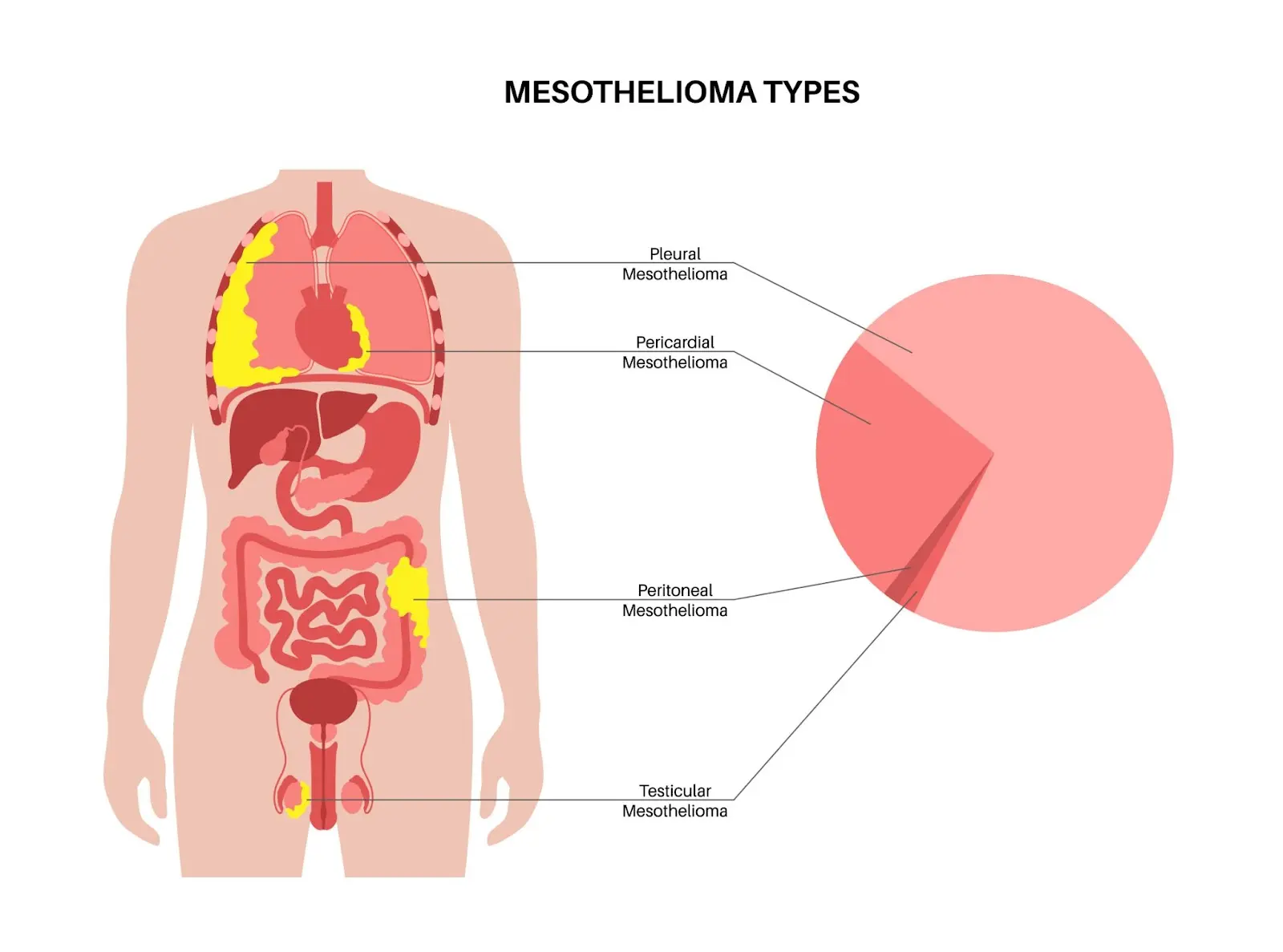

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide