Best Rewards Credit Cards: Maximize Your Benefits

Discover the world of rewards credit cards designed to help you maximize your benefits. These cards offer enticing perks, including cash back, travel points, and exclusive discounts. By choosing the right rewards card, you can earn valuable rewards on everyday purchases, turning your spending into exciting opportunities. Unlock the full potential of your finances with these top-rated options.

When it comes to choosing the best rewards credit cards, understanding how to maximize your benefits can significantly enhance your financial strategy. With a plethora of options available, selecting the right card requires careful consideration of your spending habits and preferences. Below, we will explore the top rewards credit cards that can help you make the most out of your purchases.

Understanding Credit Card Rewards

Credit card rewards come in different forms, including cash back, points, and travel miles. Each type has its own unique benefits. For instance, cash back rewards provide a straightforward way to earn money on purchases, while points and miles can be redeemed for travel, merchandise, or experiences. Understanding how these rewards work is essential to choose the best card for your needs.

Types of Rewards Credit Cards

There are several types of rewards credit cards available in the market. Here are some popular categories:

- Cash Back Credit Cards: These cards offer a percentage of your spending back as cash rewards. They are ideal for those who prefer straightforward benefits.

- Travel Rewards Credit Cards: Perfect for frequent travelers, these cards earn you miles or points that can be redeemed for flights, hotel stays, and travel-related expenses.

- Points Rewards Credit Cards: These cards allow you to accumulate points for various purchases, which can be redeemed for gift cards, products, or services.

- Bonus Category Credit Cards: Some credit cards offer higher rewards in specific categories, such as groceries, gas, or dining, making them suitable for those who spend heavily in those areas.

Top Rewards Credit Cards to Consider

Choosing the right rewards credit card can be daunting, but here are some of the top options currently available:

| Card Name | Rewards Rate | Annual Fee | Sign-Up Bonus |

|---|---|---|---|

| Chase Freedom Unlimited | Cash Back | $0 | $200 after spending $500 in the first 3 months |

| American Express Gold Card | 4x points on dining | $250 | 60,000 points after spending $4,000 in the first 6 months |

| Capital One Venture Rewards Credit Card | 2x miles on every purchase | $95 | 60,000 miles after spending $3,000 in the first 3 months |

| Citi Double Cash Card | Cash Back | $0 | None |

Maximizing Your Rewards

To truly make the most of your rewards credit card, consider the following tips:

- Pay Your Balance in Full: Avoid interest charges by paying off your balance each month. This ensures that your rewards are not offset by interest payments.

- Take Advantage of Sign-Up Bonuses: Many cards offer lucrative sign-up bonuses that can significantly enhance your rewards. Make sure to meet the minimum spending requirement within the specified timeframe.

- Use Your Card for Everyday Purchases: The more you use your rewards card, the more you earn. Consider using it for groceries, gas, and other regular expenses.

- Stay Informed About Promotions: Credit card companies often run promotions that offer additional rewards for specific purchases. Keeping an eye on these can help you earn more.

Common Mistakes to Avoid

While rewards credit cards can offer significant benefits, there are some common pitfalls to avoid:

- Ignoring the Annual Fee: Some cards come with high annual fees that may outweigh the benefits of the rewards. Always calculate if the rewards you earn justify the cost.

- Focusing Solely on Rewards: It's essential to consider the overall benefits of the card, including interest rates and fees, not just the rewards.

- Not Redeeming Rewards on Time: Many rewards have expiration dates. Make sure to redeem your rewards before they expire to maximize your benefits.

Final Thoughts

In conclusion, choosing the best rewards credit card depends on your financial habits and lifestyle. By understanding the various types of rewards, selecting the right card, and employing strategies to maximize your benefits, you can enhance your overall financial health. Always read the fine print and keep track of your spending to ensure that you are getting the most out of your rewards credit card.

Remember, the key to maximizing your benefits lies in knowing how to leverage the rewards system effectively. With the right approach, you can enjoy perks that align with your spending habits and lifestyle preferences.

Explore

How Travel Credit Cards Can Maximize Your Rewards

Building Credit from Scratch: Cards Designed for Beginners

How to Pick the Best Credit Card in 2025

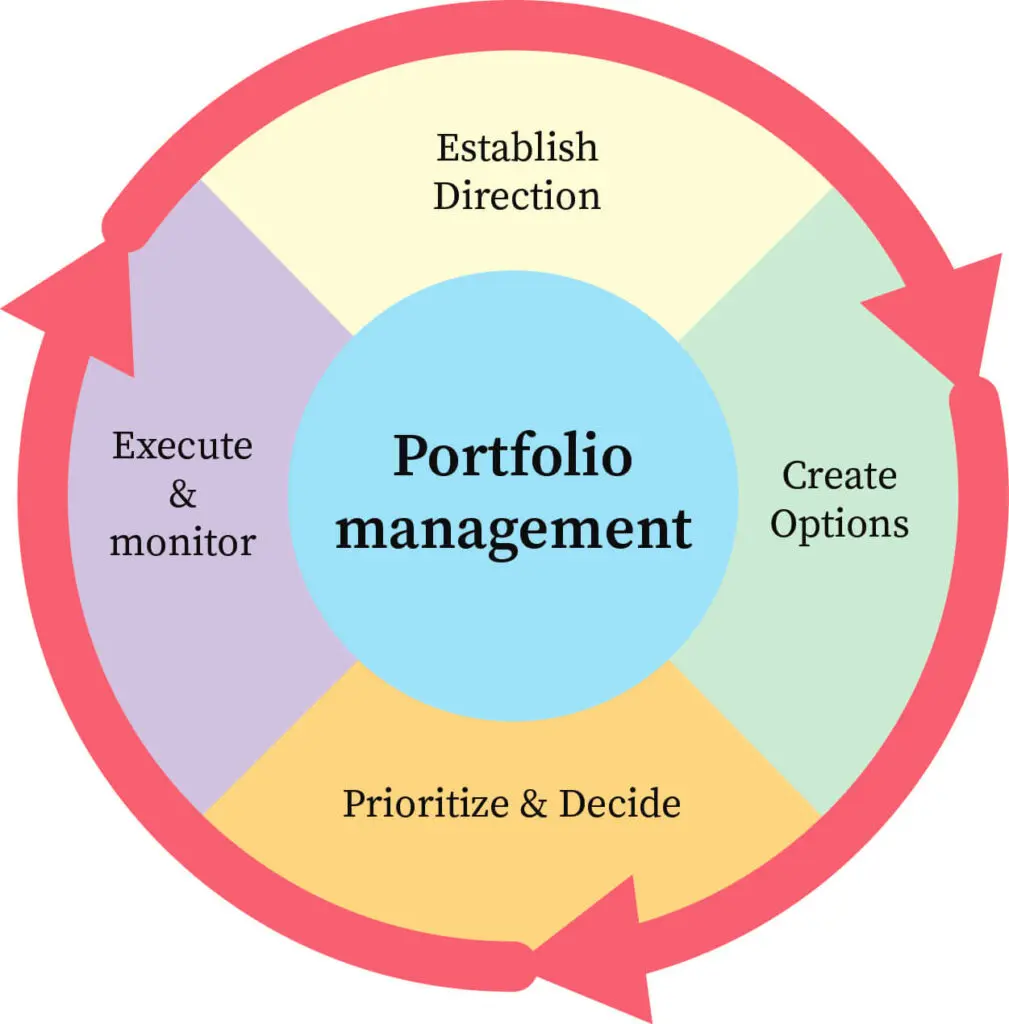

How to Choose the Right Portfolio Management Software for Your Business

Is It Time to Replace Your Roof? 7 Signs to Watch For

How to Choose the Right Fund Manager Software for Your Investment Firm

Online MHA Programs That Fit Your Busy Schedule

How to Choose a Cloud Backup Service That Truly Protects Your Data