Investing in ETFs: 2025 Strategies and Tips

Investing in ETFs in 2025 requires understanding market trends and diversification strategies. Consider focusing on sectors poised for growth, such as technology and renewable energy. Utilize low-cost ETF options to maximize returns while minimizing fees. Regularly review your portfolio and stay informed about economic indicators to make informed decisions when trading ETFs. Embrace a long-term perspective for optimal results.

Exchange-Traded Funds (ETFs) have gained immense popularity among investors due to their flexibility, diversity, and cost-effectiveness. As we move towards 2025, understanding the landscape of ETF investments is crucial for maximizing your portfolio's potential. In this article, we will explore effective strategies and tips for investing in ETFs, ensuring that you are well-prepared for the future.

Understanding ETF Basics

Before diving into advanced strategies, it's essential to grasp the fundamental characteristics of ETFs. An ETF is a marketable security that tracks an index, commodity, or a basket of assets, allowing investors to buy shares that represent a portion of the underlying assets. One of the key factors that set ETFs apart from mutual funds is their ability to be traded on stock exchanges like individual stocks, providing real-time pricing and liquidity.

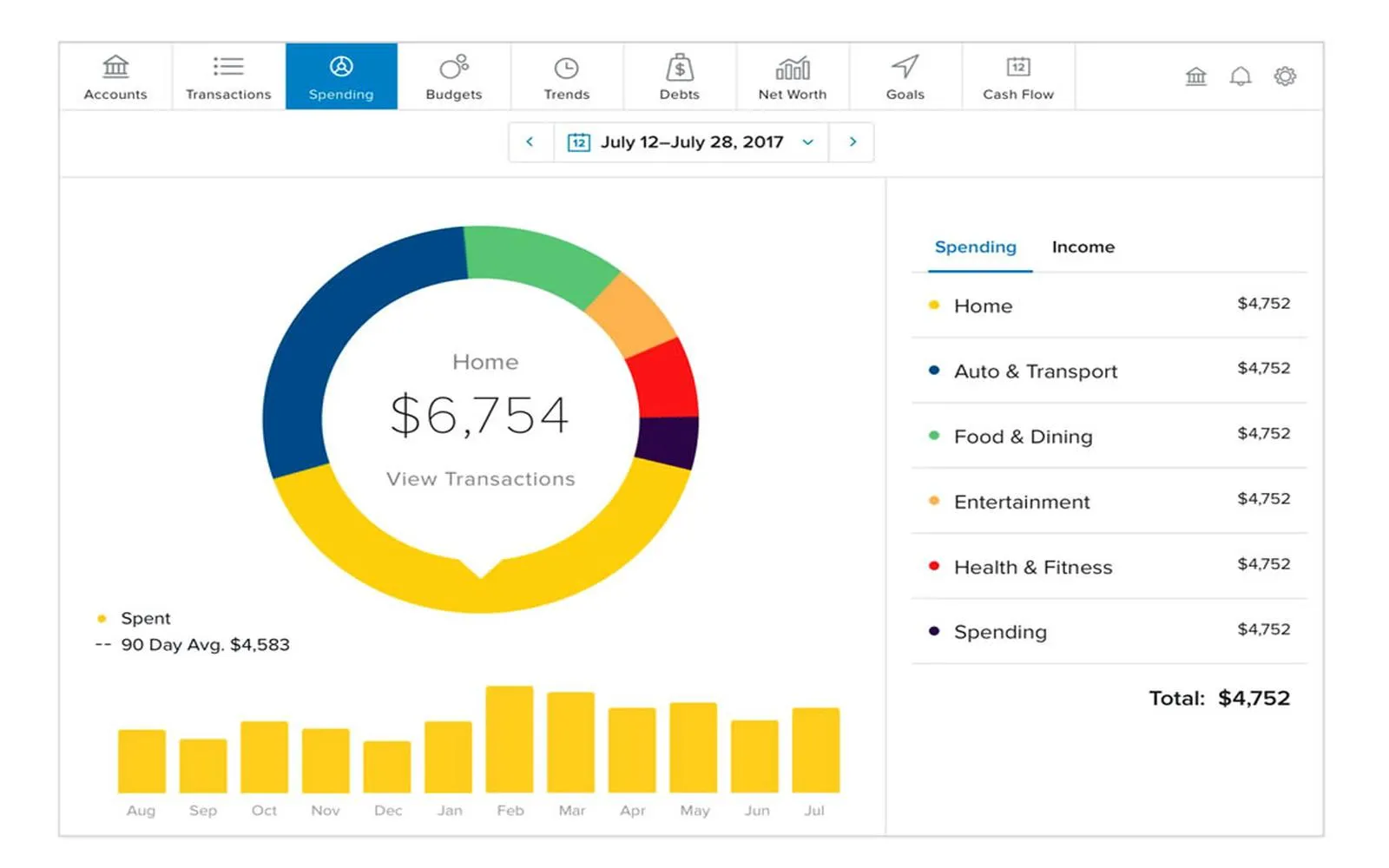

Diversification in Your ETF Portfolio

One of the primary advantages of investing in ETFs is the built-in diversification they offer. By investing in a single ETF, you can gain exposure to a broad range of assets, reducing the overall risk associated with your investment. For 2025, consider diversifying your portfolio across various sectors and asset classes. Below is a sample allocation strategy:

| Asset Class | Percentage Allocation |

|---|---|

| Equity ETFs | 40% |

| Bond ETFs | 30% |

| Commodity ETFs | 15% |

| International ETFs | 15% |

This allocation allows you to balance risk and potential returns while taking advantage of various market conditions.

Choosing the Right ETFs

With thousands of ETFs available, selecting the right ones for your portfolio can be daunting. Here are some key factors to consider when choosing ETFs:

- Expense Ratios: Look for ETFs with low expense ratios to keep your investment costs down. Lower fees can significantly impact your long-term returns.

- Performance History: Analyze the historical performance of the ETF compared to its benchmark index. While past performance is not indicative of future results, consistent performance can be a good sign.

- Liquidity: Ensure the ETF has sufficient trading volume. Higher liquidity typically means tighter bid-ask spreads, reducing trading costs.

- Tracking Error: This measures how closely an ETF follows its benchmark. A low tracking error indicates that the ETF effectively replicates the performance of its index.

Utilizing Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money in ETFs at regular intervals, regardless of market conditions. This approach can reduce the impact of volatility and lower your average cost per share over time. As you plan for 2025, consider implementing DCA to build your ETF positions gradually and reduce the emotional stress that often accompanies investing.

Tax Efficiency and Tax-Loss Harvesting

One of the significant benefits of investing in ETFs is their tax efficiency. Unlike mutual funds, ETFs are structured in a way that minimizes capital gains distributions. However, it’s still essential to be mindful of your tax situation. Consider employing tax-loss harvesting, a strategy that involves selling underperforming investments to offset capital gains. This can be particularly effective in managing your tax liability as you grow your ETF portfolio.

Staying Informed and Adapting to Change

The financial landscape is constantly evolving, and staying informed about market trends and economic indicators is critical for ETF investors. As we approach 2025, consider subscribing to financial news platforms, following reputable investment blogs, and joining investment communities. This will help you adapt your strategies as needed and stay ahead of potential market shifts.

Final Thoughts on ETF Investing in 2025

Investing in ETFs offers a unique opportunity to enhance your investment portfolio with diversification, cost-effectiveness, and flexibility. By implementing the strategies and tips discussed in this article, you can position yourself for success in the evolving investment landscape of 2025. Remember to regularly review your portfolio, stay informed, and adjust your strategies as necessary to align with your financial goals.

As you embark on your ETF investment journey, keep in mind that patience and discipline are key. With the right approach, you can harness the power of ETFs to achieve your financial objectives.

Explore

Strategies for Tax-Efficient Investing in 2025

Best Fund Management Software for Smart Investing

Top Online Advertising Strategies for Small Businesses in 2025

Currency Hedging Strategies for Investors in 2025

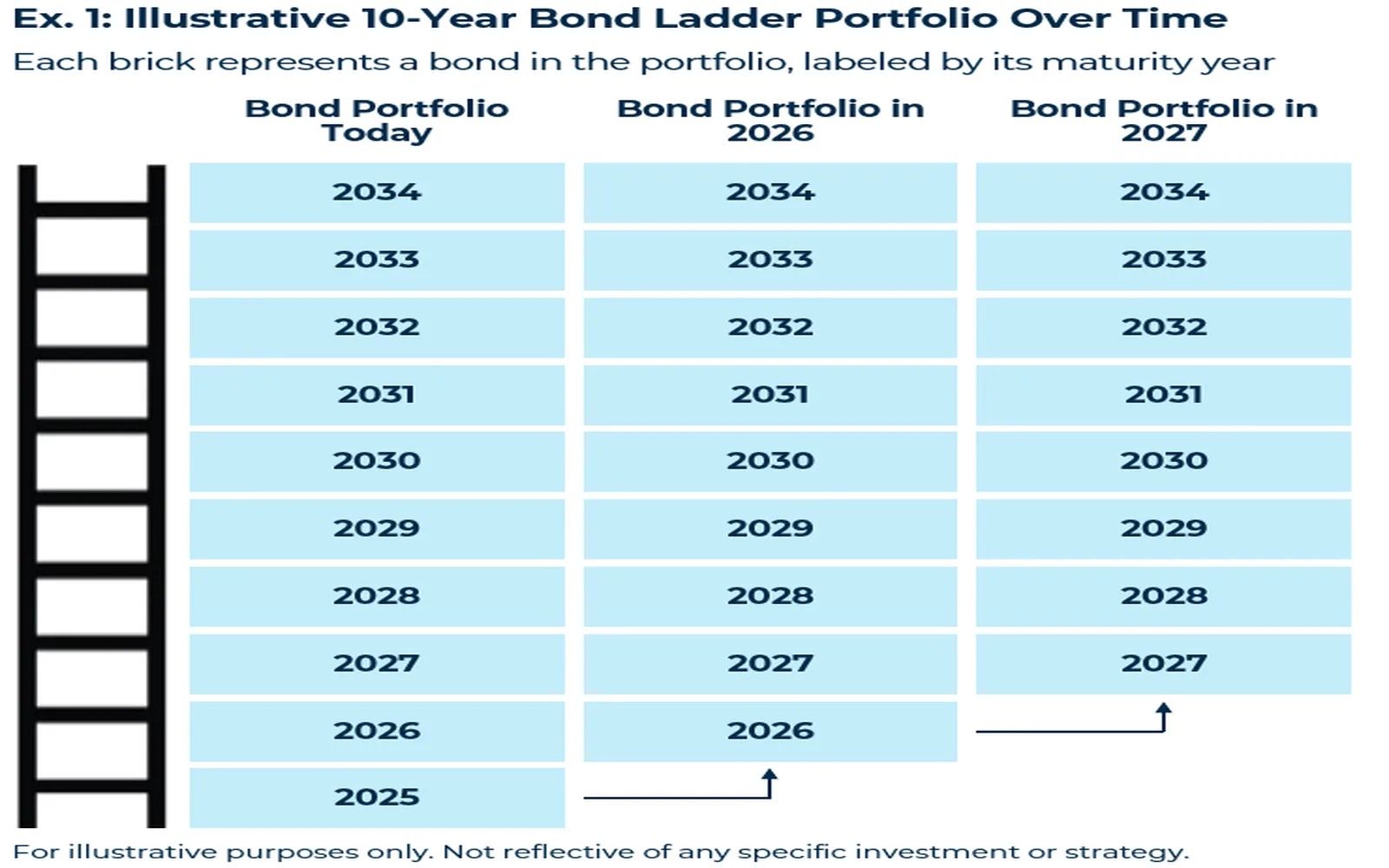

2025 Bond Laddering Tips for Income & Risk Control

Insider Tips for the Best Cruise Deals

Finance Tips to Secure Your Future in 2025

Financial Planning Tips to Secure Your 2025 Goals