Strategies for Tax-Efficient Investing in 2025

In 2025, implementing effective strategies for tax-efficient investing is crucial for maximizing returns. Investors should consider utilizing tax-advantaged accounts, focusing on long-term capital gains, and employing tax-loss harvesting techniques. Additionally, diversifying investments across various asset classes and leveraging municipal bonds can further enhance tax-efficient investing. Staying informed about changes in tax laws will also play a vital role in optimizing your portfolio's performance.

Introduction

As we move into 2025, tax-efficient investing continues to be a critical consideration for individuals aiming to maximize their returns while minimizing their tax liabilities. With changing tax laws, evolving investment products, and increasing financial literacy among investors, it’s essential to adopt strategies that enhance after-tax returns. This article delves into various strategies for tax-efficient investing that can be employed in 2025, ensuring that investors are well-equipped to navigate the complexities of the tax landscape.

Understanding Tax Efficiency

Tax efficiency in investing refers to the practice of structuring investments in a way that minimizes the impact of taxes on returns. This involves considering the types of accounts in which investments are held, the choice of investment vehicles, the timing of asset sales, and the tax implications of income generated from investments. Achieving tax efficiency can lead to greater wealth accumulation over time, as taxes can significantly erode investment gains.

Utilizing Tax-Advantaged Accounts

One of the most effective strategies for tax-efficient investing is to make full use of tax-advantaged accounts. In 2025, options such as Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), and 401(k) plans remain pivotal. Contributions to these accounts often provide immediate tax benefits, such as tax deductions or tax-free growth.

For example, traditional IRAs allow individuals to deduct contributions from their taxable income, while Roth IRAs provide tax-free withdrawals in retirement. HSAs, on the other hand, enable individuals to save for medical expenses with triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Maximizing contributions to these accounts is a fundamental step in tax-efficient investing.

Asset Location Strategy

Asset location involves strategically placing investments in the most tax-efficient accounts. Generally, investments that generate high taxable income, such as bonds and real estate investment trusts (REITs), should be held in tax-advantaged accounts, while investments with lower tax implications, like stocks that are expected to appreciate over the long term, can be placed in taxable accounts. This strategy helps to shield high-income-generating assets from immediate taxation, allowing them to grow more effectively over time.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling investments that have declined in value to offset gains realized from other investments. This practice can help investors reduce their taxable income. In 2025, investors should consider monitoring their portfolios regularly for opportunities to realize losses strategically. It’s important to be aware of the “wash sale rule,” which disallows the deduction of a loss if the same or substantially identical security is repurchased within 30 days.

Long-Term Investing and Holding Periods

Holding investments for the long term can significantly enhance tax efficiency. In 2025, the long-term capital gains tax rates remain lower than short-term rates, incentivizing investors to hold their assets for at least one year before selling. This approach not only reduces the tax burden but also aligns with sound investment principles, allowing for potential capital appreciation.

Qualified Dividends and Capital Gains

Investors should aim to invest in assets that generate qualified dividends and long-term capital gains, as these are taxed at lower rates compared to ordinary income. In the current tax landscape, qualified dividends are typically taxed at 0%, 15%, or 20%, depending on the taxpayer’s income level. Investors in 2025 should consider dividend-paying stocks or funds that focus on growth and income to optimize their tax situations.

Municipal Bonds as a Tax-Efficient Option

Municipal bonds continue to be a popular choice for tax-efficient investing. The interest earned on these bonds is generally exempt from federal income tax and, in some cases, state and local taxes as well. In 2025, investors should evaluate municipal bonds as a viable option for diversifying their portfolios while enjoying tax benefits. They are especially appealing for high-income earners seeking to reduce their tax liabilities.

Consideration of Tax Bracket Management

Effective tax-efficient investing requires a deep understanding of one’s tax bracket. In 2025, individuals should be mindful of their income levels and the corresponding tax implications of their investment decisions. Strategic withdrawals from retirement accounts, timing the sale of assets, and managing capital gains can help investors remain in lower tax brackets, thereby minimizing their overall tax burden.

Investing in Index Funds and ETFs

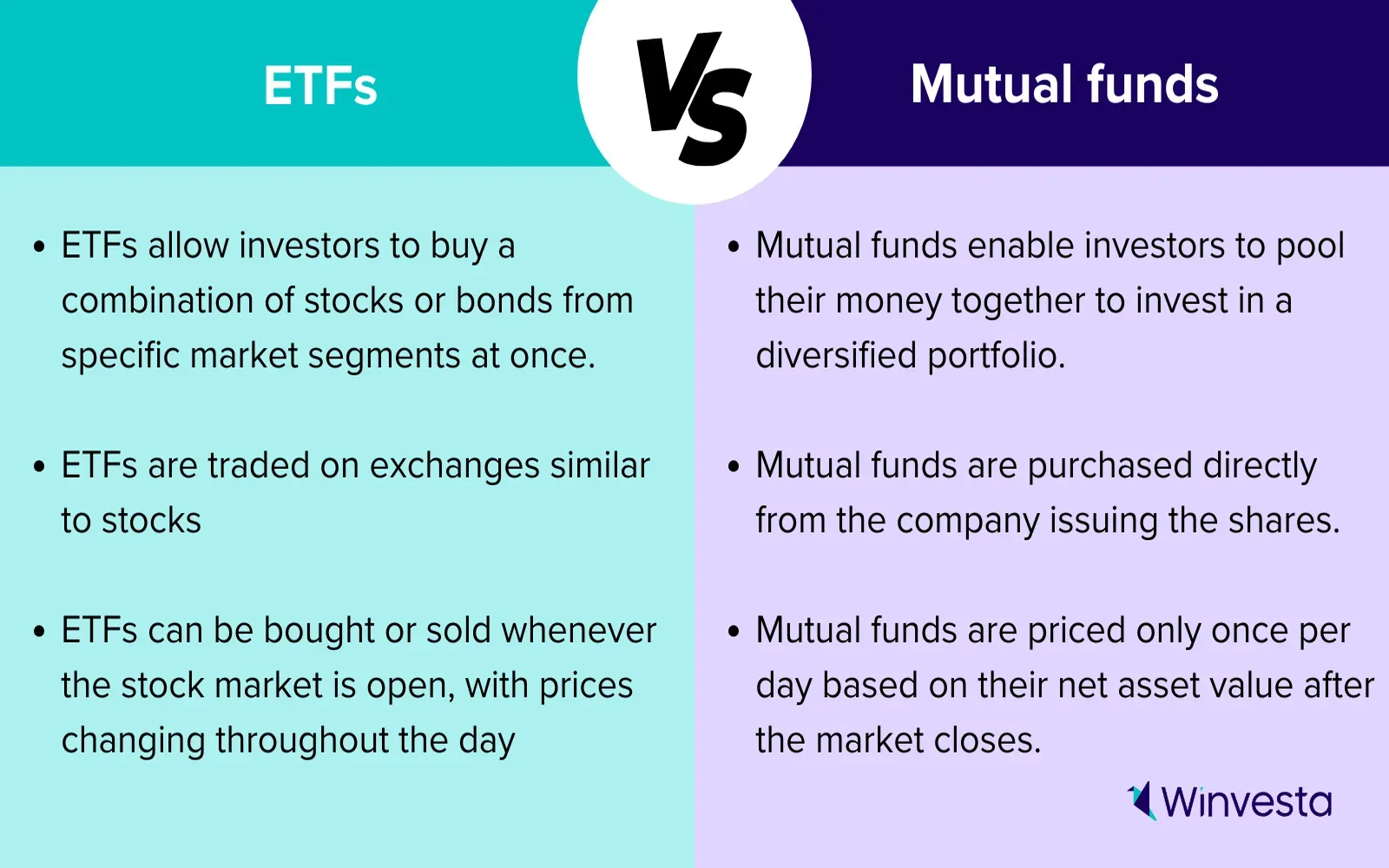

Index funds and exchange-traded funds (ETFs) are often more tax-efficient than actively managed funds due to their lower turnover rates. In 2025, investors should consider these investment vehicles as they typically generate fewer taxable events, resulting in lower tax liabilities. Additionally, ETFs provide the flexibility of intraday trading, allowing investors to strategically manage their portfolios while being mindful of tax implications.

Roth Conversions

For those who expect to be in a higher tax bracket in the future, converting traditional retirement accounts to Roth accounts can be a wise strategy. In 2025, individuals should assess their current and projected tax situations to determine if a Roth conversion makes sense. By paying taxes on the converted amount now, investors can enjoy tax-free withdrawals in retirement, potentially saving on taxes in the long run.

Regular Portfolio Review and Rebalancing

Regularly reviewing and rebalancing a portfolio is crucial for maintaining tax efficiency. In 2025, investors should conduct periodic assessments of their investment holdings to ensure they align with their financial goals and risk tolerance. Rebalancing may involve selling off assets that have performed well, leading to capital gains. Timing these transactions strategically and considering tax implications can help minimize the tax impact.

Utilizing Professional Guidance

Given the complexities of tax laws and investment strategies, seeking professional guidance from a certified financial planner or tax advisor can be invaluable. In 2025, investors should consider working with professionals who can provide personalized advice tailored to their unique financial situations and goals. A knowledgeable advisor can help identify tax-efficient investment opportunities and strategies that align with an investor’s overall financial plan.

Conclusion

As we navigate the investment landscape in 2025, adopting tax-efficient strategies is essential for maximizing returns and minimizing tax liabilities. By utilizing tax-advantaged accounts, implementing asset location strategies, engaging in tax-loss harvesting, and considering the tax implications of investment choices, investors can optimize their portfolios for tax efficiency. It is crucial to stay informed about changes in tax laws and to adapt investment strategies accordingly. With thoughtful planning and execution, investors can achieve their financial goals while minimizing the impact of taxes on their investment returns.

Explore

Top DUI Defense Strategies Every Driver Should Know

Investing in ETFs: 2025 Strategies and Tips

Hybrid Crossover SUVs 2025: The Smart Choice for Efficient and Versatile Driving

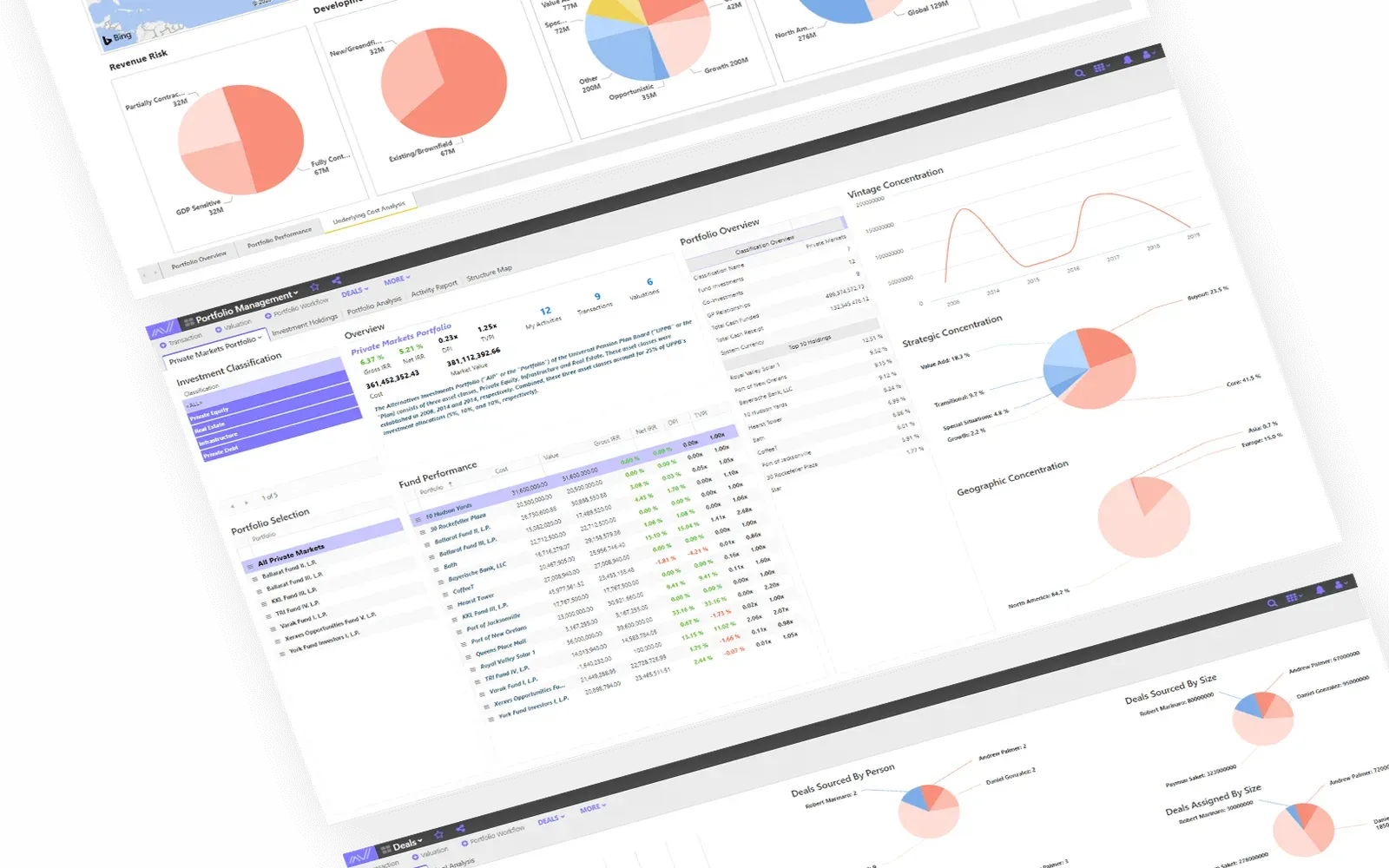

Best Fund Management Software for Smart Investing

Top Online Advertising Strategies for Small Businesses in 2025

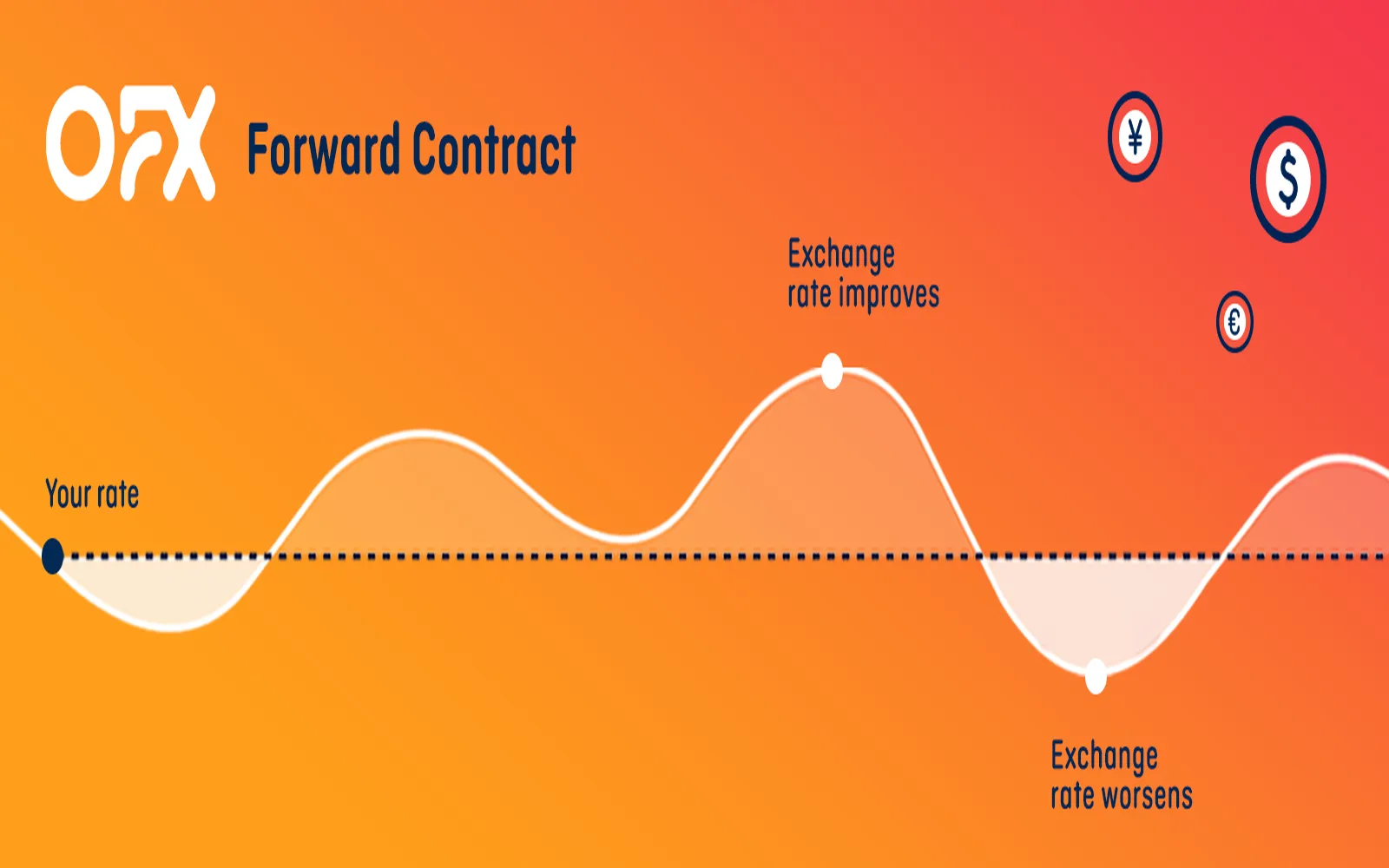

Currency Hedging Strategies for Investors in 2025

Top Online Therapy Platforms for Depression Support

Mesothelioma Treatment Options: What Patients Need to Know