2025 Bond Laddering Tips for Income & Risk Control

Building a successful bond ladder in 2025 requires strategic planning for income and risk control. Start by selecting diverse maturities to minimize interest rate risk. Regularly reinvest maturing bonds to maintain your ladder's structure. Monitor market conditions and adjust your bond selections as needed, ensuring your portfolio remains balanced and aligned with your income goals.

Bond laddering is a popular investment strategy that allows investors to manage interest rate risk while generating a steady income. By investing in bonds with different maturities, a bond laddering strategy helps to optimize returns and control risk. In this article, we will explore effective bond laddering tips for 2025, focusing on income generation and risk management.

Understanding Bond Laddering

Bond laddering involves purchasing bonds that mature at staggered intervals, creating a “ladder” of bonds to ensure that some investments mature regularly. This strategy provides liquidity and reduces the impact of interest rate fluctuations on your investment portfolio. As bonds mature, investors can reinvest the principal into new bonds at potentially higher rates, thus maximizing income opportunities over time.

Benefits of Bond Laddering

Implementing a bond ladder strategy offers several advantages:

- Income Stability: Regular bond maturities provide a steady income stream, making it easier to manage cash flow needs.

- Risk Mitigation: Staggering maturities helps to spread out interest rate risk, reducing the impact of rising rates on the overall portfolio.

- Flexibility: Investors can adjust their portfolios by reinvesting matured bonds or changing investment strategies based on market conditions.

Creating Your Bond Ladder

When constructing a bond ladder, consider the following tips:

1. Determine Your Investment Horizon

Before you start investing in bonds, assess your financial goals and investment horizon. A bond ladder should align with your cash flow needs and the time frame for your financial objectives. For example, if you require income in the short term, focus on shorter maturities within your ladder.

2. Select Appropriate Bond Types

Choose a mix of bond types to enhance your ladder's performance. Some options include:

- Government Bonds: Generally considered safe, they offer lower yields but provide stability.

- Corporate Bonds: Typically yield higher returns, but they come with increased risk. Diversifying across various sectors can help mitigate this risk.

- Muni Bonds: Municipal bonds offer tax advantages, making them appealing for investors in higher tax brackets.

3. Diversify Across Maturities

To maximize returns and minimize risk, ensure that your ladder includes bonds with varying maturities. A typical ladder might include bonds maturing in one, three, five, seven, and ten years. This diversification allows you to benefit from different interest rate environments while ensuring that some of your bonds are maturing regularly.

Monitoring and Adjusting Your Ladder

Once your bond ladder is established, it’s essential to monitor its performance and make adjustments as necessary. Here are some key factors to consider:

1. Interest Rate Environment

Interest rates are subject to fluctuations based on economic conditions. If rates rise, consider reinvesting maturing bonds into longer-term bonds to lock in higher yields. Conversely, if rates fall, maintaining shorter maturities may be beneficial.

2. Credit Quality

Keep an eye on the credit ratings of the bonds in your ladder. If a bond’s credit quality deteriorates, it may be prudent to sell it and reinvest in a more stable option. This proactive approach can help protect your income and reduce risk.

Tax Considerations for Bond Investors

Tax implications can significantly impact your investment returns. Here are some tips to maximize after-tax income:

1. Understand Taxable vs. Tax-Exempt Bonds

Government bonds are typically subject to federal taxes, while municipal bonds may offer tax-exempt income at the federal and sometimes state levels. Assess your tax situation to determine which bond type is more advantageous for your portfolio.

2. Utilize Tax-Advantaged Accounts

Consider holding taxable bonds in tax-advantaged accounts, such as IRAs or 401(k)s, to defer taxes on interest income. This can enhance your overall returns and provide greater flexibility in managing your investment strategy.

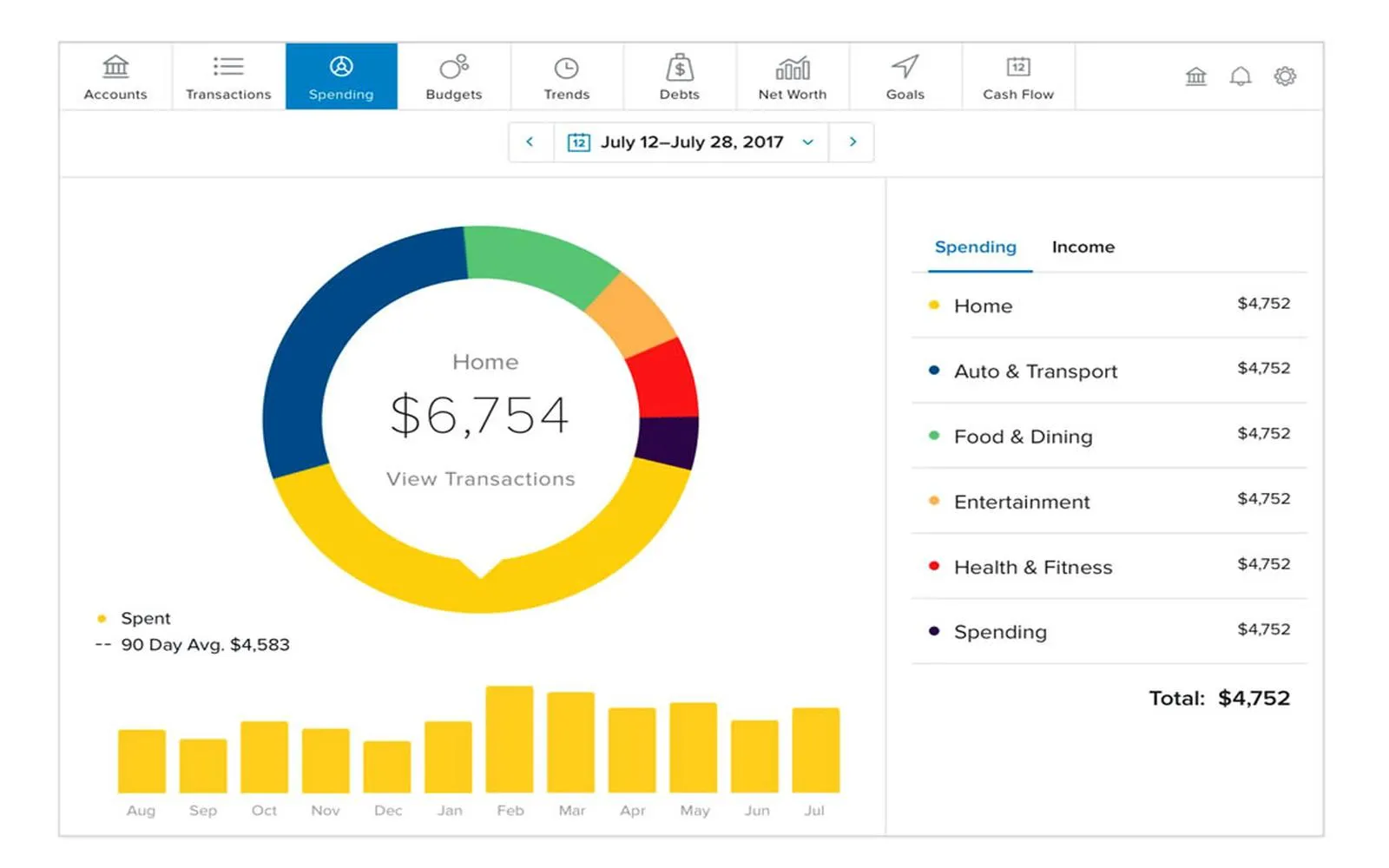

Using Technology for Bond Laddering

In today's digital age, leveraging technology can enhance your bond laddering strategy. Various investment platforms and tools can assist in monitoring your portfolio, analyzing bond performance, and providing real-time data on market conditions.

Consider using bond ladder calculators available online to visualize your ladder structure and potential income. These tools can help you assess the impact of different interest rate scenarios and make informed investment decisions.

Conclusion

Implementing a bond ladder strategy can provide a reliable income stream while controlling risk in an unpredictable interest rate environment. By following these tips, you can construct an effective bond ladder that aligns with your financial goals. Remember to stay informed and be prepared to adjust your strategy as market conditions evolve. With careful planning and management, bond laddering can be an ideal addition to your investment portfolio in 2025 and beyond.

Explore

Finfluencers in 2025: Risk-Takers or Financial Educators?

Insider Tips for the Best Cruise Deals

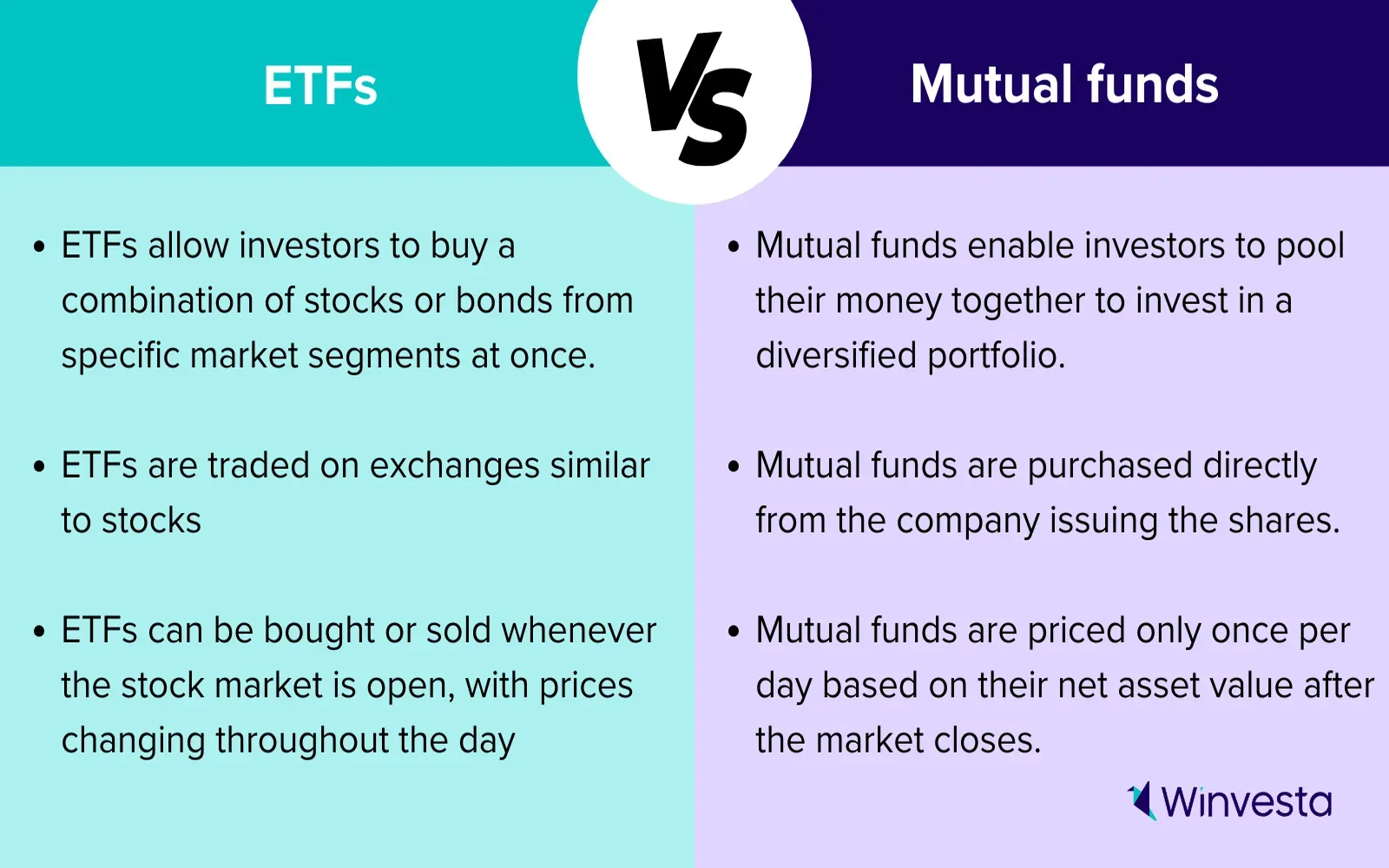

Investing in ETFs: 2025 Strategies and Tips

Finance Tips to Secure Your Future in 2025

Financial Planning Tips to Secure Your 2025 Goals

Top Online Therapy Platforms for Depression Support

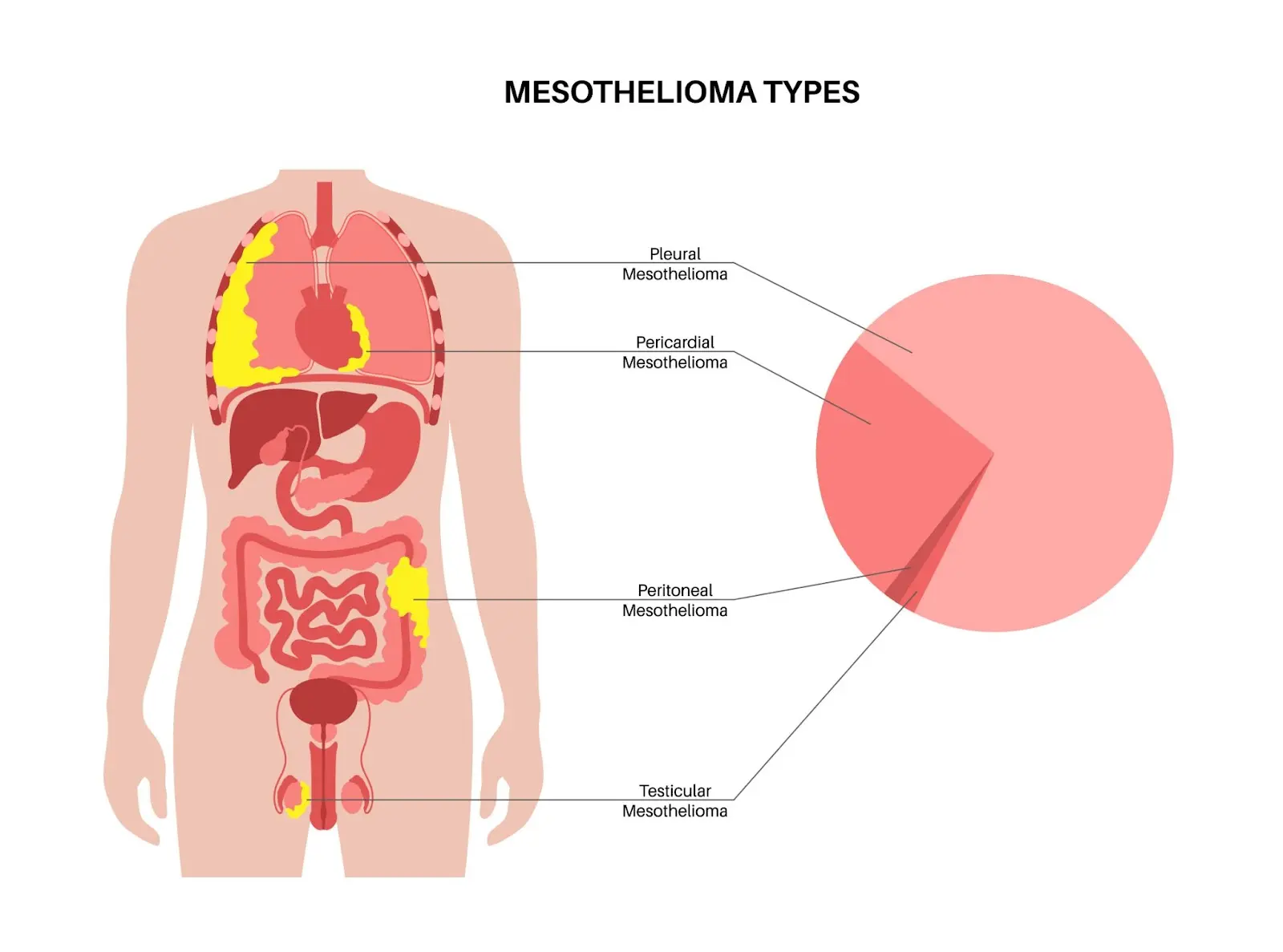

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide