Financial Planning Tips to Secure Your 2025 Goals

Achieving your financial goals for 2025 requires careful planning. Start by setting clear, measurable objectives and creating a realistic budget. Prioritize building an emergency fund and consider investing in diverse assets to grow your wealth. Regularly review your financial progress, adjusting your strategies as needed, and seek advice from financial professionals to optimize your financial health.

As we approach 2025, it’s crucial to start thinking about your financial future and how to achieve your goals. Proper financial planning can make a significant difference in your ability to meet both short-term and long-term objectives. Below, we’ll explore some essential tips to help you secure your financial goals for 2025.

1. Define Your Financial Goals

The first step in effective financial planning is to clearly define your goals. Whether you want to save for a house, retirement, or your child’s education, knowing what you are aiming for is crucial. Make your goals SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying, “I want to save money,” specify, “I want to save $20,000 for a down payment on a house by the end of 2025.”

2. Create a Budget

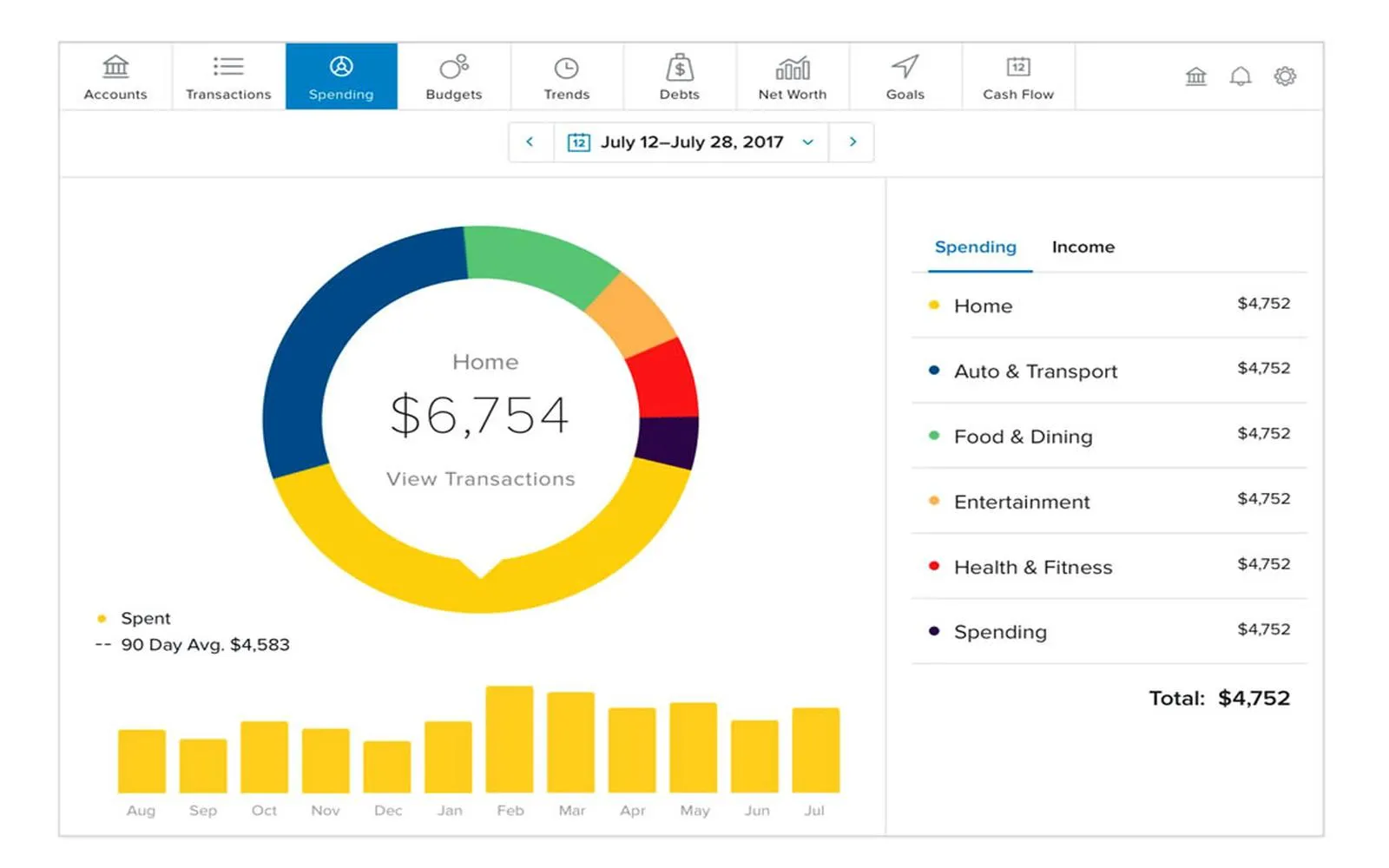

Budgeting is a fundamental aspect of financial planning. To create a budget, start by tracking your income and expenses for a month. This will help you identify areas where you can cut back and allocate more funds toward your financial goals. Use budgeting tools or apps to streamline the process and stay organized. Remember, the more you know about your spending habits, the better you can control them.

3. Build an Emergency Fund

An essential part of any financial plan is an emergency fund. An unexpected expense can derail your plans if you're not prepared. Aim to save at least three to six months' worth of living expenses in a separate savings account. This fund will give you peace of mind and protect your long-term savings from unforeseen circumstances.

4. Invest Wisely

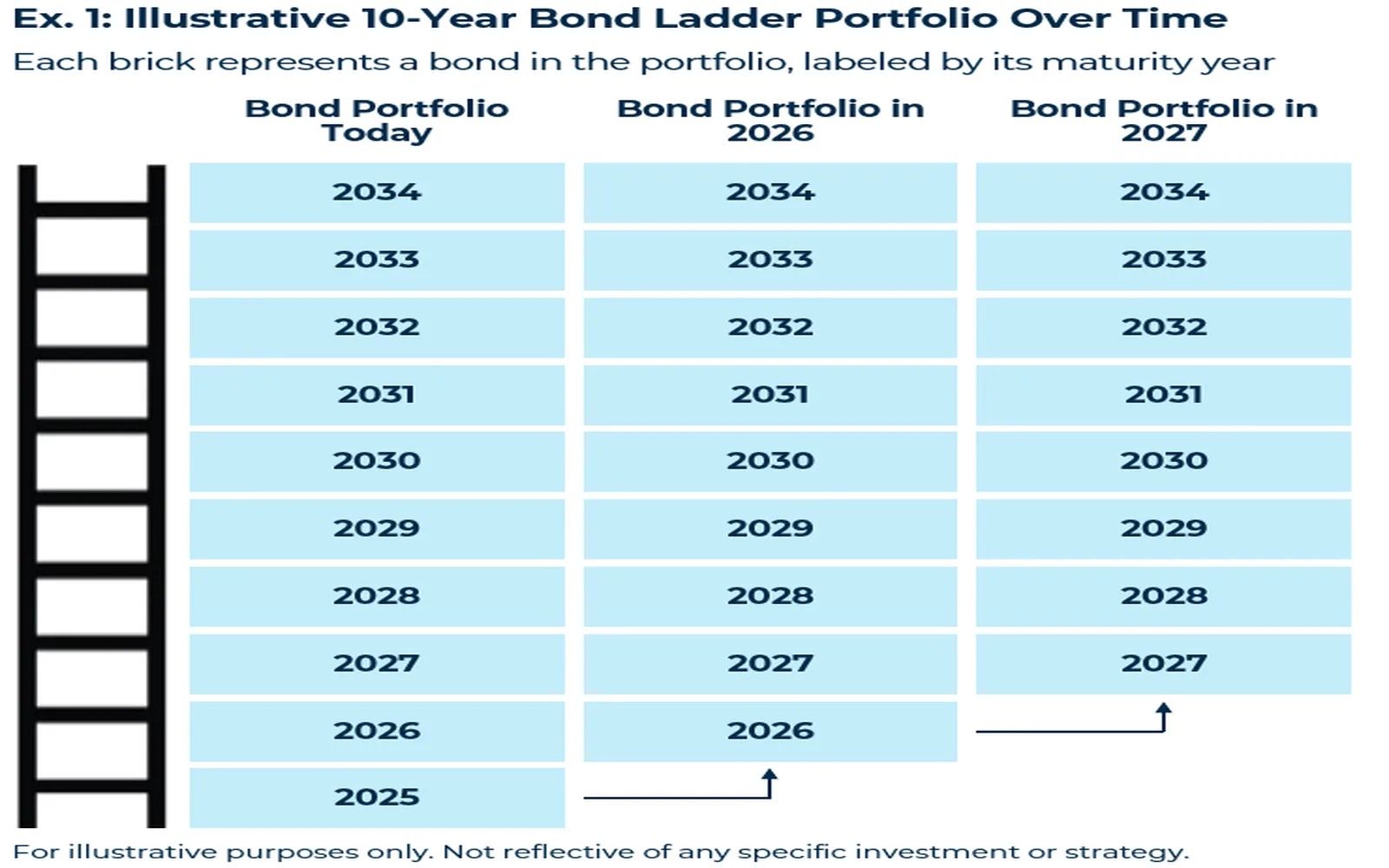

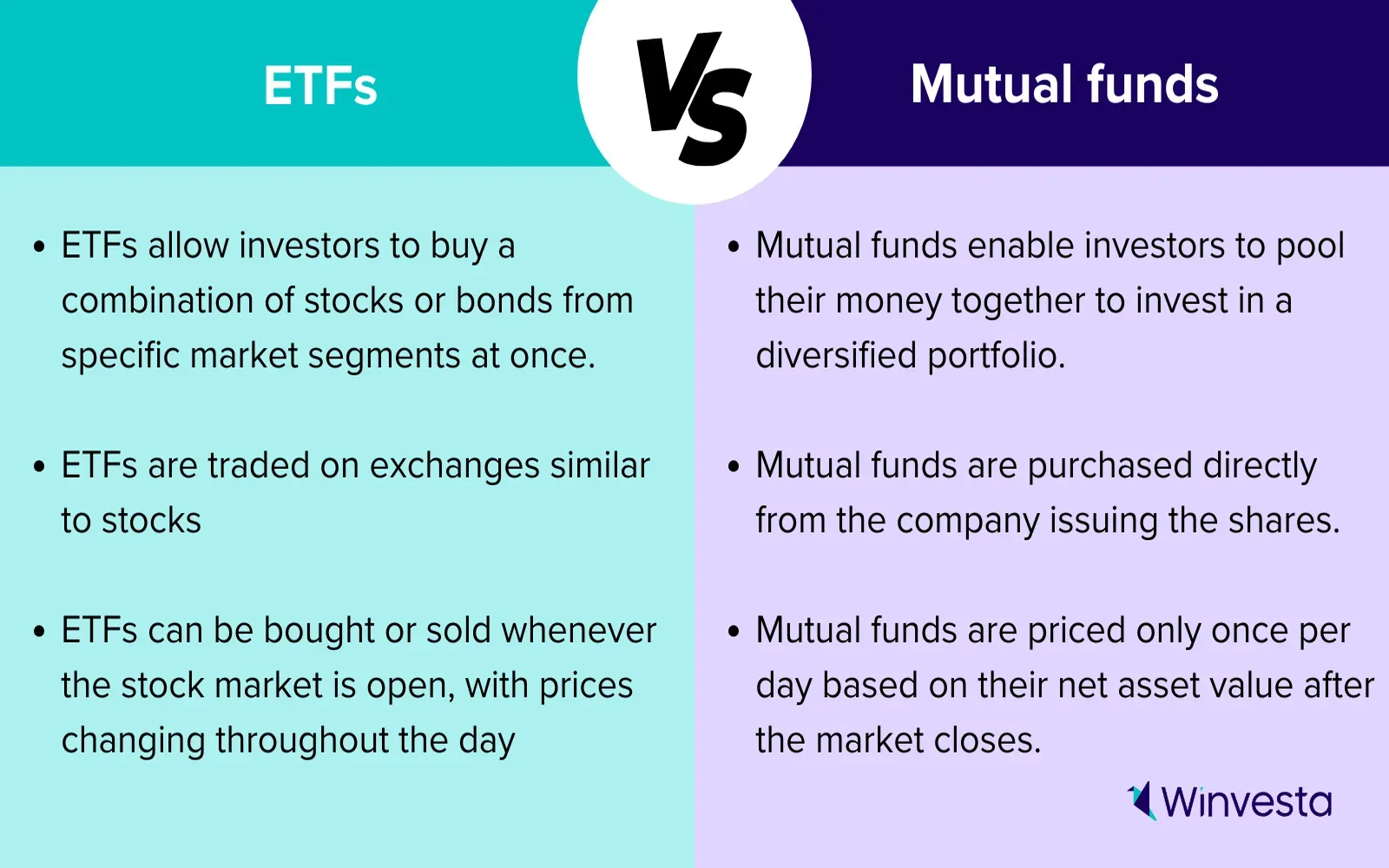

Investing is a key component of financial planning that can help grow your wealth over time. Consider diversifying your investments across various asset classes, including stocks, bonds, and real estate. Understand your risk tolerance and choose investments accordingly. If you're unsure where to start, consult a financial advisor who can guide you based on your goals and financial situation.

5. Monitor Your Progress

Regularly reviewing your financial goals and progress is vital in financial planning. Set aside time each month to assess your budget, savings, and investments. Adjust your strategies if you are falling short of your goals. This ongoing evaluation will help you stay on track and make necessary changes to meet your 2025 objectives.

6. Save for Retirement

It’s never too early to start saving for retirement. Contributing to a retirement account, such as a 401(k) or an IRA, can provide you with tax benefits and help you build a nest egg for the future. Aim to contribute at least 15% of your income towards retirement savings, and consider increasing this percentage as your financial situation improves.

7. Educate Yourself

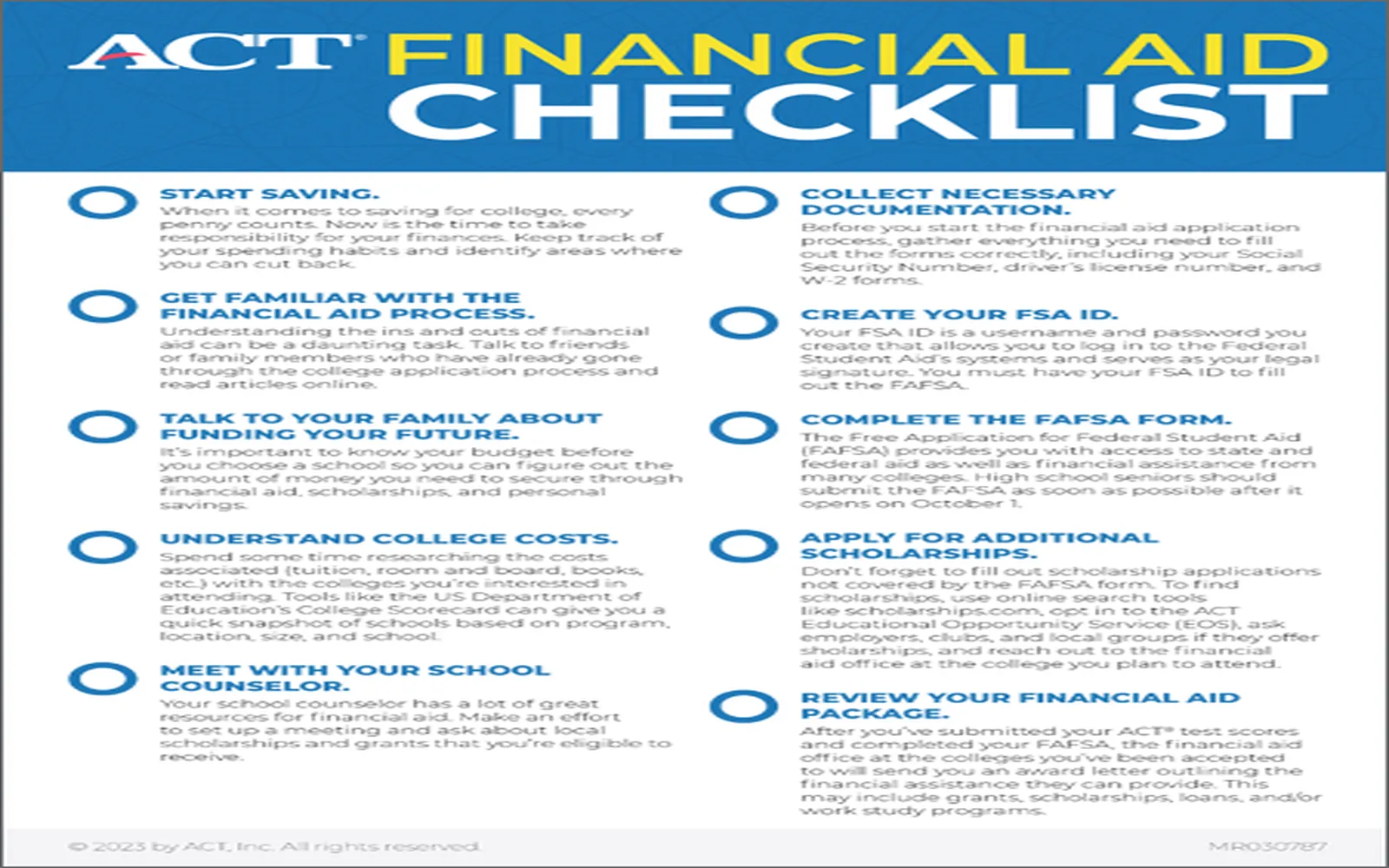

Financial literacy is a crucial aspect of financial planning. Educate yourself about personal finance topics such as investing, taxes, and insurance. There are many resources available, including books, online courses, and seminars. The more you know, the better equipped you will be to make informed financial decisions that align with your goals.

8. Seek Professional Help

If you find yourself overwhelmed or unsure about your financial plan, don’t hesitate to seek professional assistance. A certified financial planner can provide personalized advice and help you create a comprehensive strategy to achieve your goals. They can also offer insights into tax strategies, investment options, and retirement planning.

9. Reduce Debt

High levels of debt can hinder your ability to achieve your financial goals. Focus on paying off high-interest debt first, such as credit cards, while making minimum payments on other debts. Consider consolidating your debts to lower your interest rates, or negotiate with creditors for better terms. Reducing debt should be a priority in your financial planning efforts.

10. Stay Disciplined

Finally, discipline is key to successful financial planning. Stick to your budget, avoid impulse purchases, and stay focused on your long-term goals. It can be tempting to deviate from your plan, especially when faced with short-term desires, but maintaining discipline will ultimately lead you to success in achieving your 2025 objectives.

Conclusion

Securing your financial goals for 2025 requires a combination of careful planning, disciplined saving, and educated investment strategies. By following these tips and regularly monitoring your progress, you’ll be well on your way to achieving the financial stability and success you desire by the end of 2025. Remember, the earlier you start your financial planning, the more likely you are to reach your goals.

Explore

Finance Tips to Secure Your Future in 2025

Event Planning Software for Small Teams: Affordable and Effective Options

How to Choose a Secure Online File Storage Provider

2025 Bond Laddering Tips for Income & Risk Control

Insider Tips for the Best Cruise Deals

Investing in ETFs: 2025 Strategies and Tips

Finfluencers in 2025: Risk-Takers or Financial Educators?

Online Schools That Offer Financial Aid