Finfluencers in 2025: Risk-Takers or Financial Educators?

In 2025, finfluencers have evolved into pivotal figures in the financial landscape. While some continue to thrive as financial educators, providing valuable insights into the stock market, others embrace risk-taking strategies that can lead to significant gains or losses. Balancing entertainment and education, these stock market influencers challenge traditional finance norms, reshaping how individuals approach investing.

The emergence of finfluencers—a blend of finance and influencers—has transformed the landscape of financial education and investment strategies. By 2025, these digital personalities are expected to play an even more significant role in shaping public perception of the stock market. However, the question remains: are they merely risk-takers or genuine financial educators? The answer may vary depending on the individual finfluencer and their approach to sharing financial knowledge.

The Rise of Finfluencers

In recent years, social media platforms have become the breeding ground for stock market influencers. These individuals leverage platforms like Instagram, TikTok, and YouTube to share their investment strategies, stock tips, and financial advice. With the ability to reach a vast audience, finfluencers have attracted both seasoned investors and newcomers to the world of finance. In 2025, we can expect an even more significant influx of these personalities as technology continues to evolve and more people seek financial independence.

Education vs. Entertainment

One of the defining characteristics of finfluencers is their ability to blend education with entertainment. Many of them use humor, relatable stories, and engaging visual content to capture the attention of their followers. This approach can make complex financial concepts more digestible for the average person. However, the line between education and entertainment can sometimes blur, raising concerns about the quality and accuracy of the information being shared.

For example, consider the following table that highlights the differences between educational content and entertainment-focused content in the context of financial advice:

| Aspect | Educational Content | Entertainment-Focused Content |

|---|---|---|

| Purpose | To inform and educate | To engage and entertain |

| Depth of Information | In-depth analysis and research | Surface-level insights and anecdotes |

| Audience Engagement | Encourages critical thinking | Focuses on humor and relatability |

| Long-term Impact | Promotes informed decision-making | May lead to impulsive actions |

As the table illustrates, finfluencers who prioritize education can pave the way for better financial literacy, while those who lean towards entertainment may inadvertently encourage risky behaviors. This dichotomy poses a challenge for followers, who must discern between the two types of content.

The Risks Involved

Investing in the stock market inherently comes with risks, and the influence of finfluencers can amplify these risks. In 2025, the potential for misinformation could lead novice investors to make impulsive decisions based on trends rather than sound financial principles. The popularity of certain stocks, driven by a finfluencer's recommendation, could lead to market volatility and significant losses for unprepared investors.

Moreover, the regulatory landscape surrounding finfluencers remains murky. As more individuals turn to social media for financial advice, there is a growing call for clearer regulations to protect investors from fraudulent claims. The lack of oversight means that not all finfluencers have the necessary qualifications to provide financial advice, further complicating the situation.

Building Trust and Credibility

For finfluencers to be seen as genuine financial educators, they must prioritize transparency and accountability. Establishing trust is crucial in an industry where misinformation can lead to financial ruin. In 2025, we may see a shift towards finfluencers who are willing to disclose their qualifications, investment strategies, and even past mistakes. This transparency can foster a more informed community of investors.

Additionally, collaborations with certified financial planners and educational institutions could bolster the credibility of these influencers. By aligning with experts in the field, finfluencers can enhance their content's reliability and provide followers with well-rounded financial education.

The Future of Finfluencers: A Balanced Approach

As we look towards 2025, the role of stock market influencers will likely continue to evolve. A balanced approach that combines entertainment with credible financial education may emerge as the ideal model for finfluencers. This approach not only engages the audience but also equips them with the necessary tools to make informed investment decisions.

Furthermore, as financial literacy becomes increasingly important, the demand for reliable and trustworthy sources of information will grow. Finfluencers who prioritize education over sensationalism may find themselves at the forefront of this movement, reshaping how individuals engage with the stock market.

Conclusion

In conclusion, finfluencers in 2025 will represent a pivotal force in the financial landscape. Whether they are viewed as risk-takers or financial educators largely depends on their approach to content creation and the responsibility they take in guiding their followers. As the financial world continues to change, the onus will be on both the influencers and their audiences to navigate the complexities of investment wisely.

Explore

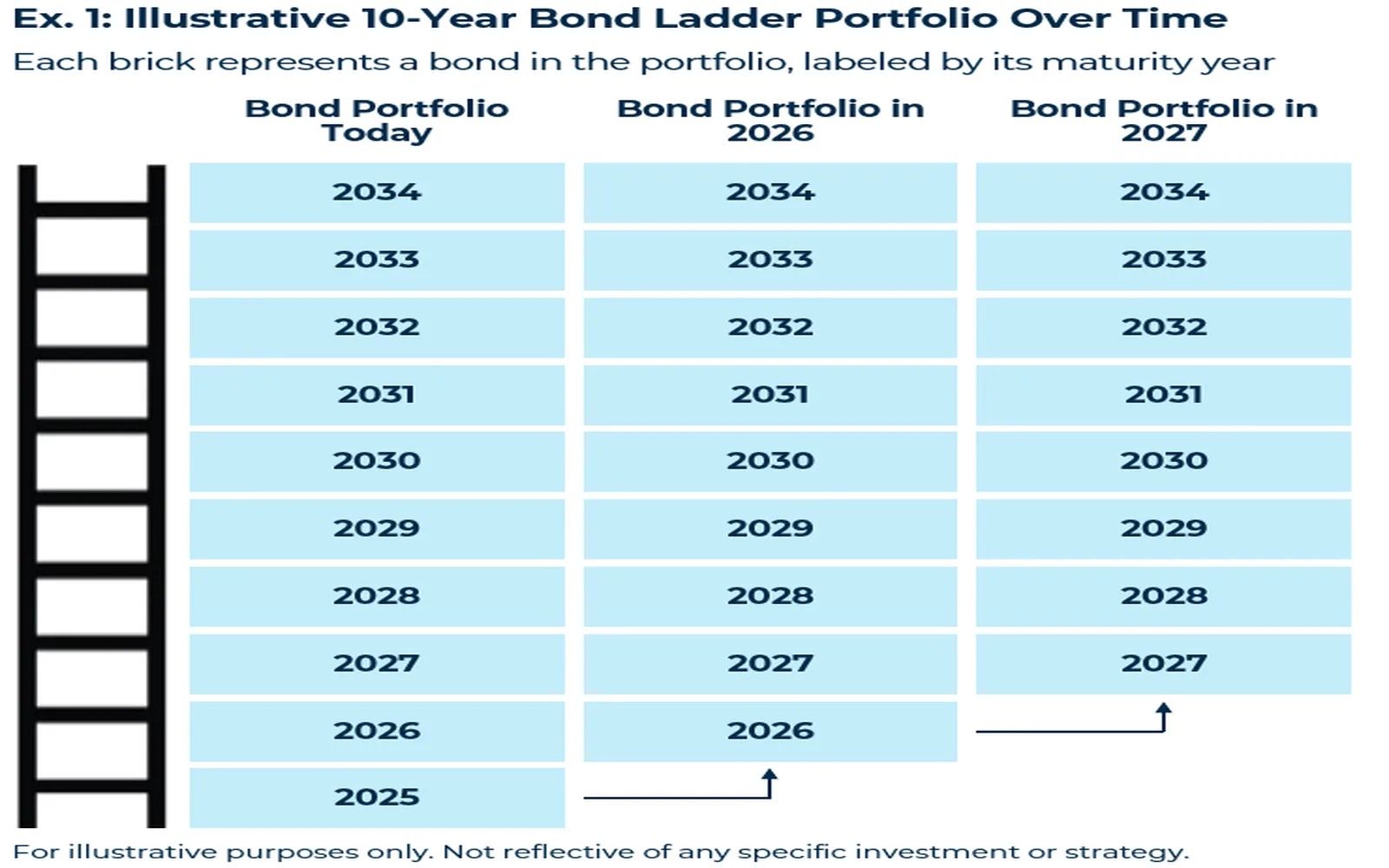

2025 Bond Laddering Tips for Income & Risk Control

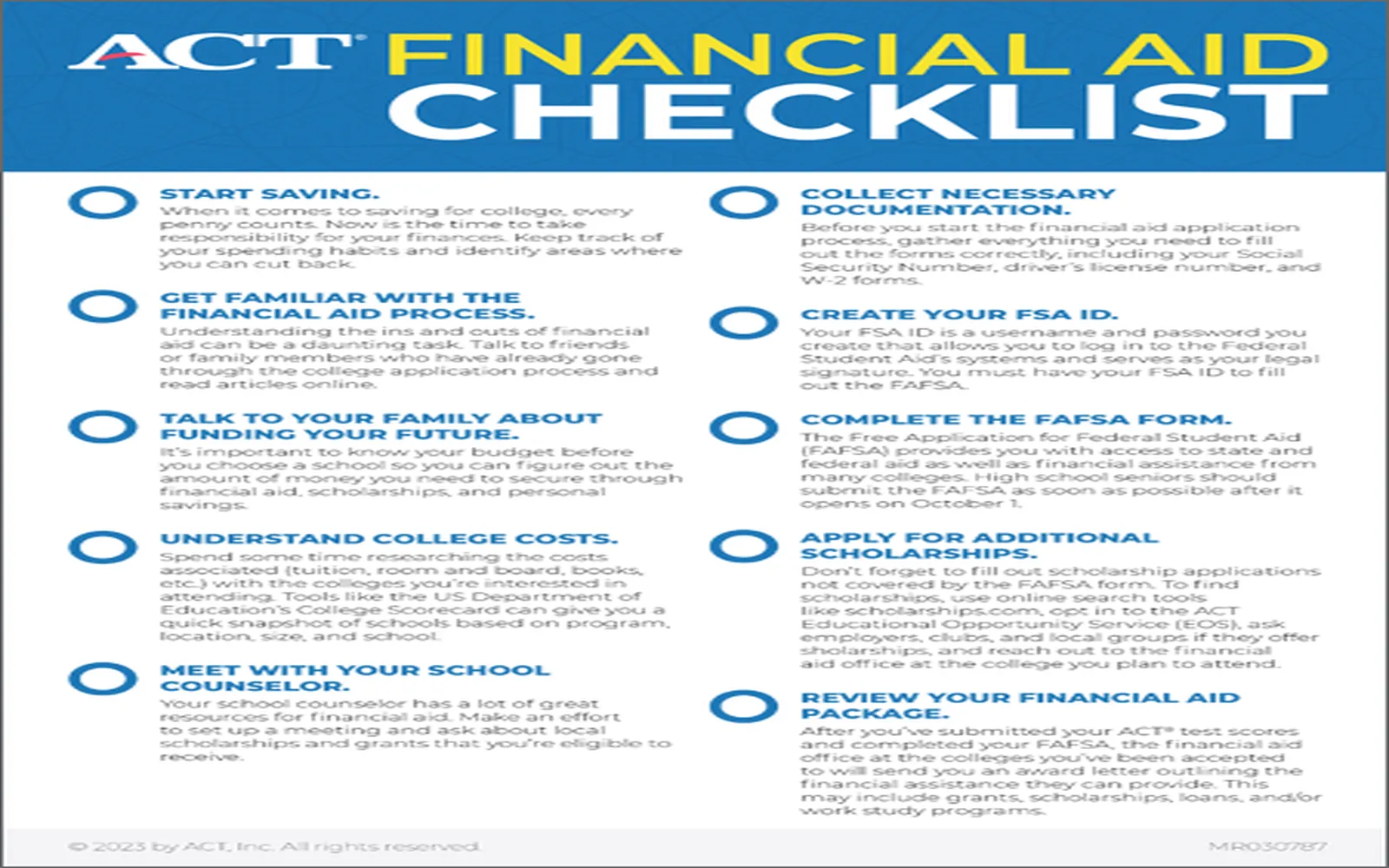

Online Schools That Offer Financial Aid

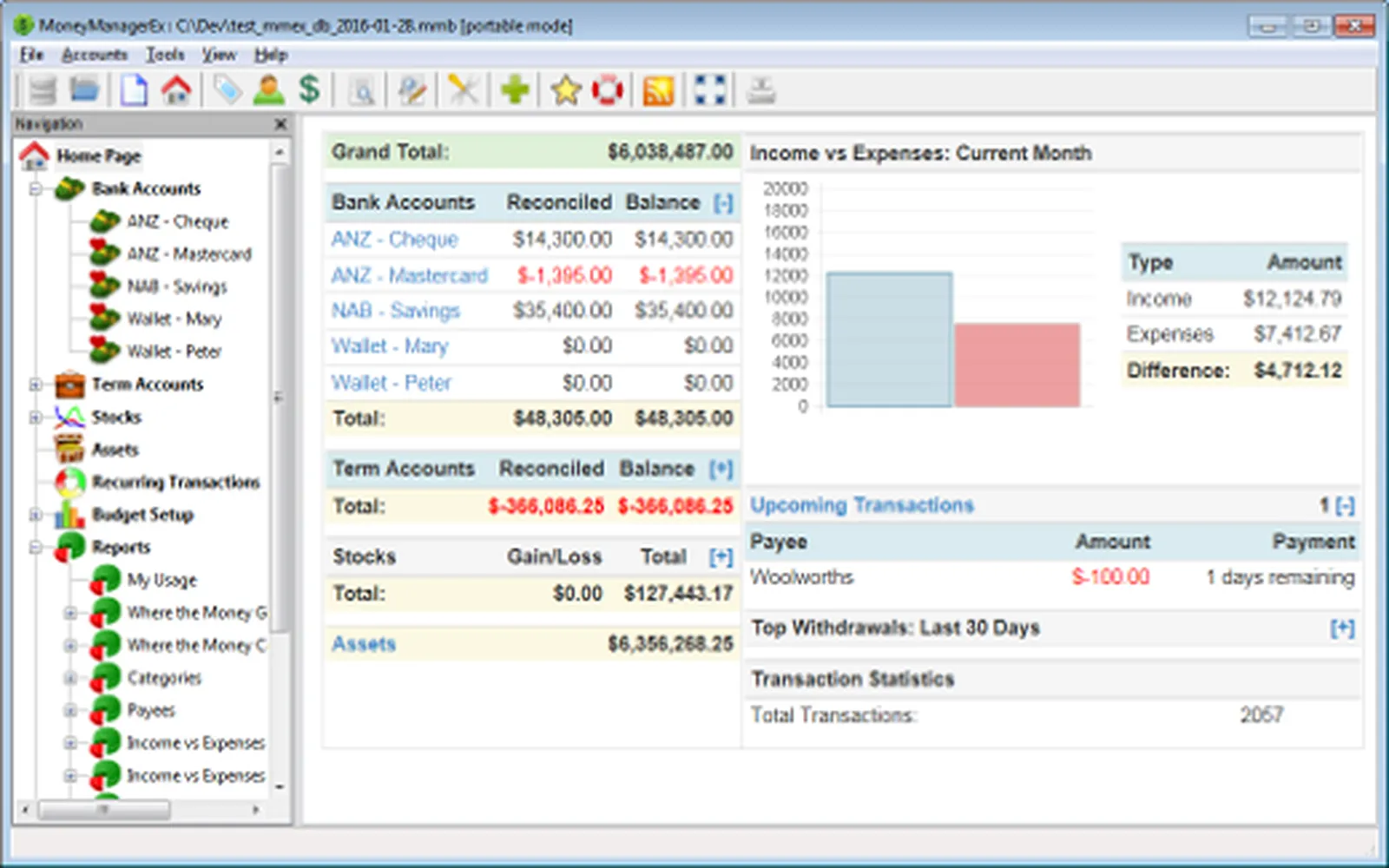

Top Financial Software to Simplify Finances

Financial Planning Tips to Secure Your 2025 Goals

Top Online Therapy Platforms for Depression Support

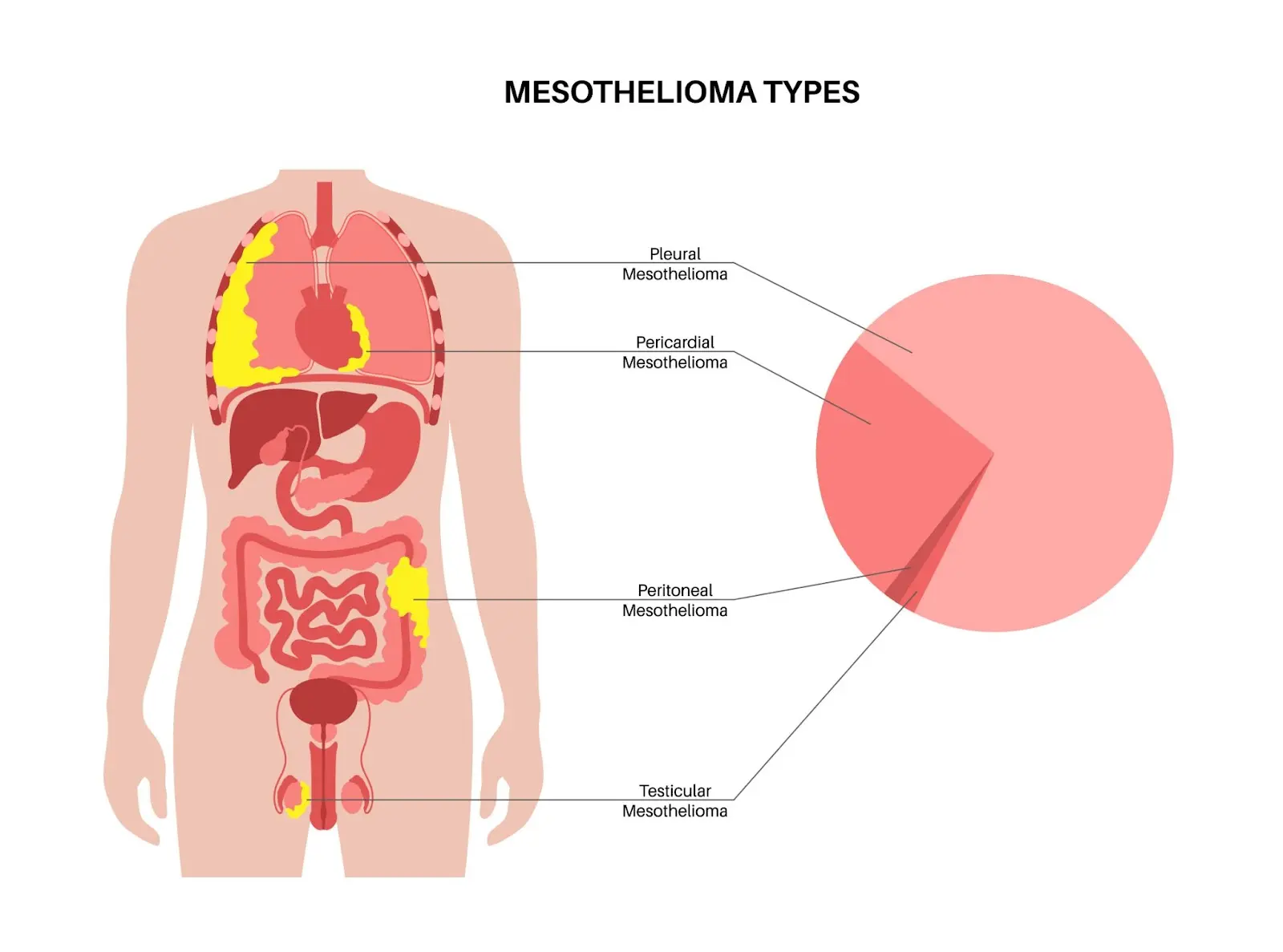

Mesothelioma Treatment Options: What Patients Need to Know

Choosing the Right Health Insurance Plan: A 2025 Guide

Understanding Childhood Asthma: Symptoms, Causes, and Treatment Options