Top Financial Software to Simplify Finances

Managing finances can be a daunting task, but with the right tools, it can become an effortless process. The emergence of various financial software solutions has transformed the way individuals and businesses handle their financial responsibilities. In this article, we will explore some of the top financial software options available today, each designed to simplify your financial management tasks.

1. QuickBooks

QuickBooks is one of the most recognized names in accounting software. It is particularly popular among small to medium-sized businesses for its comprehensive features. Users can easily track income and expenses, manage payroll, and generate financial reports. The software also offers invoicing capabilities and integrates with various banking institutions, making it easier for users to reconcile their accounts.

2. Mint

Mint is a free personal finance app that helps users track their spending, create budgets, and manage bills. It consolidates all bank accounts, credit cards, and investments into a single platform, allowing for a comprehensive overview of one’s financial health. Mint's budgeting tools are particularly helpful for users looking to save money and improve their financial habits. Additionally, it offers credit score monitoring, which is crucial for maintaining good credit health.

3. YNAB (You Need A Budget)

YNAB is designed for proactive budgeting, offering a unique approach that encourages users to allocate every dollar they earn. This budgeting software emphasizes the importance of planning for expenses before they occur, which helps users avoid debt and save effectively. YNAB also offers educational resources, including workshops and tutorials, to help users improve their financial literacy.

4. Personal Capital

Personal Capital stands out for its focus on investment tracking and retirement planning. Combining financial planning software with personal finance tools, it allows users to supervise their investments and net worth. The platform offers detailed insights into asset allocation and fees, helping users make informed investment decisions. Personal Capital also provides retirement planning tools that help users project their financial future based on their current savings and expenses.

5. Wave Accounting

Wave is a free accounting software that caters primarily to small business owners and freelancers. It offers invoicing, accounting, and receipt scanning capabilities without any cost. Wave’s user-friendly interface and robust features make it a popular choice for those needing basic financial management tools without the burden of monthly fees. Additionally, Wave allows users to connect their bank accounts for seamless transaction synchronization.

6. FreshBooks

FreshBooks is an invoicing and accounting software especially favored by service-based businesses. With features like time tracking, expense tracking, and customizable invoices, FreshBooks simplifies the financial management process for freelancers and small businesses. Its cloud-based platform ensures that users can access their accounts from anywhere, making it ideal for those who are always on the move.

7. Zoho Books

Zoho Books is a comprehensive online accounting software that offers a variety of tools, including invoicing, expense tracking, and inventory management. With its automated workflows, users can save time on repetitive tasks. Zoho Books also provides integration with other Zoho applications, making it an excellent choice for businesses already using the Zoho suite. The software is designed for small to medium-sized businesses, providing a robust solution at an affordable price.

8. Tiller Money

Tiller Money brings together the power of spreadsheets with the automation of financial tracking. It allows users to create customized spreadsheets while automatically importing financial transactions and balances. This flexibility is ideal for users who prefer hands-on management of their finances but want the convenience of automation. Tiller Money is particularly beneficial for those who want to tailor their financial reports to their specific needs.

9. Sage Intacct

Sage Intacct is a cloud-based financial management solution designed for medium to large businesses. It offers advanced features such as multi-entity and multi-currency management, making it suitable for organizations that operate on a global scale. Sage Intacct provides real-time financial insights and reporting, allowing finance teams to make data-driven decisions efficiently. Its robust API allows for easy integration with other business systems, enhancing overall operational efficiency.

10. GnuCash

For those seeking a free and open-source option, GnuCash is a powerful financial software solution that offers a wide range of features. It is suitable for both personal and small business use. GnuCash includes functionalities such as double-entry accounting, scheduled transactions, and financial reporting. While its interface may not be as modern as some paid options, it provides a comprehensive set of tools for managing finances effectively.

Conclusion

Choosing the right financial software is essential for simplifying financial management, whether for personal use or business operations. Each of the options discussed above caters to different needs, ensuring that users can find a solution that suits their financial requirements. By leveraging these tools, individuals and businesses can take control of their finances, reduce stress, and make informed financial decisions.

Explore

2025 Business Software to Simplify Your Workflow

Finfluencers in 2025: Risk-Takers or Financial Educators?

Online Schools That Offer Financial Aid

Financial Planning Tips to Secure Your 2025 Goals

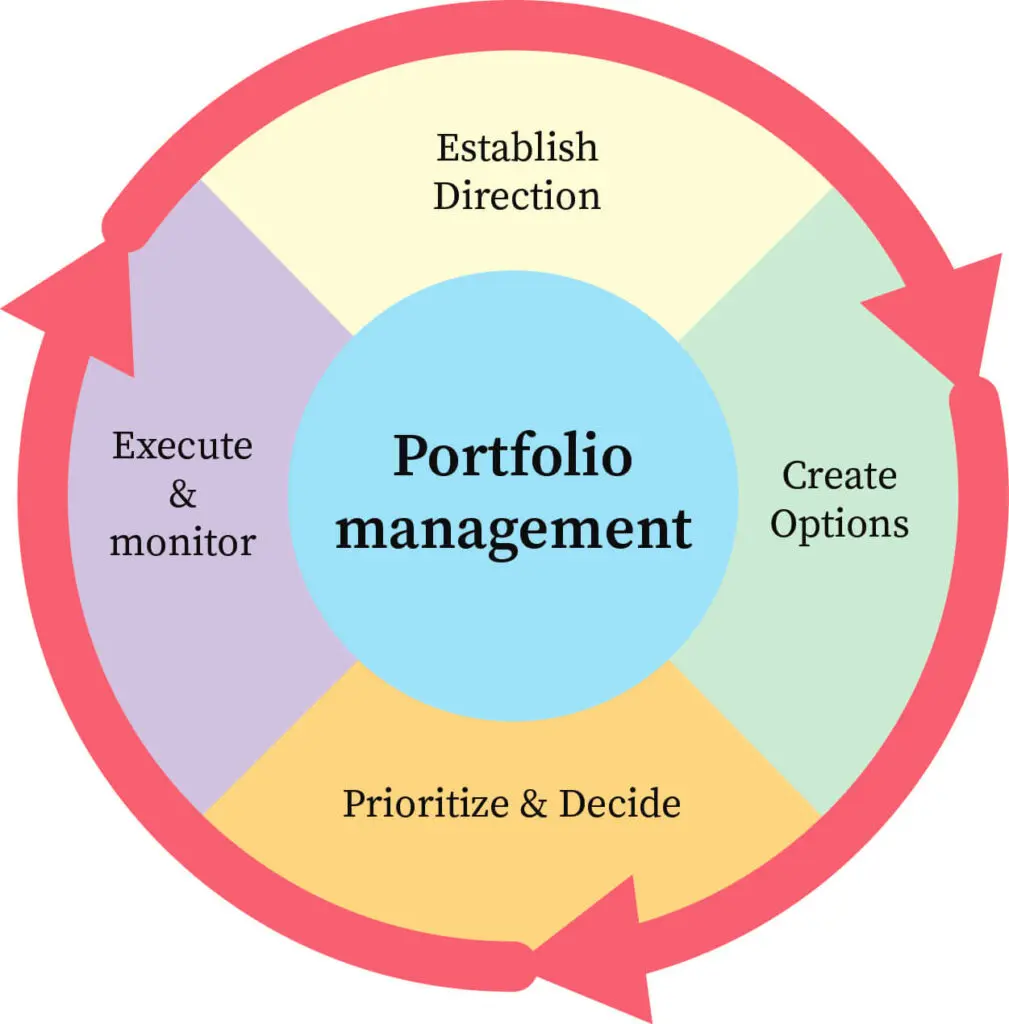

How to Choose the Right Portfolio Management Software for Your Business

Top Payroll Software Solutions for Small Businesses in 2025

How to Choose the Right Fund Manager Software for Your Investment Firm

Event Planning Software for Small Teams: Affordable and Effective Options