Best Startup Business Loans to Fund Your Vision

When launching a startup, one of the most significant challenges entrepreneurs face is securing the right funding. The availability of various financing options can be both a blessing and a curse. Among these, business line of credit for startups has emerged as a popular choice for many new entrepreneurs. This type of funding allows flexibility in managing cash flow, making it an attractive option for startups looking to grow their operations. In this article, we will delve into some of the best startup business loans available to help you fund your vision effectively.

Understanding Business Line of Credit for Startups

A business line of credit is a revolving credit facility that allows startups to borrow money up to a predetermined limit. Unlike traditional loans, which provide a lump sum, a line of credit gives entrepreneurs the ability to withdraw funds as needed and only pay interest on the amount borrowed. This flexibility makes it ideal for managing unexpected expenses or cash flow gaps. When considering a business line of credit for startups, it's crucial to understand the terms and conditions, interest rates, and repayment schedules to find the best fit for your business needs.

Top Startup Business Loans to Consider

Here are some of the top startup business loans that can help you in funding your vision:

| Loan Type | Description | Best For |

|---|---|---|

| Traditional Bank Loans | These are long-term loans typically offered by banks, requiring detailed business plans and credit history. | Established startups with proven revenue |

| SBA Loans | Small Business Administration loans are government-backed loans offering lower interest rates and longer repayment terms. | Startups with solid business plans |

| Online Lenders | These lenders provide quick access to funds, often with less stringent requirements than banks. | Startups needing fast capital |

| Business Line of Credit | A flexible credit option allowing startups to borrow as needed within a set limit. | Startups facing cash flow issues |

| Equipment Financing | Loans specifically designed for purchasing equipment, using the equipment itself as collateral. | Startups needing to buy expensive equipment |

| Personal Loans | Entrepreneurs can use personal loans to fund their startups, but this comes with higher risk. | Startups with limited business credit history |

1. Traditional Bank Loans

Traditional bank loans are often the first option many entrepreneurs consider. These loans typically come with lower interest rates but require a solid credit score and collateral. Banks will scrutinize your business plan, financial forecasts, and cash flow statements. If your startup has a proven track record of revenue, this could be an excellent option. However, the application process can be lengthy, and startups without established credit may find it challenging to secure these loans.

2. SBA Loans

The Small Business Administration (SBA) offers several loan programs that are particularly beneficial for startups. These loans are partially guaranteed by the government, which reduces the risk for lenders and often results in lower interest rates and longer repayment terms. The most popular SBA loan programs for startups include the 7(a) loan and the CDC/504 loan. To qualify, you will generally need a solid business plan and a clear demonstration of your ability to repay the loan.

3. Online Lenders

For startups requiring quick access to funds, online lenders can be a viable solution. These lenders often provide a fast application process and may offer more flexible eligibility criteria compared to traditional banks. However, interest rates can be higher, so it’s essential to read the fine print and understand the terms before committing. Online lenders are ideal for startups that need cash quickly to cover immediate business expenses or opportunities.

4. Business Line of Credit

A business line of credit is particularly advantageous for startups facing cash flow fluctuations. It allows you to borrow up to a certain limit and only pay interest on the funds used. This flexibility can help with managing day-to-day expenses, purchasing inventory, or handling unexpected costs. Many financial institutions offer business lines of credit, and they can be an essential tool for sustaining and growing your startup.

5. Equipment Financing

If your startup requires significant equipment purchases, equipment financing can be a smart option. This type of loan uses the purchased equipment as collateral, which can make it easier for startups to obtain financing. Interest rates are often lower than unsecured loans, and repayment terms align with the expected life of the equipment. This can be particularly useful for startups in industries like manufacturing, construction, or technology.

6. Personal Loans

While not always recommended, personal loans can provide a quick funding solution for startups, especially when business credit history is limited. These loans often come with higher interest rates and require personal guarantees, which means the borrower is personally liable for repayment. If you choose this route, ensure you have a solid repayment plan in place to avoid jeopardizing your personal finances.

Conclusion

Choosing the right funding option for your startup is crucial for turning your vision into reality. Understanding the various types of startup business loans, including the benefits of a business line of credit for startups, can help you make informed decisions. Whether you opt for a traditional bank loan, an SBA loan, or an online lender, ensure that you assess your business needs and financial situation carefully. With the right funding in place, you can propel your startup towards success.

Explore

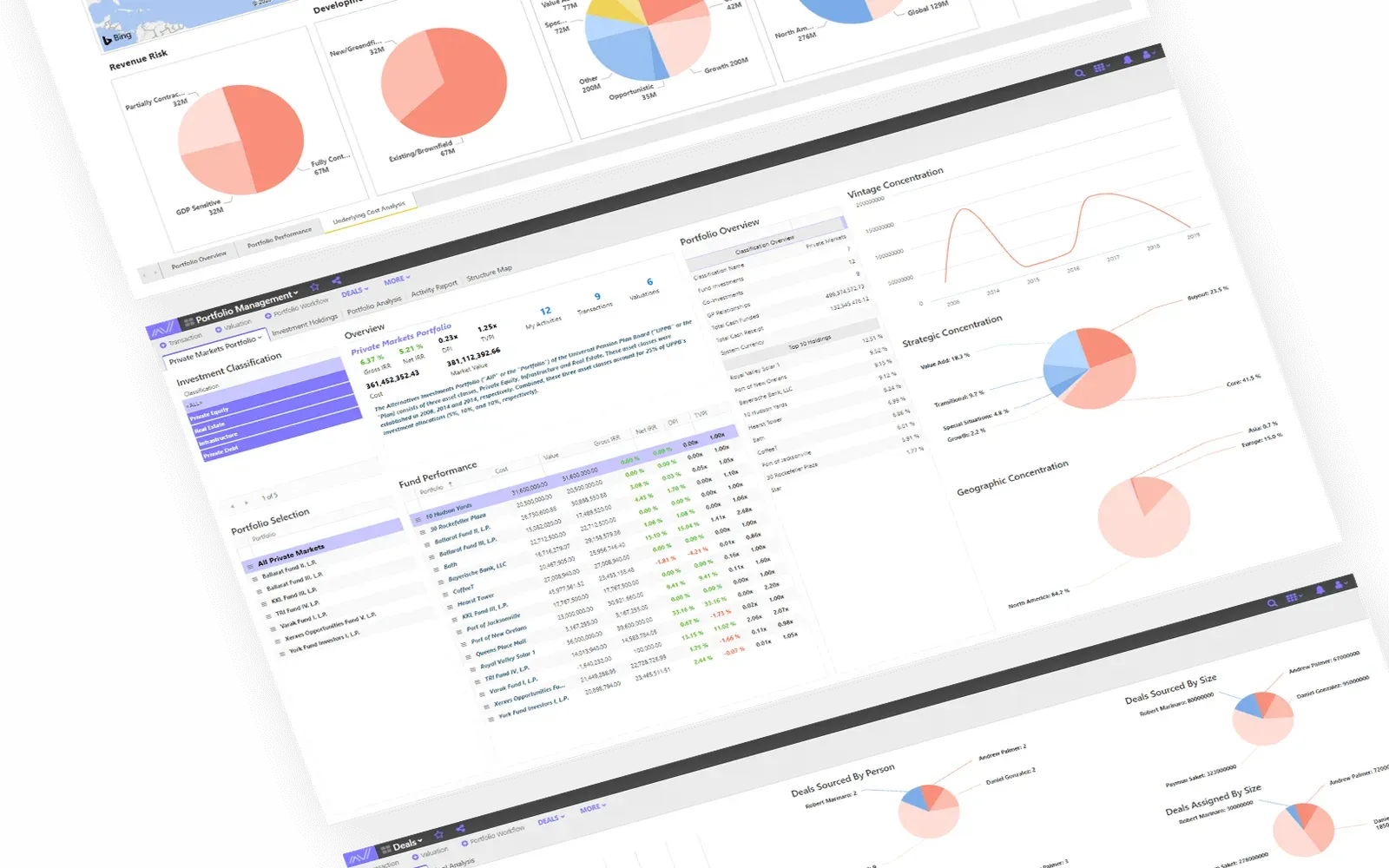

How to Choose the Right Fund Manager Software for Your Investment Firm

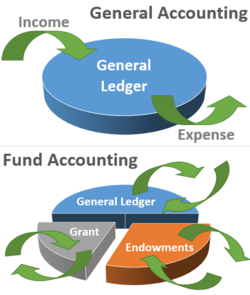

Online Fund Accounting Programs: Flexibility for Busy Learners

Emergency Fund Essentials: What You Need Saved by 30, 40, 50

Best Fund Management Software for Smart Investing

FHA Loans Explained: Who Qualifies and What You Can Buy

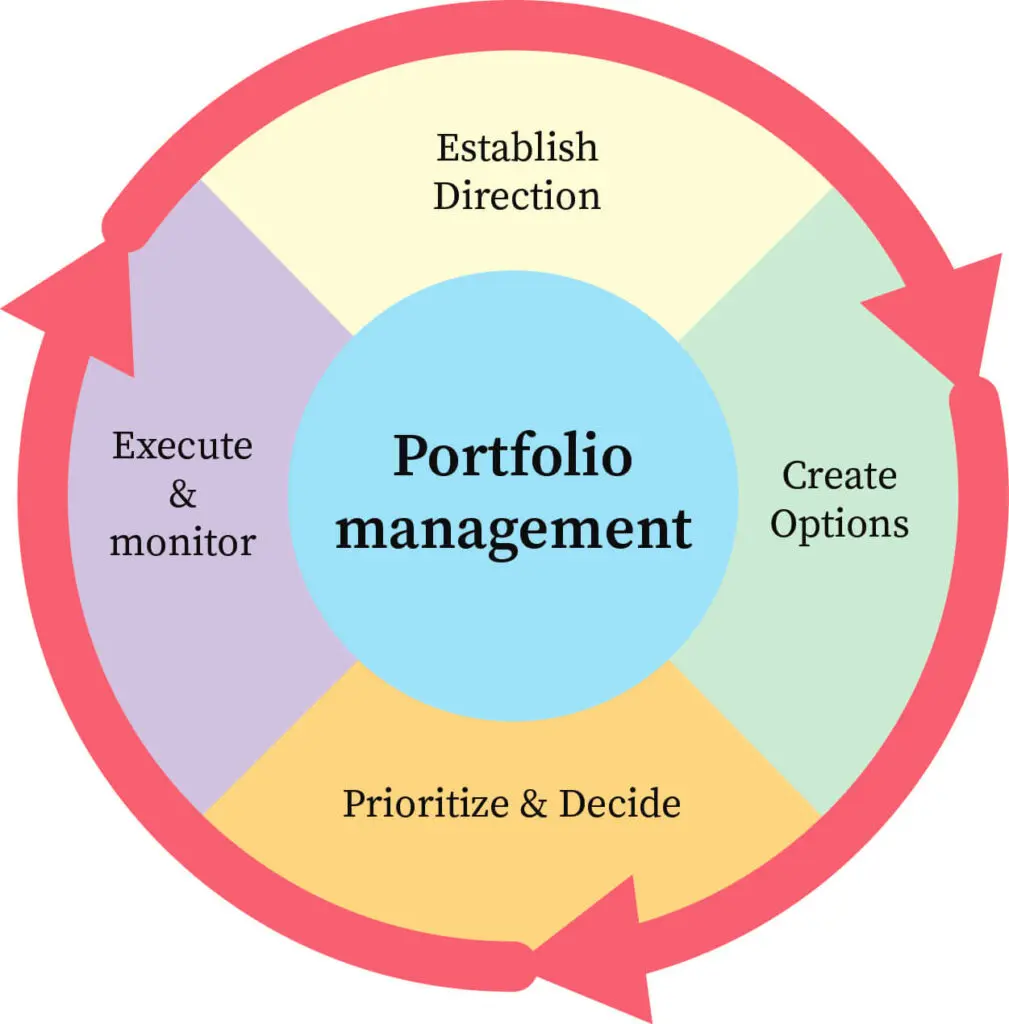

How to Choose the Right Portfolio Management Software for Your Business

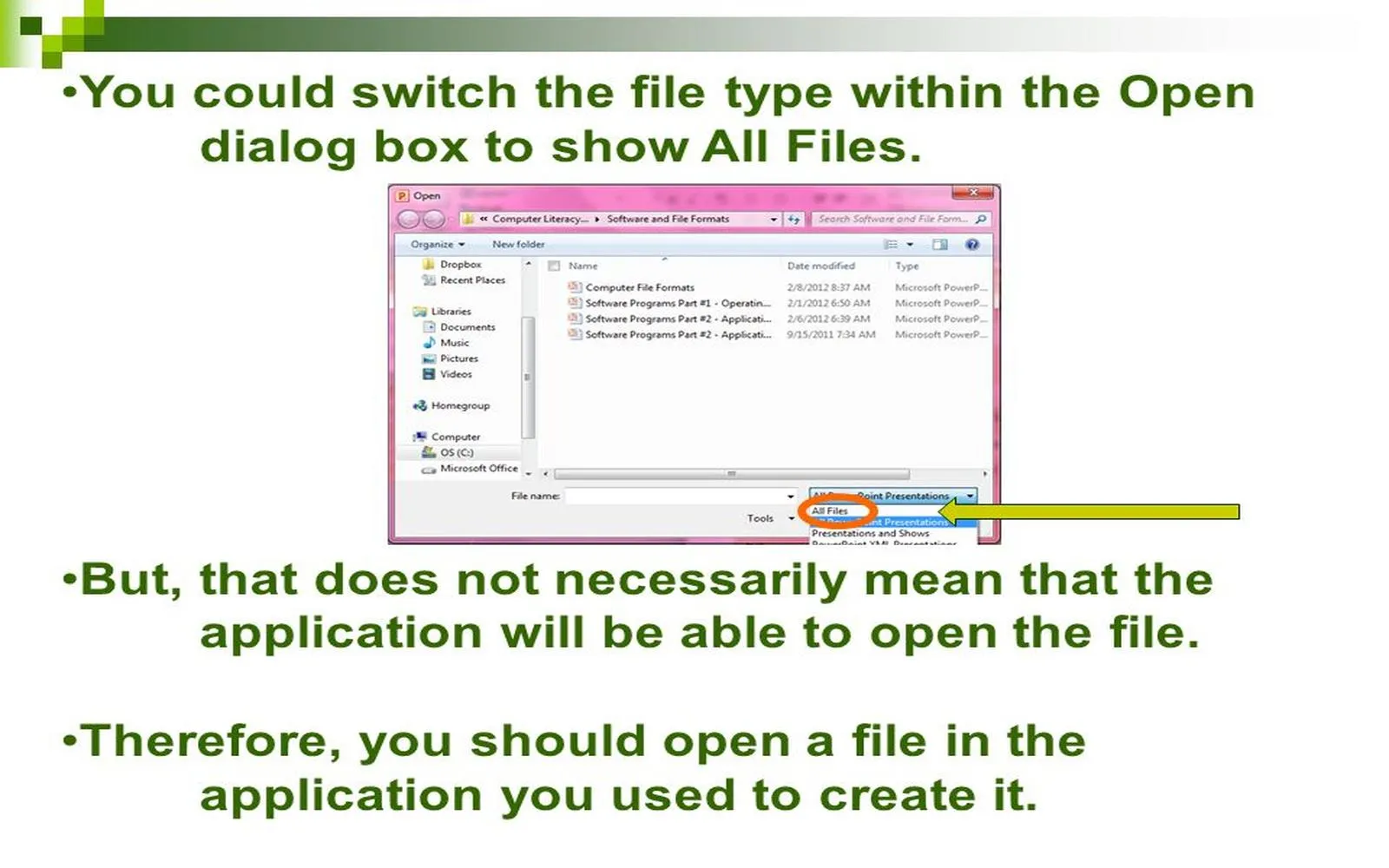

2025 Business Software to Simplify Your Workflow

Top Business Internet Providers in the U.S.: A Comparison